- Coinbase’s Base L2 blockchain is on track to become the largest Ethereum Layer 2 by TVL, showing rapid growth.

- The Coinbase BTC wrapper, cbBTC, has surpassed $350M in market cap within a month, overtaking WBTC in transaction volume.

- More companies and centralized exchanges are entering the Layer 2 (L2) space, indicating a growing trend.

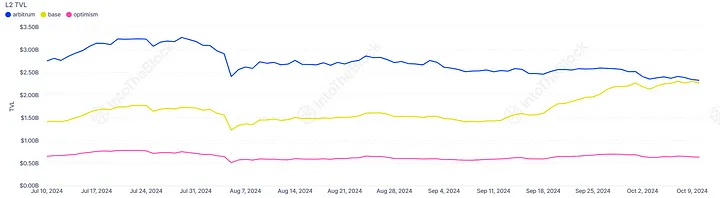

Coinbase’s Layer 2 (L2) blockchain, Base, launched just over a year ago, is making significant strides in the Ethereum scaling ecosystem. According to IntoTheBlock, Base was poised to eclipse Arbitrum and become the largest Ethereum L2 in terms of Total Value Locked, or TVL. It is on track to claim the number one position by the end of the year, having increased its TVL by a whooping $700 million last month alone. But TVL is just one of many metrics where Base is excelling.

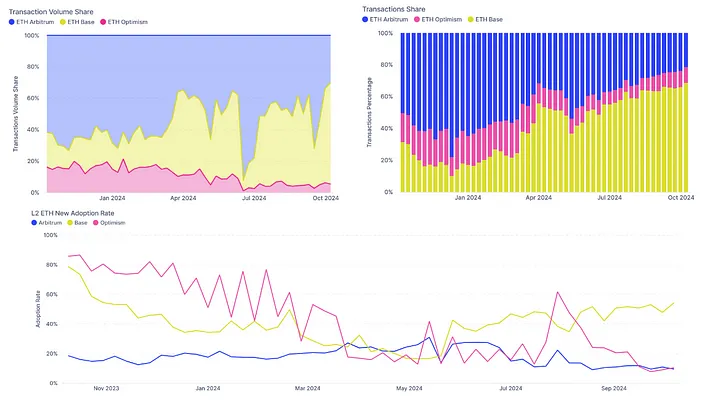

Consistently, Base captures 40-60% of all transaction volume activity among major L2 networks, such as Arbitrum and Optimism. Since June, Base has also become the dominant player for Ethereum transactions, while its popularity is continuously increasing. This would noticeably make Base the only L2 amongst its peers to continue seeing steady growth in new user adoption and, hence, a user-preferred platform.

Coinbase’s cbBTC Takes the Spotlight

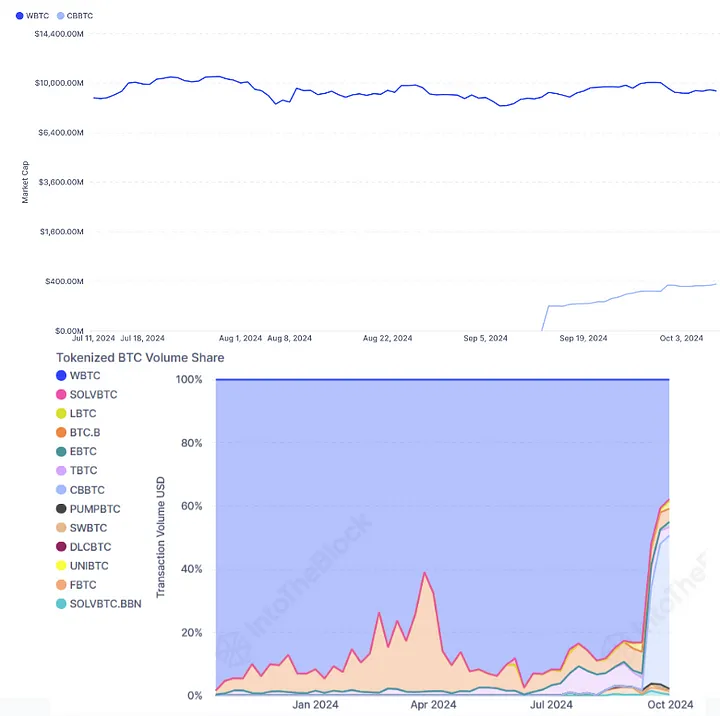

The recent release of cbBTC by Coinbase has gained rapid momentum- an ERC-20 Bitcoin wrapper that allows BTC holders on the exchange to interact with DeFi on Ethereum. In just one month, the market capitalization of cbBTC has surged past $350 million. It has broken WBTC’s dominance in transaction volumes, with more than 35% of all tokenized Bitcoin transactions taking place on Ethereum being processed by cbBTC for the first time.

Although cbBTC is still far from fully challenging WBTC’s supremacy, its rapid rise is a surefire indicator of fast-growing interest in centralized exchange users integrating into the DeFi space, a trend that may well go up a notch as Coinbase continues its expansion into the world of DeFi.

L2 Expansion to Broaden Across Industries

All this has made Coinbase’s Base and cbBTC quite successful, something that has not escaped other centralized exchanges and companies, which now follow suit by launching their own L2 blockchains. OKX’s X Layer and Morph’s upcoming Centralized Exchange Coalition are two notable entrants. Even companies outside of crypto have jumped into the L2 space, such as Sony.

Even the major DeFi protocols, such as Uniswap or Aave, hint at launching their own chains to create seamless ecosystems for their users. As this gets easier and easier with modular blockchain solutions, we will see a flood of new L2 launches with a decided bias toward specific user needs and product ecosystems.

Related Reading | Bitcoin’s Long-Term Outlook Mirrors 2013 And 2020 Cycles: Report