- Binance’s Zhao Changpeng urges a shift to real blockchain use cases amid rising concerns over memecoins.

- 76% of Twitter-promoted memecoins are now worthless, exposing risks of influencer-driven hype.

- While investors lose, influencers earn $399 per tweet promoting volatile tokens.

Binance founder Zhao Changpeng expressed concern about the growing absurdity of memecoins, calling them “a little weird” and advocating for real blockchain applications instead of speculative hype.

His remarks came shortly after Binance launched futures contracts for two BNB Chain memecoins. However, the tokens saw sharp price declines following the launch, highlighting their inherent volatility and speculative nature.

Changpeng’s comments signal a need for the industry to prioritize meaningful blockchain advancements over fleeting trends. While memecoins often attract short-term attention, their long-term impact on the crypto market remains questionable.

Coinwire Study Exposes Memecoin Pitfalls

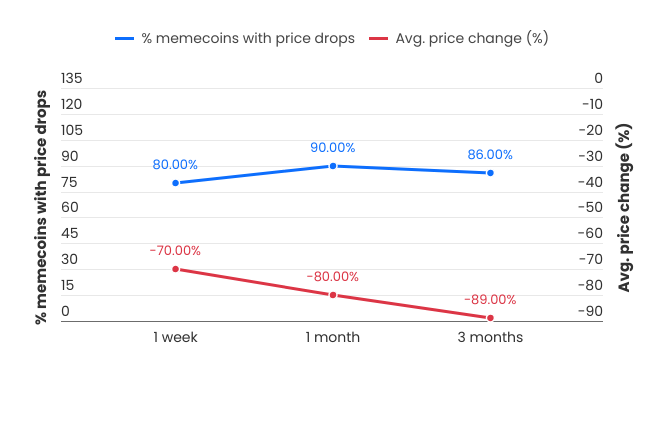

A report by Coinwire delves into the sobering reality of memecoin promotions. After analyzing 1,500 tokens endorsed by 377 Twitter influencers, the study found that 76% of these tokens are now dead, offering no value to investors. Short-term performance metrics paint an equally grim picture: 80% of promoted memecoins lost 70% of their value within a week, and 90% plummeted by 80% after a month.

The study highlights the disparity between the perceived and actual potential of memecoins. Only 3% of promoted tokens achieved a tenfold increase in value, a stark contrast to the promises made by influencers.

Notably, influencers with larger followings (over 200,000) performed worse, with 89% of their promoted tokens showing negative returns after three months. In contrast, smaller influencers (fewer than 50,000 followers) demonstrated better outcomes, with 141% positive returns over the same period, suggesting a more genuine approach to endorsements.

Financial Incentives Drive Influencer Promotions

While investors often face steep losses, influencers promoting memecoins continue to profit. On average, a single promotional tweet earns an influencer $399 and garners approximately 15,000 views. These earnings highlight the financial motivations behind promoting even high-risk or questionable tokens.

This incentive structure underscores the broader problem of influencer-driven promotions in the cryptocurrency space. The lack of accountability, coupled with significant financial rewards, allows influencers to promote risky assets without facing repercussions.

Zhao’s criticism of memecoins serves as a call to action for the crypto industry. By shifting focus from speculative tokens to real-world blockchain applications, the sector can work towards fostering innovation and creating sustainable value for investors. Until then, the memecoin hype cycle remains a cautionary tale for crypto enthusiasts.

Related Reading | Chainlink’s Bullish Momentum: LINK Gains 29% in One Week, Eyes $50 Price Target