- Bitcoin Long-Term Holders are selling a substantial portion of their holdings, with daily realized profits reaching an all-time high of $2.02 billion.

- LTHs are spending 0.27% of their total supply daily, a faster rate than during the March 2024 rally, with the majority of coins sold being acquired in the past year.

- The Sell-Side Risk Ratio is nearing the upper end, suggesting increased profit-taking, but not yet at extreme levels.

As Bitcoin approaches the long-anticipated $100k mark, recent data from Glassnode reveals a significant shift in the behavior of Long-Term Holders (LTHs), who have started to sell off a substantial portion of their holdings. Over the past few weeks, LTHs have distributed more than 507,000 BTC, marking a notable sell-off.

Although this amount is lower than the 934,000 BTC sold during the March rally, the current distribution remains impactful, with daily realized profits reaching an all-time high (ATH) of $2.02 billion.

With Bitcoin’s price nearing $100,000, LTHs are capitalizing on the strong market demand by locking in substantial profits. The daily volume of realized profit now sits at an ATH of $2.02 billion, surpassing the previous record set earlier this year. This massive profit-taking is an essential factor in the price discovery process, as LTHs, who control a significant portion of Bitcoin’s supply, release previously dormant coins into the market.

LTHs Show Aggressive Distribution Patterns

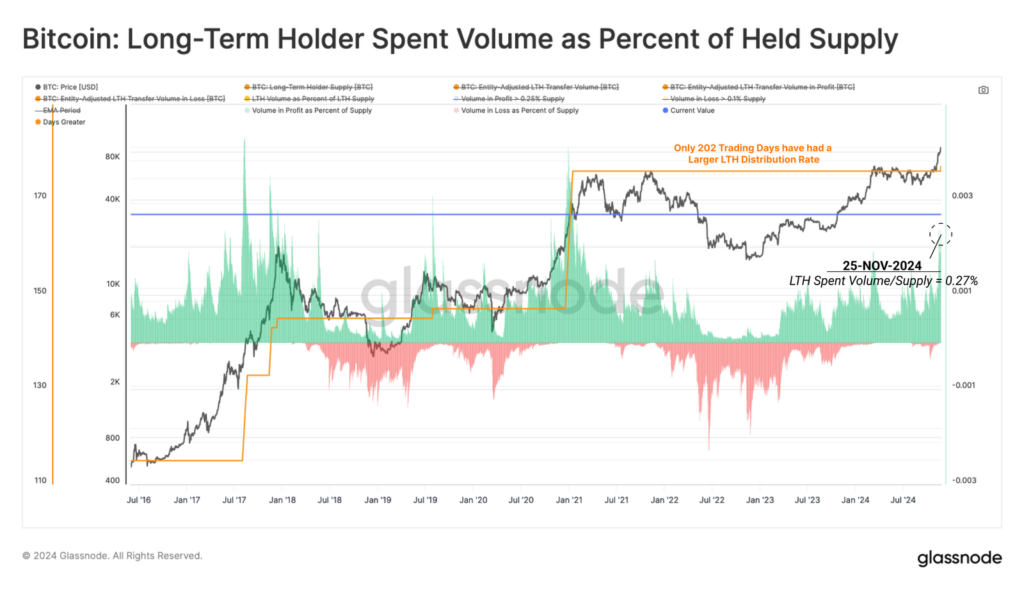

The distribution pattern seen today is more intense than the one observed during Bitcoin’s March 2024 rally. Currently, 0.27% of the total LTH supply is being spent daily, which is higher than the distribution rate during the March ATH.

This uptick in spending suggests an aggressive profit-taking strategy among LTHs, despite the fact that the volume of “coinday destruction” (a metric indicating the age of coins spent) remains lower than at the March peak. This indicates that the coins being sold are relatively young, with many acquired between six months and one year ago.

