- Institutional demand for Bitcoin limits asset rotation to altcoins.

- These crypto assets need fresh capital influx to hit new market cap highs.

- Retail Bitcoin FOMO could spark renewed exchange activity for the alternative coins.

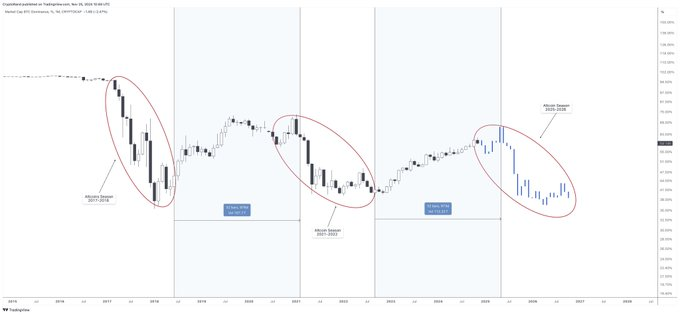

The much-awaited Altcoin season remains elusive as institutional Bitcoin demand sidesteps minor cryptocurrencies. CryptoQuant CEO Ki Young Ju, in his latest post, explains the liquidity and the broader market challenges.

He attributes the delay to the changing dynamics of capital inflow with institutional investors and spot ETFs driving the current Bitcoin rally. In contrast to traditional crypto users, these institutional players are more risk averse and would favor Bitcoin due to its established track record and relative stability compared to the volatile altcoins market. This behavior might impact the liquidity and growth potential of the lesser-known cryptocurrencies. As a result, fresh capital inflows are crucial for alternative crypto assets to achieve new market highs.

Unlike crypto exchange users, institutional investors and ETF buyers have no intention of rotating their assets from Bitcoin to alternative coin. Moreover, as they operate outside of crypto exchanges, asset rotation becomes inherently less feasible. While institutional investors might allocate funds to major altcoins via ETFs or investment vehicles, minor alternative coins still rely on crypto exchange users to buy them.

Altcoins Needs Renewed Retail FOMO

Institutional investors operate through traditional financial vehicles, making asset rotation into altcoins inherently less feasible. While major altcoins might benefit from institutional interest through ETFs or other avenues, minor cryptos remain heavily reliant on retail users active on exchanges. With the current alternative coin market cap still below its previous all-time high, it’s evident that fresh liquidity from new exchange users is lacking.

While market analysts often associate Bitcoin’s dominance with the onset of the altcoin season, Ki Young Ju suggests that the current cycle’s alternative coin growth might depend on the resurgence of retail investors’ interest in Bitcoin. A renewed retail FOMO could drive new users to crypto exchanges. Such activity might reignite the alternative coin market.

For these crypto assets to thrive independently, they must focus on developing innovative strategies to attract new capital rather than relying on Bitcoin’s momentum.