- EIP-7781 proposes to reduce Ethereum block times from 12 seconds to 8 seconds.

- The proposal aims to increase transaction throughput and improve the efficiency of the Ethereum network.

- The reduction in block times could potentially lead to increased adoption of Ethereum and its L2 solutions.

Ethereum, the largest smart contract platform has faced challenges with slow transaction speed leading to the emergence of scaling solutions. This has led to a decrease in on-chain activity on the main net. However, a new proposal, dubbed EIP-7781, aims to significantly increase the network’s transaction speed by reducing block times from 12 seconds to 8 seconds. Illyriad Games co-founder Ben Adams, who initiated the proposal on October 5 has garnered attention from the ETH community.

If the proposal receives the green light, EIP-7781 would not only improve block times but also enhance rollup performance and boost the capacity of blobs, a temporary data structure used to reduce layer-2 network fees. This would effectively distribute bandwidth usage over time, lowering peak bandwidth requirements without compromising individual block or blob counts.

Pseudonymous developer Cygaar believes that EIP-7781 could be a crucial step in improving the base layer of the ETH network, particularly as developer focus has been largely directed toward L2 networks for scaling solutions.

Ethereum’s Deflationary Days Are Over: What’s Next?

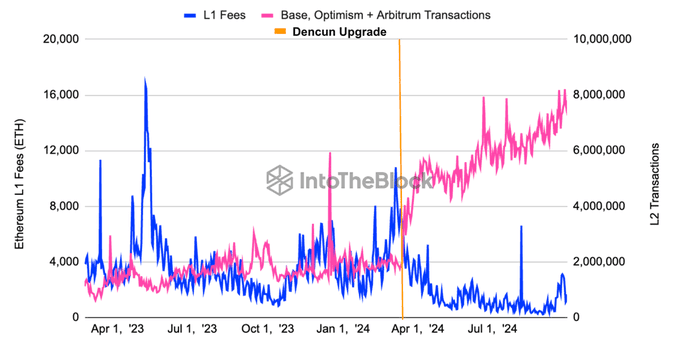

Meanwhile, Ethereum Mainnet fees reached an all-time low post-Dencun upgrade due to the surge in L2 transactions. The implementation of EIP-4844, which slashed L2 costs by 10x, contributed to this record activity, per IntoTheBlock data. However, this surge in L2 usage has come at a cost.

With fewer fees being burned, the supply of ETH has transitioned from deflationary to inflationary. This shift in dynamics has implications for the overall value proposition of Ethereum and its long-term economic health.

As the Ethereum ecosystem continues to evolve, it will be crucial to monitor the interplay between L1 and L2 activity, as well as the impact of fee burning on the supply of ETH.