- Trump’s potential economic policies may lead to a weaker US dollar and increased Bitcoin appeal.

- The “American Capitalism with Chinese Characteristics” approach may involve strategic government support for key industries.

- Quantitative easing targeted at the broader public can fuel economic growth, contrasting with policies benefiting the wealthy.

Arthur Hayes’ recent blog post outlines a compelling argument for Bitcoin’s future price surge, potentially reaching $1 million. According to Hayes, Donald Trump’s economic policies could inadvertently drive the US dollar down and boost Bitcoin’s attractiveness.

By adopting economic strategies similar to China’s, Trump could increase the money supply and accelerate growth, making alternative assets like Bitcoin a safe haven for investors looking to hedge against inflation.

The U.S. Economy’s Shift

Hayes draws parallels between U.S. and Chinese economic models, pointing out that while China’s “Socialism with Chinese Characteristics” has allowed for flexible economic reforms, the U.S. may adopt its own version of “American Capitalism with Chinese Characteristics.”

Over the years, the U.S. has abandoned pure free-market principles, moving towards a model often involving socializing losses, as seen during the 2008 financial crisis and the 2020 pandemic.

Following China’s playbook, Trump’s likely Treasury Secretary, Scott Bassett, could implement policies that further stimulate economic growth by supporting key industries through subsidies and tax credits.

Impact on Bitcoin and Inflation

As the U.S. government pursues this new economic agenda, Hayes suggests that inflation could rise, undermining the dollar’s value. This would make hard assets, particularly Bitcoin, more appealing as a store of value.

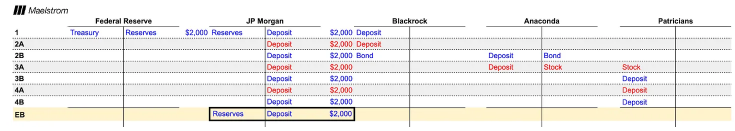

Zoltan Pozar’s work on monetary policy highlights the risks of quantitative easing (QE) favoring the wealthy and inflating financial assets without creating real growth. On the other hand, QE directed at everyday consumers can spur tangible economic benefits.

As these policies evolve, Bitcoin may become a valuable asset for investors seeking to protect their wealth from inflation and government-backed debt.

Nevertheless, Hayes suggests that Trump’s economic policies could lead to a weaker dollar, driving investors towards assets like Bitcoin. As the government intervenes more in the economy, traditional financial structures may face challenges, and Bitcoin could stand out as a critical asset to hedge against these shifts.

Related Reading | FTX Sues Binance and Zhao for $1.8B Over Alleged Fraudulent 2021 Deal