- XRP’s growth and value appreciation depend on resolving the SEC lawsuit.

- The valuation models reveal significant potential if not for the SEC lawsuit.

- The legal battle negatively impacted the token’s adoption and price.

A new report has shed light on the fair market value of XRP, the cryptocurrency affiliated with the Ripple network. The six quantitative models were developed by a group of experts to assess the impact of different scenarios on the token’s value had the SEC lawsuit not occurred.

The SEC vs Ripple legal battle in 2020 led to a massive sell-off of XRP and a subsequent decline in its market price. Many in the industry believed that the lawsuit hindered the adoption of the XRPL from its ability to realize its intended use case. To assess the financial damages, experts at Valhil Capital came together to form a committee in the fall of 2022. Over several months, the report developed six different valuation models.

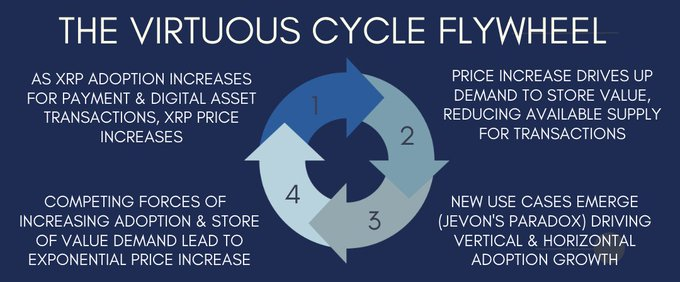

The models produced valuations ranging from $9.81 to $513,000 per XRP, demonstrating the significant potential upside for the cryptocurrency. Secondly, it pointed out that the significant drivers of the token’s price are its use as a transaction utility and a store of value. Additionally, the models highlight the potential for a virtuous cycle, where increased adoption as a transaction utility leads to higher demand as a store of value, further driving price appreciation.

XRP: Impact of SEC Lawsuit

The researchers acknowledge the negative impact of the ongoing SEC lawsuit on XRP’s adoption and price. They believed that the legal ambiguity has hindered the realization of the altcoin’s full potential as a digital asset.

If the legal issues surrounding the crypto asset are resolved, the cryptocurrency could experience significant growth and value appreciation. The valuation models provide valuable insights into the factors that will drive XRP’s future price and demonstrate the significant potential upside for investors. The report emphasizes the importance of understanding the assumptions and limitations of the models. The actual value of the Ripple-backed token will depend on various factors, including market dynamics, regulatory developments, and technological advancements.

Regardless of what the various models simulate in terms of potential value, one fact remains unchanged. The YEARS that the XRPL has been under the dark cloud of the lawsuit cannot be recovered.