- Allez Labs aims to generate $70M annually using Morpho Vaults to turn $1.3B in Polygon’s stablecoin reserves into yield-bearing assets.

- The plan deposits Dai (DAI) and Tether (USDT) into decentralized lending protocols to boost yields.

- Yearn Finance will manage rewards to support Polygon’s proof-of-stake (PoS) and AggLayer ecosystems.

- The proposal aligns with the 2024 DeFi revival, promoting decentralized financial innovation.

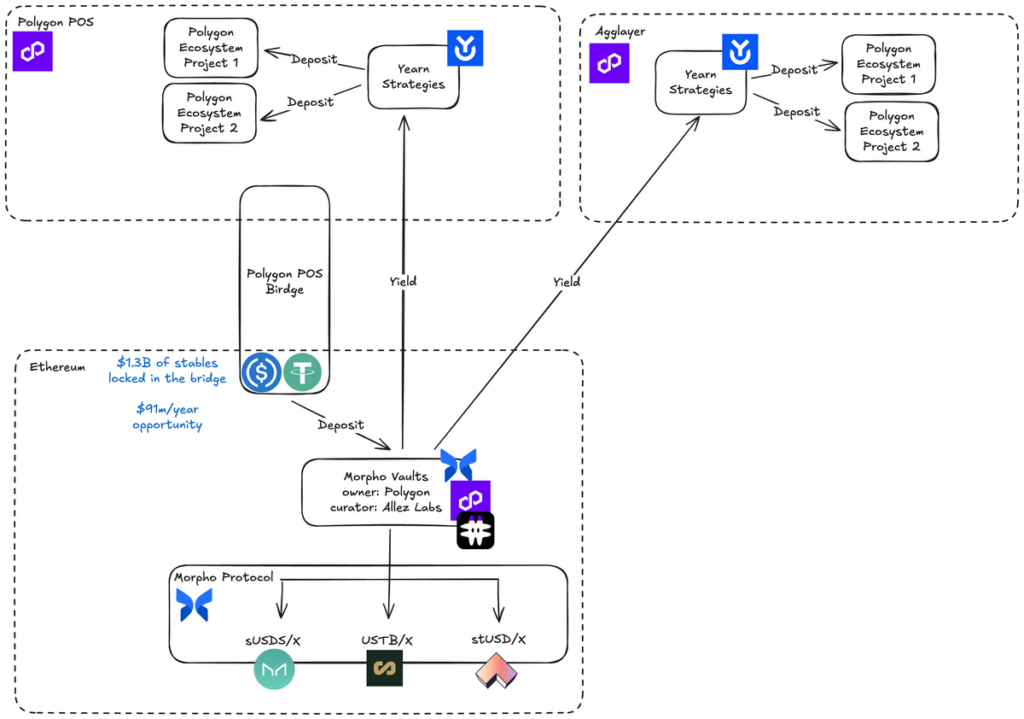

Allez Labs has introduced a bold proposal to revolutionize how Polygon’s stablecoin reserves are managed, potentially generating $70 million annually in yield. The pre-Polygon Improvement Proposal (PIP) outlines a strategy to turn the roughly $1.3 billion in stablecoins held in Polygon’s proof-of-stake (PoS) Portal bridge into active, yield-bearing assets.

Currently, those reserves- Dai (DAI), Tether (USDT), and Circle- remain parked, which is an opportunity cost if that indeed could meaningfully contribute to both ecosystem growth and DeFi innovation. This plan would deposit those stablecoins into Morpho Vaults, a decentralized lending protocol with an efficient native design that would naturally generate competitive yields.

By leveraging Morpho, these stablecoins would earn significant returns that are then funneled into the Polygon ecosystem to create an even bigger incentivized environment for projects to develop and innovate.

The proposal does not stop at generating yield. Allez Labs has proposed that the proceeds be managed through dedicated Polygon Ecosystem Vaults by Yearn Finance, a market-leading DeFi protocol. Each of the stablecoins would have its vault to enable Yearn to deploy rewards in a targeted way across both the PoS and AggLayer ecosystems of Polygon for its further development of decentralized applications and enhancement of community engagement.

DeFi Revival Sees $136B TVL Surge with Allez Labs

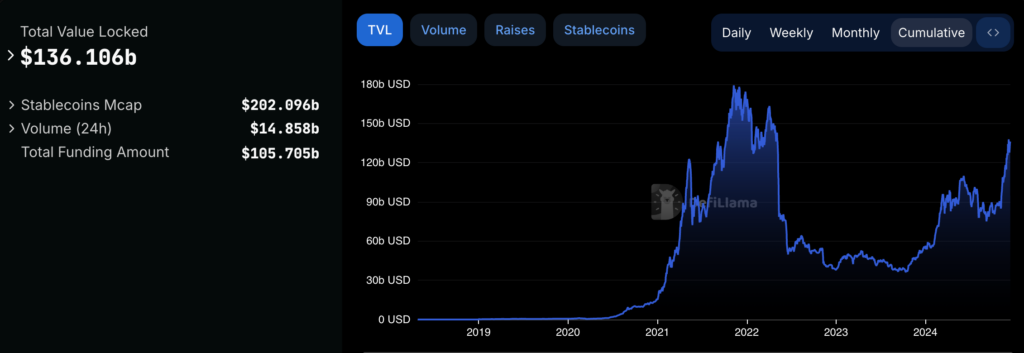

This is a timely initiative, with the dramatic rebound in the DeFi space this year, 2024. According to DefiLlama, the total value locked (TVL) across different platforms has risen to around $136 billion from this year’s low of $36 billion. The Allez Labs proposal is aligned with rejuvenation, underpinning increased demand for novel ways of achieving maximum returns in decentralized ecosystems.

Further bolstering confidence in DeFi’s revival, decentralized exchange Curve Finance reported a 23% increase in revenue in November, with annualized earnings reaching $37 million. Market experts attribute this growth to macroeconomic shifts and the increasing adoption of tokenized Bitcoin (BTC) products, which allow Bitcoin holders to generate yield in Ethereum-based DeFi protocols.

If implemented, the proposal sent by Allez Labs has the potential to set a precedent in how blockchain ecosystems manage their reserves. More than mere return maximization, this underlines the sector’s ability to stand in with traditional financial institutions by delivering innovative yield-driven solutions.

As the DeFi industry matures, such initiatives could be the precursor to products that would position themselves to directly compete with more traditional banking: private credit market access and more sophisticated lending solutions. The presence of Polygon at the leading edge may make this proposal a template for such strategies on other networks. This, a whole new era of decentralized financial innovation is born.

Related | Bank of England Requests Crypto Exposure Disclosures to Strengthen Financial Stability