- Bitcoin surged past $61.9K after the Federal Reserve’s 0.5% interest rate cut.

- Capital outflows have outpaced price drops, indicating weaker demand.

- Short-term holders are facing unrealized losses, but they are less severe than in past sell-offs.

Bitcoin has once again surged past $61.9K following the Federal Reserve’s 0.5% interest rate cut, reclaiming the short-term holder cost basis, a critical price level for many new investors. The next key target for the leading cryptocurrency is its 200-day moving average of $63.9K, which could signal a continuation of the bullish momentum if it holds.

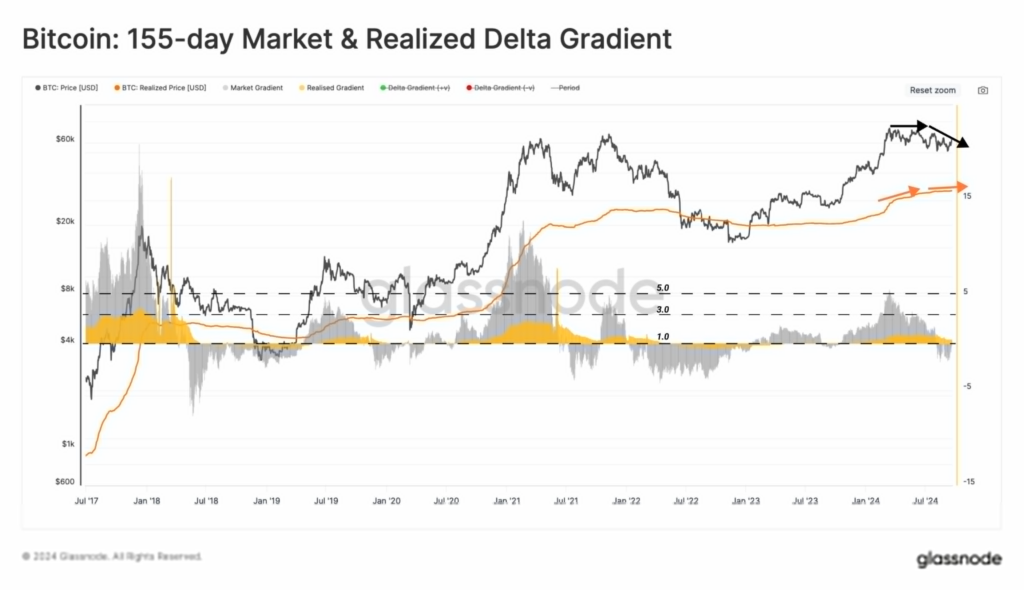

This price rally comes after weeks of declining capital inflows, especially after the market peaked in March. As highlighted in a report by Glassnode, the drop in price momentum indicates weaker demand. The 155-day price gradient showed that capital outflows have outpaced spot price drops, reinforcing Bitcoin’s challenges in the current market environment.

