- After a 10% price drop, Bitcoin has rebounded to $63,500, indicating resilience despite a challenging market environment.

- The Short-Term Holder cost basis has reclaimed the critical $62,500 level, essential for maintaining upward momentum.

- Current market conditions suggest potential volatility, with significant supply nodes acting as support or resistance.

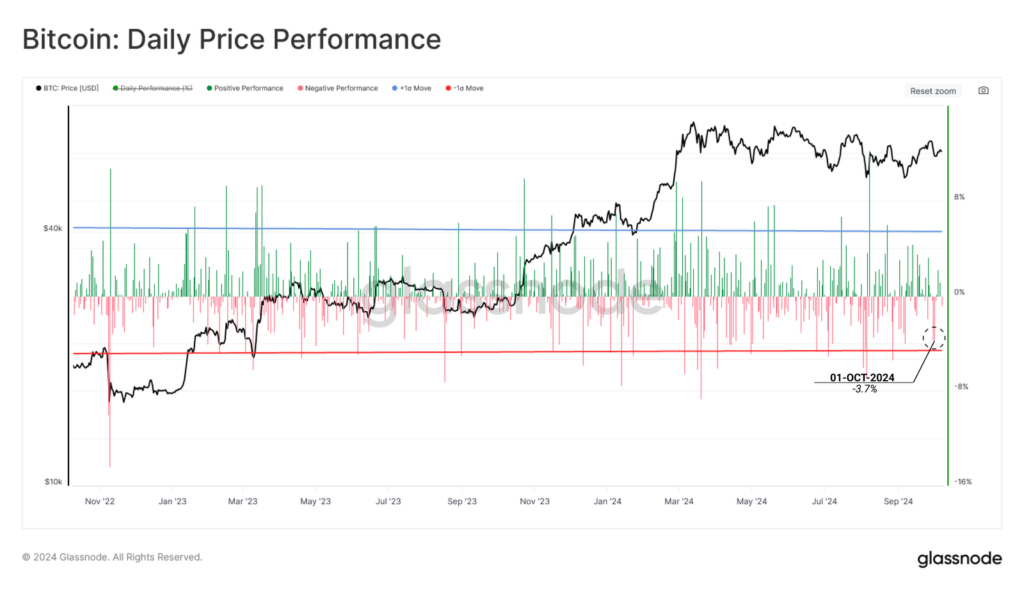

In a striking display of market resilience, Bitcoin has rebounded to approximately $63,500 following a significant 10% price correction. This recovery highlights the unique liquidity profile of the cryptocurrency market, allowing for trades to occur globally across all time zones—even when traditional markets are closed.

According to a recent report from Glassnode, such conditions often lead to notable price fluctuations, especially during weekends when trading volumes tend to dip. The recent price pullback, which saw Bitcoin dip into the $60,000 range late last week, marked one of the most profound single-day sell-off events since the lows of 2022.

