- XRP experiences a pullback but analysts predict a rise to $4 after consolidation.

- XRP’s technical indicators show promise, with $1.96 breakout level as key support.

- Rexas Finance’s rapid rise and Ripple’s bullish growth highlight potential market shifts.

Ripple’s (XRP) has recently experienced a sharp correction, trading between $2.25 and $2.50 after peaking at $2.82 on December 2. The pullback follows a brief dip below $2.00 earlier this month. Despite this volatility, analysts maintain optimism, forecasting a potential rally to $4 once consolidation is complete.

Prominent crypto analyst Harry emphasises on X the importance of XRP retesting its $1.96 breakout level. Currently hovering between $1.96 and its 2017 high of $2.82, XRP displays promising technical indicators. Harry predicts a deeper retracement might reset market conditions, paving the way for a surge to $4 with sufficient consolidation.

XRP’s Technical Analysis Points to $4 Target

For Ripple to reach $4 this December, several factors must align. Legislative changes, particularly the creation of a spot XRP ETF, could drive institutional adoption. Additionally, Ripple’s developments into stablecoins with RLUSD and its preparations for an IPO provide a solid foundation for increased market confidence. However, short-term overbought conditions could cause a downturn.

Rexas Finance’s meteoric rise could also challenge Ripple’s dominance. As a leader in the real-world asset (RWA) sector, Rexas Finance has raised over $20.78 million in its presale and is poised for a projected listing price of $0.20. Analysts predict RXS could soar to $3 by the end of December, offering returns that far outpace Ripple’s potential rally.

Rexas Finance is transforming asset management by enabling users to tokenize real-world assets, attracting significant investor attention. The project’s presale success and its $1M giveaway campaign have fueled demand for its token, RXS. While Ripple’s fundamentals remain strong, RXS’s explosive growth potential may be a more attractive option for investors seeking massive returns this December.

XRP’s Bullish Surge to 6-Year High

XRP has been on a bullish trajectory, reaching a six-year high of $2.82 on December 2, reflecting nearly 350% gains since the beginning of 2024 and currently trading at $2.57 with 5.91% surge in past 24 hours. The token’s price surge has allowed it to overtake Tether (USDT) as the third-largest cryptocurrency by market cap. Ripple’s market cap now stands at $146B surpassing Tether’s $138 billion.

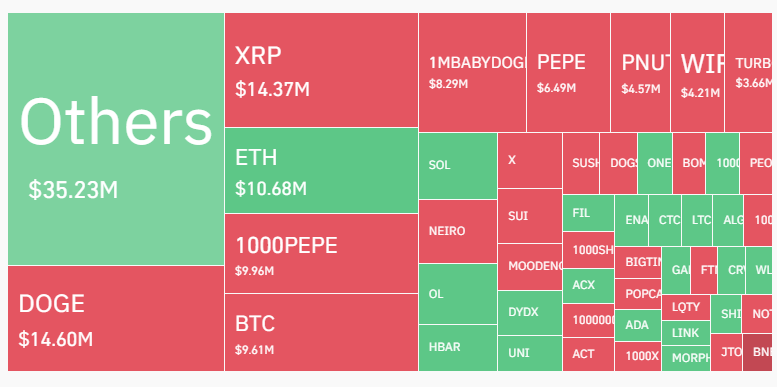

Ripple’s rise is attributed to the shifting regulatory landscape, particularly benefiting from the ongoing legal battle with the SEC. Ripple’s recent surge reflects increasing confidence within the crypto space. According to CoinGlass data, XRP’s recent rally has resulted in $14.37 million in future contract liquidations, with short positions contributing to the liquidation total. The high volume of short position liquidations indicates a strong bullish sentiment.

With the broader crypto market experiencing fluctuating trends, Ripple’s next move remains crucial. Investors closely monitor these pivotal price levels to determine if Ripple will resume its upward momentum or face further consolidation. The coming days could shape Ripple’s trajectory as market conditions evolve.

Related Reading: Ripple (XRP) Targets $3.99 as Legal and Stablecoin Momentum Builds