- VeChain (VET) is experiencing a medium to long-term downward trend, indicating ongoing investor sell-offs.

- VET is testing a critical support level at $0.02; a bounce back could trigger positive sentiment, while a break below may lead to further decline.

- VeChain’s RSI has dropped below 30, signaling an oversold status that might prompt an upward correction.

- Crypto analyst highlights the critical support level VET is resting on; holding it is essential to maintain the bullish outlook.

VeChain (VET) has been sailing through troubled waters, which is pretty evident from its medium to long-term downward trend channel. This pattern indicates a constant sell-off by investors, who have been selling their holdings at ever-decreasing prices. The bearish sentiment circulating around VeChain reflects a broader pessimistic development for the cryptocurrency.

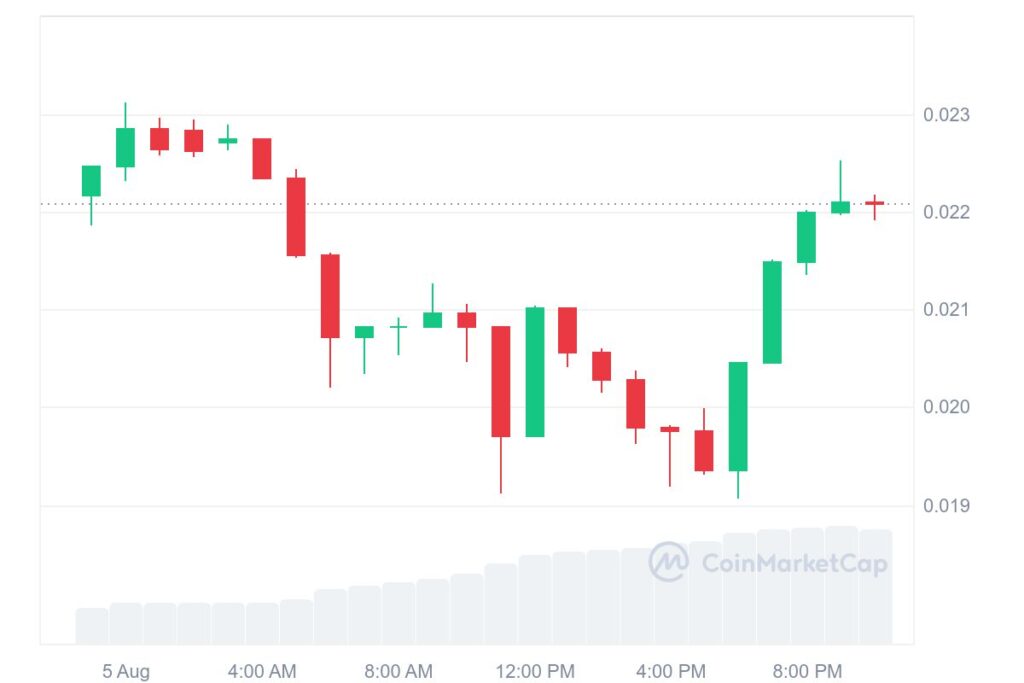

At present, VET is testing a critical support level at $0.02. The outcome at this juncture would be of key importance: if it bounces back from there, positive sentiment might get triggered to arrest this downfall. On the other hand, if VeChain breaks below this support, it would mean further downtrend continuation and actually strengthen the bearish view..

Adding to the woes, VeChain Relative Strength Index has plunged below 30 after weeks of falling prices. Computed RSI below 30 generally indicates an oversold status of an asset that may come with an imminent upward correction.

The strong negative momentum does, however, prevail to indicate that the decline may continue. Even in large-cap assets, though, a low RSI sometimes hints at a potential rebound as investors might consider it oversold and, hence, ripe for a buying opportunity.

VeChain’s recent performance has been disheartening. The cryptocurrency hit a significant low at $0.19, largely triggered by Bitcoin’s sharp decline, which rippled through the market, inducing extreme fear among investors. Over the past week, VET has plummeted nearly 19%, and over the last 30 days, it has shed around 7% of its value.

As of now, VeChain is priced at $0.022103, with a 24-hour trading volume of $154.08 million. Its market capitalization stands at $1.61 billion, representing a market dominance of 0.08%. In the last 24 hours alone, VET has decreased by 2.11%.

VeChain’s Make-or-Break Moment: Key Support Level in Focus

Crypto analyst, Crypto Yapper, has emphasized that VET is resting on a critical horizontal support level. According to Yapper, this support level is vital for maintaining the bullish outlook for the cryptocurrency.

If VeChain manages to hold this support, the bullish trend can be expected to continue. However, a break below this level could signal a descent into bear market territory, potentially driving VET prices significantly lower.

For VeChain, holding this support level is very critical in keeping the bears at bay and keeping market sentiment in check. VeChain has always been an innovative power for supply chain management and has built some really strong partnerships across several industries.

Inherent in these very basic strengths lies the factor that has driven the previous bullish runs. Market sentiment can change very fast, and often the technicals are a catalyst for this change.

Crypto Yapper’s analysis puts VET in a precarious position. This level is keenly watched by traders and investors who are aware that any breach could usher in a long period of price weakness. This possible changing of tides from bullish to bearish does recount the essence of strong support levels in holding price trends

Related | Ethereum Caught Amidst Jump Trading’s Perfect Storm