- Ethereum’s transaction fees and ETH burning skyrocketed 314% and 1,600% respectively.

- Active accounts plummet to a yearly low of 385,000. Increased congestion and dApp popularity drive fee surge.

- Genesis-era user makes $390M profit and deposits $9.12M into Kraken. This could impact the ETH price.

The transaction fees on Ethereum along with its burning rate have soared. However, the active address count has declined. As per on-chain data, the seven-day moving average of ETH transaction fees has reached $3.52, a surge of 314% from $0.85 on September 1. On September 21, the daily burning of ETH hit 1,360, a surge of 1,600% from 80.27 on September 1. However, the number of active accounts on the ETH network declined considerably, hitting the lowest point of the year, about 385,000.

The uptick in transaction fees could be due to a various factors, including increased network congestion and the growing popularity of decentralized applications [dApps] built on Ethereum. On the other hand, the surge in ETH burning stems from the EIP-1559 upgrade, which was implemented in August 2021. EIP-1559 introduces a base fee for transactions, which is burned rather than going to miners.

Despite the increase in transaction fees and ETH burning, on-chain data has identified a significant drop in active accounts. This is not surprising given that some users might be possibly deterred by the high fees, or that are moving away to other networks that are less congested.

That being said, Ethereum remains the most popular blockchain platform for dApps and decentralized protocols. It remains to be seen whether the recent surge in transaction fees and ETH burning will continue. If the network becomes too congested, it could restrict users and developers from using Ethereum. However, the EIP-1559 upgrade is expected to help to reduce congestion over time.

Ethereum Dormant User Makes $390M Windfall

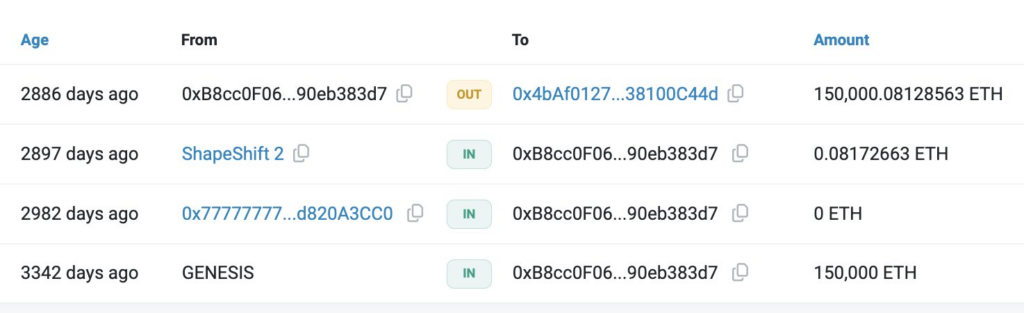

Meanwhile, an Ethereum [ETH] user of the Genesis era amassed a profit of 150k ETH worth nearly $390 million and has now deposited 3,510 ETH or $9.12 million into Kraken after being inactive for over two years. The deposit of such a large amount of ETH into Kraken could positively impact the price of the cryptocurrency.

The anonymous ICO participant bought the stash at the ICO price of $46.5K. The token’s price has since skyrocketed, turning the investment into a massive profit. The participant’s recent deposit into Kraken could mean that they may be looking to cash out some of their profits. Alternatively, they could simply be moving their funds to a more secure exchange.