Impact on Bitcoin Short-Term Holders

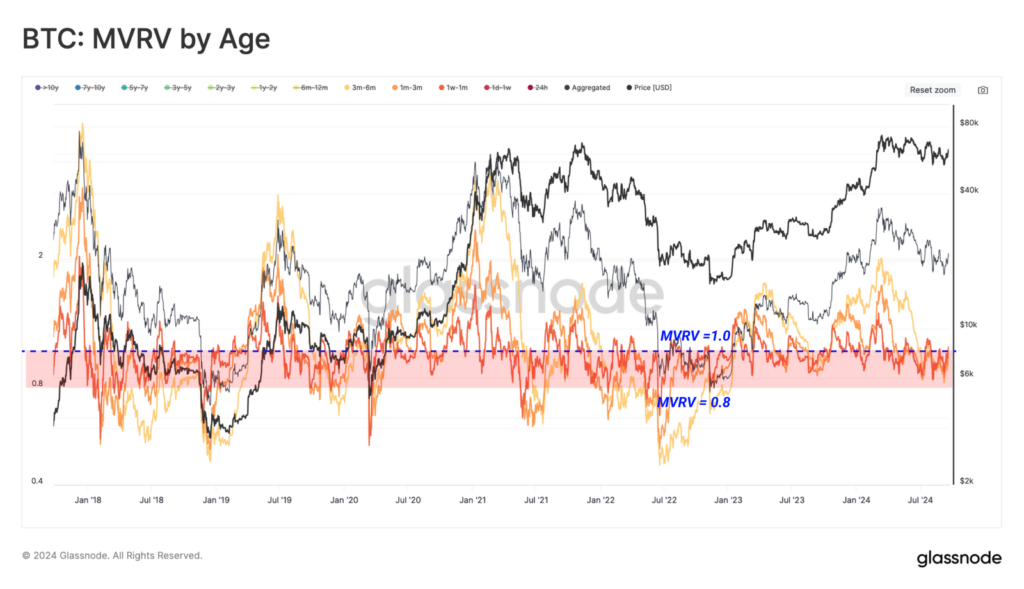

The report compares the 2019-2020 consolidation phase, where Bitcoin experienced prolonged stagnation following a strong rally. The current consolidation has pushed Bitcoin’s spot price below the cost basis of several short-term holder cohorts, resulting in unrealized losses for newer investors. Despite this, the magnitude of these losses remains less severe than the sell-offs seen in 2021 or during the COVID-19 crash in March 2020.

Capital flow metrics suggest a downward trend, with younger coins’ cost basis declining faster than older coins, indicating a net capital outflow. However, there are signs that a potential market reversal is in its early stages. Confidence among newer investors remains higher than in previous downturns, as reflected by the relatively low locked-in losses.

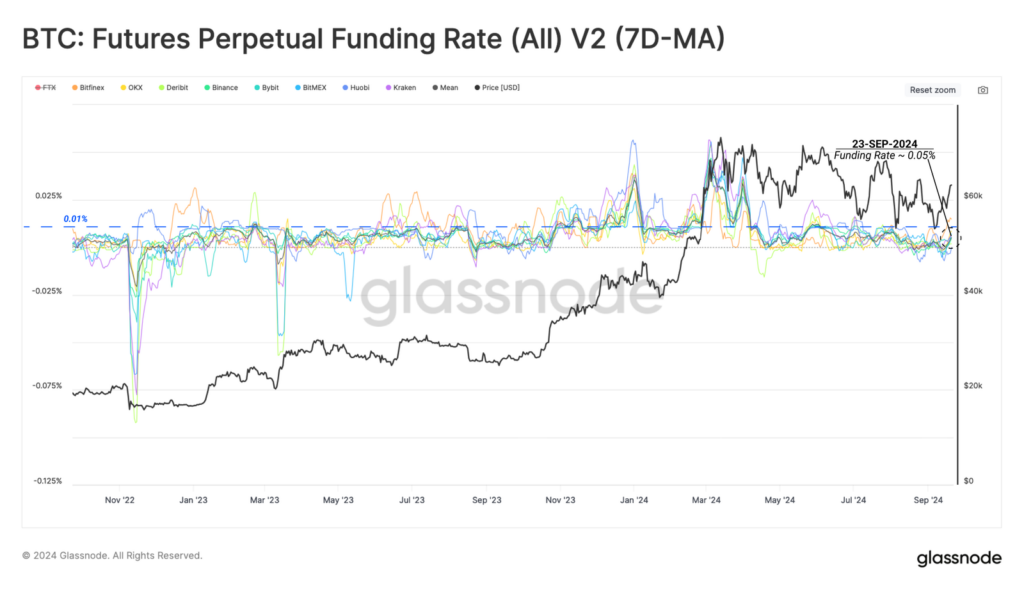

The futures market also offers insights into investor sentiment. The Futures Perpetual Funding Rate has climbed to 0.05%, slightly above the equilibrium of 0.01%. This suggests a growing interest in long positions, but demand for leverage remains much lower compared to earlier this year.

The cumulative monthly premium paid by long contracts has also increased, although it’s far from the levels observed during the peak in January 2023. While Bitcoin’s price surge past $61.9K is encouraging, sustaining levels above the 200-day moving average could be critical in confirming the next phase of upward momentum.

Related | Congress Urges SEC to Revoke SAB 121 Amid Bipartisan Criticism