- Over half of U.S. financial advisers see crypto as a promising investment post-Trump’s win.

- Crypto allocations in client accounts doubled in 2024, reaching a record high.

- Regulatory hurdles remain, but 2025 shows strong potential for further adoption.

The victory of Donald Trump in 2024 has set the bar high for crypto interest among U.S. financial advisers, driven by a survey conducted by Bitwise/VettaFi. A survey conducted from November 14 to December 20 showed that 56% of advisers are now more likely to consider digital asset investments.

This excitement was further driven in 2024 by the approval of the first U.S. spot Bitcoin and Ethereum ETFs. In fact, now 22% of advisers include digital assets in client portfolios, which is twice as many as in 2023 and a signal of growing adoption among financial professionals.

Client Interest Drives Growth

Advisors are responding to an unprecedented level of interest in digital assets from their clients. 96% of the respondents said their clients asked them questions about crypto last year. Those advisers who have already invested in digital assets are committed: 99% plan to maintain or increase their exposure.

Even those who have not yet entered the market are changing their minds: 19% said they plan to allocate to digital assets in 2025, more than double the 8% who said the same last year. There are still hurdles, though: just 35% of advisers have access to infrastructure that enables direct crypto investments in client accounts.

Despite these limitations, the advisers did say a rising number of their clients independently made investments in crypto assets. While as many as 71% of financial advisers attest to their clients holding crypto independently of their portfolio, integration creates a very real opportunity in the world of advisory services.

The Path Ahead for Crypto Adoption

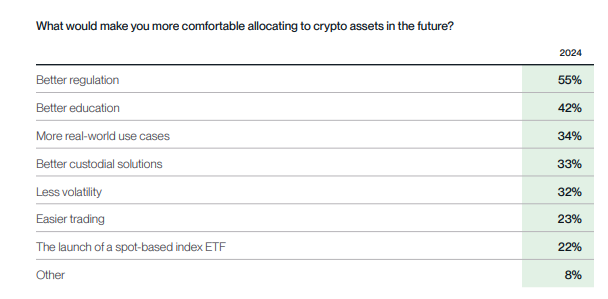

Regulatory uncertainty is still a big obstacle. 50% of advisers naming it as the main reason for not further adopting crypto. Yet, this number is lower than in previous surveys, which indicates that confidence in the sector’s regulatory clarity is growing. Crypto equity ETFs have emerged as the preferred avenue of exposure for advisers. In selecting ETFs, advisers indicate that expense ratio, brand credibility, and issuer support are more important than asset size.

2025 is expected to be the year of mass crypto adoption. Given that two-thirds of U.S. advisers are not able to access crypto for their clients, the marketplace has a considerable way to go. Better education, infrastructure, and regulatory advancement can fill the gap: industry leaders agree.