- Aave saw a 10% increase over the past week, aligning with a broader market rally led by Bitcoin.

- Crypto analyst highlighted a bullish setup for Aave, noting a key breakout from a 826-day Cup & Handle pattern.

- The analyst set ambitious price targets: $266 (short-term), $405 (mid-term), and long-term goals of $667 and $1,050.

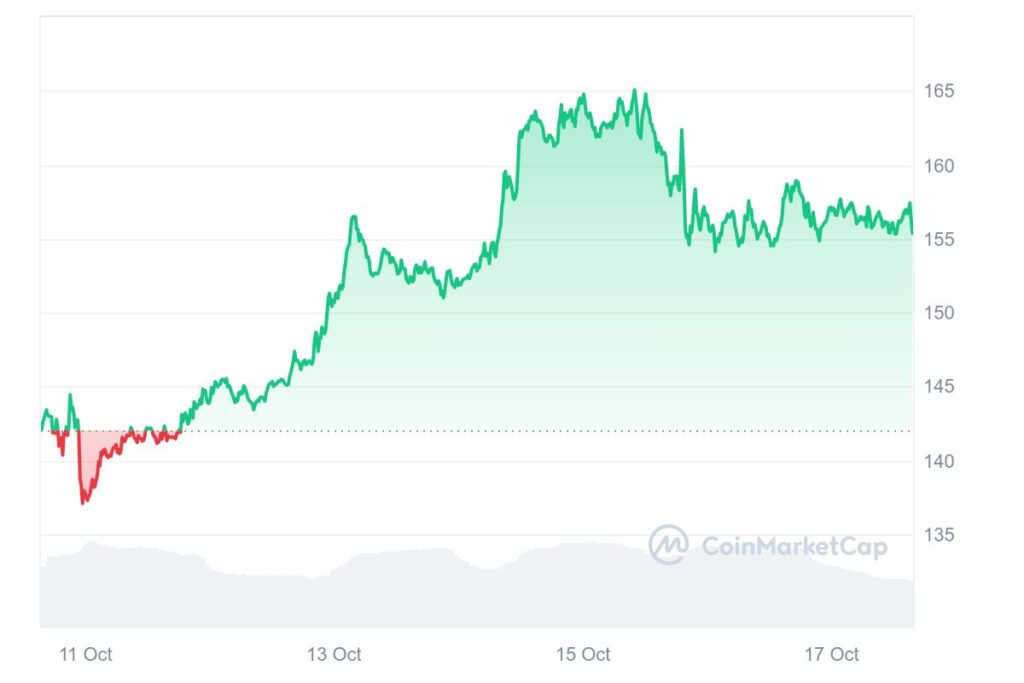

Aave (AAVE) is drawing attention as it edges closer to notable upward movements fueled by rising interest from investors. The token has witnessed a nearly 10% increase over the past week, indicating the potential for further gains. This surge comes amid a broader market upswing, driven by Bitcoin’s recent rally, which has also pushed several altcoins, including AAVE, into positive territory.

At the time of writing, the token is trading at $156.76 with a 24-hour trading volume of $232.82 million. Its market capitalization stands at $2.34 billion, accounting for a market dominance of 0.10%. Despite a slight 0.78% dip in the past 24 hours, the overall trend suggests growing momentum as the market remains in a bullish phase.

Investors are keeping a close eye on the token, anticipating further upward moves in line with the broader crypto surge. As Bitcoin continues its upward trajectory, it is setting the stage for altcoins like Aave to ride the wave, potentially leading to more price action in the coming days.

AAVE Poised for Gains Amid Bullish Setup

Aave’s future price movement is drawing increased interest from market participants, especially after crypto enthusiast Alex Clay shared his optimistic outlook. Clay has identified a bullish setup in Aave’s macro chart, suggesting the potential for a significant price surge.

He pointed to a key technical breakout following a lengthy 826-day “Cup & Handle” accumulation pattern. This particular chart formation is widely seen as a strong indicator of bullish momentum, and Aave’s breakout from this pattern marks a pivotal moment for the token’s upward trajectory.

Clay pointed out that the token has now solidified its position above a critical support area, which combines the former neckline of the Cup & Handle, a key price zone, and the 2-week SuperGuppy indicator. This confluence of support levels adds strength to the bullish outlook.

Clay has set several ambitious price targets for the token: a short-term goal of $266, a mid-term target of $405, and two long-term projections of $667 and $1,050. If market conditions remain favorable, the token could be on track to reach these levels, reinforcing its growing momentum.

Related | Bitcoin Short-Term Traders Surge: 25% Increase Signals Market Shift