- BlackRock emphasizes the growing adoption of digital assets driven by generational shifts and digital-native consumption.

- Declining trust in governments and central banks fuels demand for global monetary alternatives like cryptocurrencies.

- Venture capital and regulatory evolution have strengthened the digital asset infrastructure, enabling broader investor participation.

BlackRock, a leading AUM, recently outlined the key factors driving increased adoption of digital assets, citing changing consumption patterns, geopolitical instability, and generational shifts in wealth and technology use.

Speaking on the sidelines of the Digital Assets Conference in Brazil, the top exec emphasized how the current generations, particularly Millennials and Gen Z, are reshaping the global economy. “Millennials are entering their peak earning years and are set to inherit trillions of dollars,” the executive said. “They are the first digitally native generation, growing up with the internet and technology, making them more likely to adopt digital currencies.”

This generational shift, combined with the rise of online consumption, such as streaming and gaming, has created a natural fit for digital-native assets like cryptocurrencies. These assets facilitate seamless transactions in an increasingly digital economy.

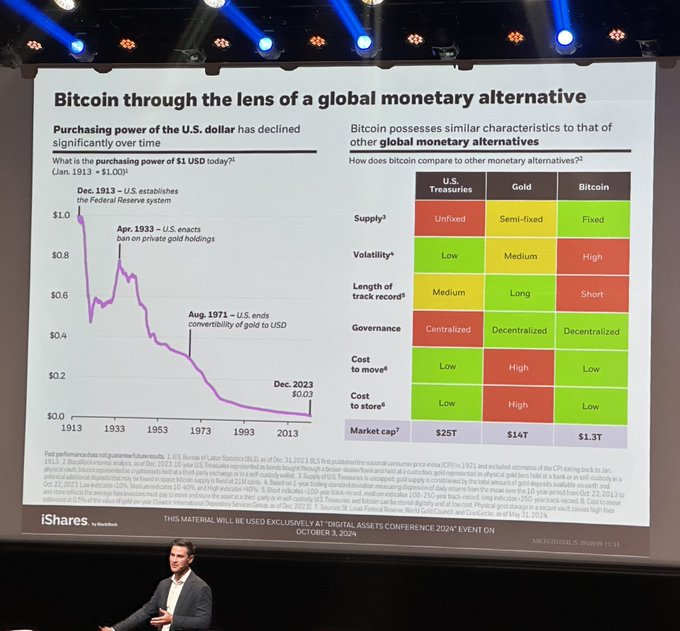

Moreover, the executive pointed to rising geopolitical risks and declining trust in traditional institutions, such as governments and central banks, as a major driver behind the demand for global monetary alternatives. “More distrust in institutions has exacerbated the need for a global monetary alternative,” he noted. Digital assets, particularly cryptocurrencies, are seen as viable options in an environment where faith in traditional financial systems is weakening.

BlackRock, PayPal Lead Crypto Adoption

The maturing infrastructure around digital assets is also playing a significant role in their adoption. Over the last five years, billions of dollars in venture capital have been pumped into blockchain and digital assets, fueling innovation and regulatory evolution. This progress has made it easier for investors to participate in the growing digital asset space.

BlackRock has focused its efforts on the two largest digital assets, Bitcoin and Ethereum, which make up around 75% of the market capitalization. This allows them to provide accessible investment vehicles for broader investor participation while tapping into the most liquid and mature areas of the market. Overall, financial giants like BlackRock, Fidelity, and Morgan Stanley have spearheaded cryptocurrency investment products, while payment giants such as PayPal, Visa, and Mastercard are enabling crypto payments on their platforms. The entry of these big institutional players into the space not only brings legitimacy but also accelerates mainstream adoption by making cryptocurrencies more accessible to the average consumer.