- Australia’s Bitcoin ETF, IBTC, achieved its highest single-day volume on August 5th.

- Launched on June 4th, making Australia the third nation to offer a direct Bitcoin ETF.

Australia’s Bitcoin ETF, IBTC broke a new record achieving its highest single-day volume day on the 5th of August. A staggering 136.88k units worth AUD 1.16 million were exchanged, marking a significant milestone for the fund. Proponents of Bitcoin have hailed this achievement calling it a testament to the growing institutional interest in crypto assets. Calls for government support have intensified as the industry seeks a more conducive regulatory environment.

IBTC’s historic launch on June 4th made Australia the third nation after Hong Kong and the United States to offer investors an ETF that holds the crypto directly. Monochrome Asset Management, the ETF issuer, announced the news of the Monochrome BTC ETF [IBTC] at an event in Sydney in June, marking a new era in the nation’s digital financial landscape.

Monochrome allowed users to withdraw and self-custody BTC. Before the spot BTC ETF, the nation hosted two crypto exchange-traded products on Cboe Australia, but neither of them holds actual Bitcoin. Australian firms were required to secure approval from the national regulator, the Australian Securities Exchange [ASX], before applying to an exchange for an ETF listing. Stepping ahead, Monochrome has already obtained this clearance from the ASX for its BTC ETF product in early April 2024.

Bitcoin: Ethereum ETF records Positive Inflows

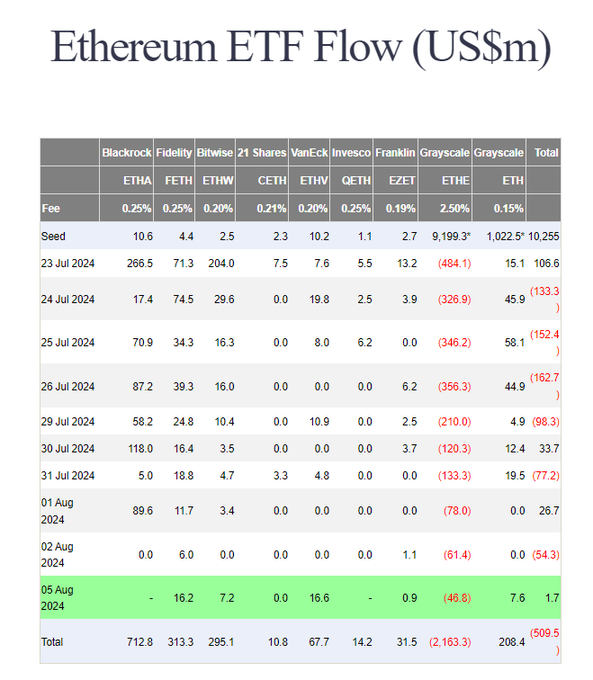

Meanwhile, the broader cryptocurrency market is showing signs of recovery. Ethereum-based ETFs are experiencing positive inflows, with an estimated $1.7 million already added today. While Grayscale’s Ethereum Trust [ETHE] continues to see outflows, the pace has slowed down, suggesting a potential bottoming out. The surge in ETF inflows underscores the increasing institutional appetite for digital assets. As more countries consider approving these crypto funds, the digital asset market is poised for further growth and maturation.

Spot ETH ETF inflows are already positive for the day at +$1.7 million with BlackRock’s ETHA inflow data still to come. Also, today was the lowest Grayscale ETHE outflow day and continues the outflow downtrend from the last few days.

The performance of IBTC and the overall ETF trend indicates a growing acceptance of Bitcoin and other cryptocurrencies as legitimate investment assets.