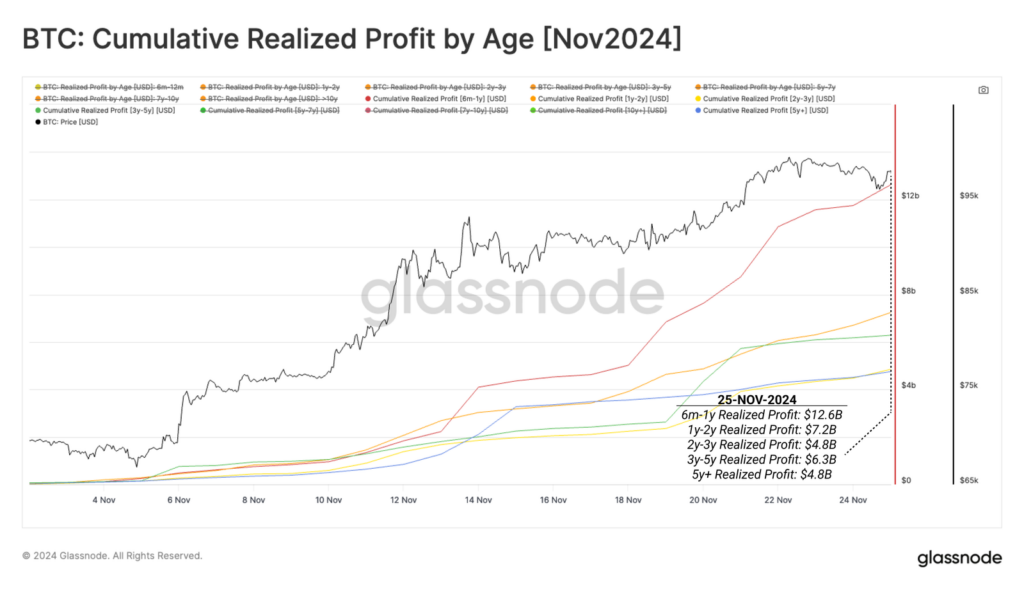

Key Sell-Side Pressure From Recently Acquired Coins

The majority of the sell-side pressure is coming from coins acquired in the past six months to one year, which constitute 35.3% of the total profit realized by LTHs. These recently acquired coins have driven much of the current distribution, suggesting that newer investors may be more likely to take profits at this stage. Older coins, particularly those held for over five years, are seeing less movement, indicating that more seasoned investors may be holding out for higher prices.

Understanding the Sustainability of the Rally

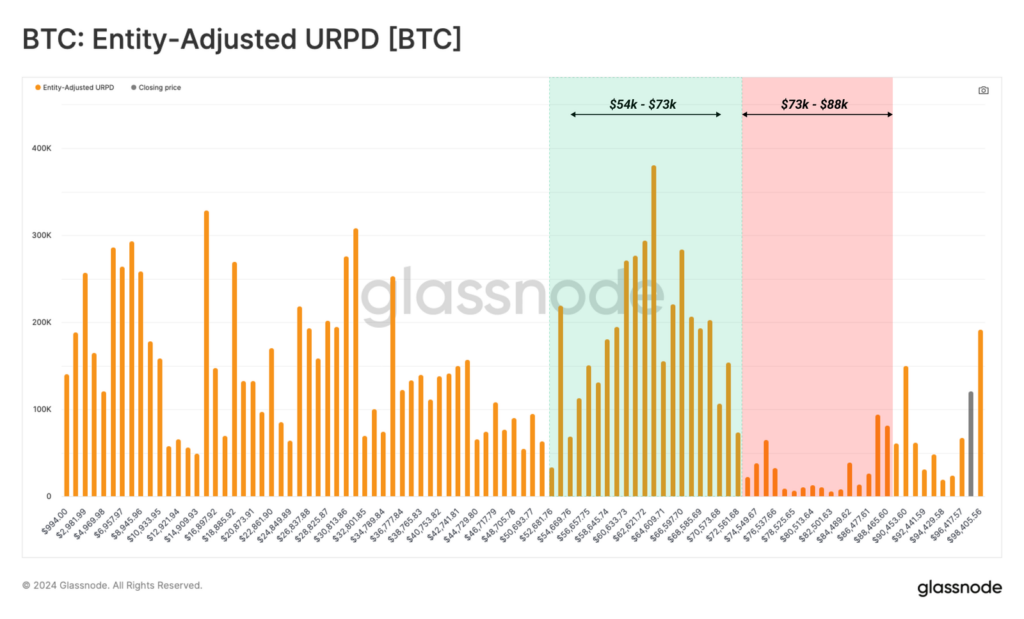

As the market continues to test new price levels, the sustainability of the current uptrend hinges on the balance between supply and demand. The Sell-Side Risk Ratio, which compares realized profits and losses to Bitcoin’s Realized Cap, is currently approaching the higher end of its range. This suggests that profit-taking is increasing, but the market has not yet reached the extreme levels seen in previous bull markets.

Looking ahead, the market may face a “gap” below the $88,000 mark, as relatively few coins have changed hands at these price levels. Should the market experience a correction, this area could become a key zone of interest for re-accumulation before any further attempts to breach the $100,000 threshold.

The recent wave of profit-taking by Long-Term Holders underscores the ongoing dynamics of Bitcoin’s price discovery process. While the sell-off has been significant, the market’s ability to absorb this supply and continue its upward trajectory will depend on the strength of demand and the re-establishment of equilibrium at higher price levels. As Bitcoin approaches new milestones, the balance between profit realization and re-accumulation will be crucial in determining the sustainability of this rally.

Related | Tezos (XTZ) Eyes $2+ Targets After Weekly Double Bottom Formation