- Nikkei 225 fell 12.4%, its largest one-day drop since 1987.

- Topix index decreased 12.23%, affecting major trading companies.

- Kospi and Kosdaq fell sharply, with trading halts due to large declines.

- Nasdaq entered correction territory; S&P 500 and Dow Jones also down from peaks.

Japan’s stock market plunged into a bear market Monday after the Nikkei 225 and Topix indexes plummeted over 12% each, as the broader Asia-Pacific region faced another day of sharp selling from last week.”.

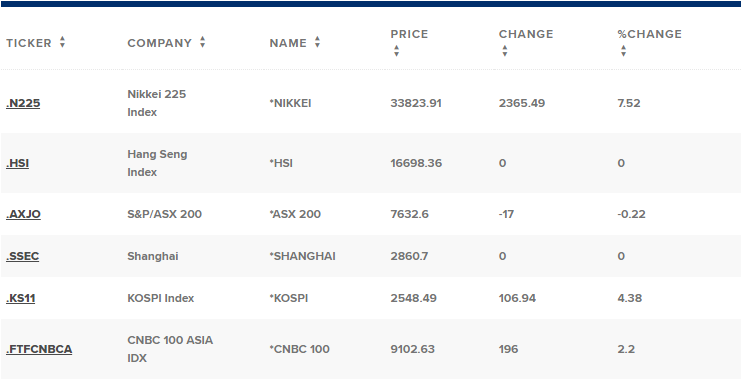

The Nikkei 225 had its biggest one-day slip since “Black Monday” in 1987, closing at 31,458.42 for a loss of 12.4%. It lost 4,451.28 points in its greatest point drop ever. It is now down all its year-to-date gains and down more than 20% from the peak on July 11.

Nikkei Leads Asian Decline Amidst Global Market Turmoil

Similarly, the Topix index tumbled 12.23%, ending at 2,227.15. Major trading companies, including Mitsubishi, Mitsui & Co, Sumitomo, and Marubeni, all experienced sharp declines, with Mitsui’s market cap shrinking by nearly 20%.

This downturn followed a significant drop on Friday, when the Nikkei 225 and Topix fell more than 5% and 6%, respectively. The yen also strengthened against the dollar to its highest level since January, trading at 142.09.

In South Korea, the Kospi index fell 8.77% to 2,441.55, while the Kosdaq dropped 11.3%, closing at 691.28. Both indices experienced circuit breaker halts during trading due to the magnitude of the declines, which saw the Kospi halt at 2:14 p.m. Seoul time and the Kosdaq at 1:56 p.m. Both halts lasted for 20 minutes, triggered by movements exceeding 8%.

Investors are now awaiting significant economic data from China and Taiwan later this week, as well as central bank decisions from Australia and India. China’s service sector showed a faster expansion in July, with the purchasing managers’ index rising to 52.1 from 51.2 in June. This growth was attributed to increased new business and improved demand conditions.

In Taiwan, the Taiwan Weighted Index fell over 8%, affected by declines in technology and real estate stocks. Meanwhile, Australia’s S&P/ASX 200 dropped 3.7% to 7,649.6. The Reserve Bank of Australia is expected to keep rates steady at 4.35% during its two-day monetary policy meeting, though markets will be attentive to any indications of future rate hikes.

Hong Kong’s Hang Seng Index ended its trading day down 1.62%, while mainland China’s CSI 300 saw a smaller decline of 1.21%, closing at 3,343.32. In the U.S., Friday’s market was marked by sharp declines following a weaker-than-expected jobs report for July, raising recession fears.

Having fallen more than 10% from its record high, the Nasdaq entered correction territory. Similarly, the S&P 500 and Dow Jones Industrial Average were down 5.7% and 3.9% from their peaks respectively. The S&P 500 lost 1.84%, the Nasdaq Composite fell by 2.43%, and the Dow Jones Industrial Average slid by a total of 610.71 points, or rather1.51%.

Related | Ethereum Caught Amidst Jump Trading’s Perfect Storm