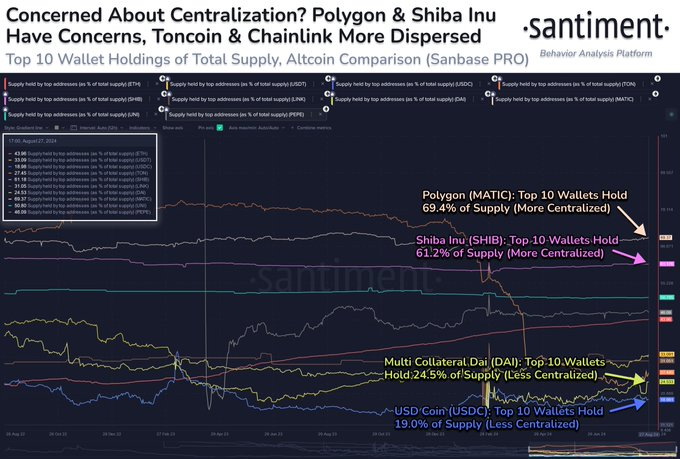

Polygon, Shiba Inu, and several other altcoins exhibit a significant amount of centralization, per the Santiment report. This assessment was based on the percentage of total supply held by the top 10 wallets. The analysis highlights significant issues that investors should carefully consider before making investment decisions.

Centralization has long been a contentious issue within the digital asset community, often viewed in a negative light as it suggests a concentration of power within a few entities. This centralization can manifest in various ways, such as a small number of addresses holding the majority of a coin’s supply or a few entities controlling significant portions of a network’s governance or mining power.

Leading the altcoins tally is Polygon, whose top 10 wallets hold a significant 69.4% of the total supply, making it one of the more centralized assets. Major Ethereum L-2s have come under criticism for being centralized. In Jan, the scaling protocol initiated a hard fork after receiving approval from only 13 validators.

Close trailing behind is the popular meme coin Shiba Inu, with 61.2% of its supply concentrated among the top 10 wallets. Ironically, decentralized behemoth Uniswap [UNI] is ranked 3rd with a 50.8% concentration within its top wallets.

Altcoins Centralization

A smaller yet still notable is PEPE, where 46.1% of its supply is centralized. In contrast, Ethereum, despite being the largest altcoin in the market, still exhibits a notable level of centralization, with 44.0% of its total supply held by the top 10 wallets. Stablecoin giant Tether [USDT] shows a lower concentration, with 33.1% of its supply centralized. The list also contained toncoin [TON], which has a distribution of 27.5%.

As per Santiment, several factors contribute to these levels of concentration. For instance, early adopters or insiders may hold substantial amounts of altcoins, leading to higher concentration. Additionally, certain coins are heavily used in staking or governance, which requires validators to hold large quantities. On the flip side, assets that have been widely distributed through airdrops or community rewards tend to have a more decentralized distribution.

Nevertheless, when a small number of entities or individuals hold a large portion of a cryptocurrency’s supply, there is a greater risk of manipulation. These entities could potentially influence the price, market sentiment, and even development decisions.