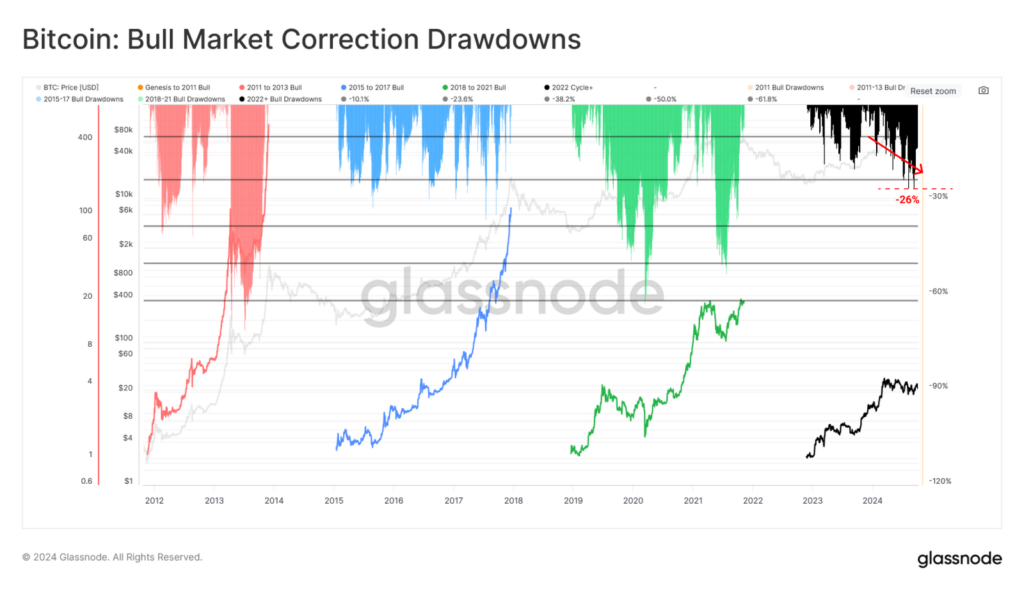

However, despite the lighter trading activity typical of weekends, the market’s strength allowed it to close the week at $63,500. This movement is largely consistent with historical trends, as the maximum drawdown during this cycle reached 26%, which is notably less severe than previous downturns.

Bitcoin Surpasses Critical Cost Basis, But Risks Remain

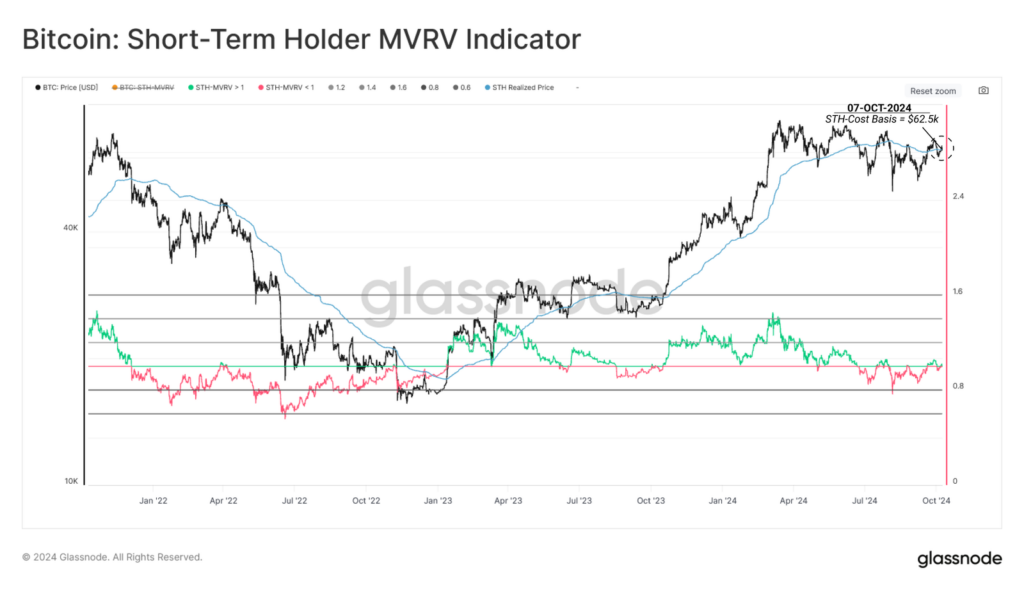

A key component of understanding Bitcoin’s price trajectory is evaluating the average cost basis of investor cohorts. The Short-Term Holder (STH) cohort, often regarded as new market demand, has seen the spot price surpass its critical cost basis of $62,500.

This recovery signals a potentially constructive market environment. However, failure to maintain this level could pressure recent buyers, particularly in light of the recent market challenges.

Analyzing macro trends through tools such as the True Market Mean ($47,000) and the Active Investor Price ($52,500) reveals that Bitcoin has consistently traded above these benchmarks this year, barring a brief dip during the August sell-off. This trend indicates a relatively strong market structure historically supporting demand during downturns.

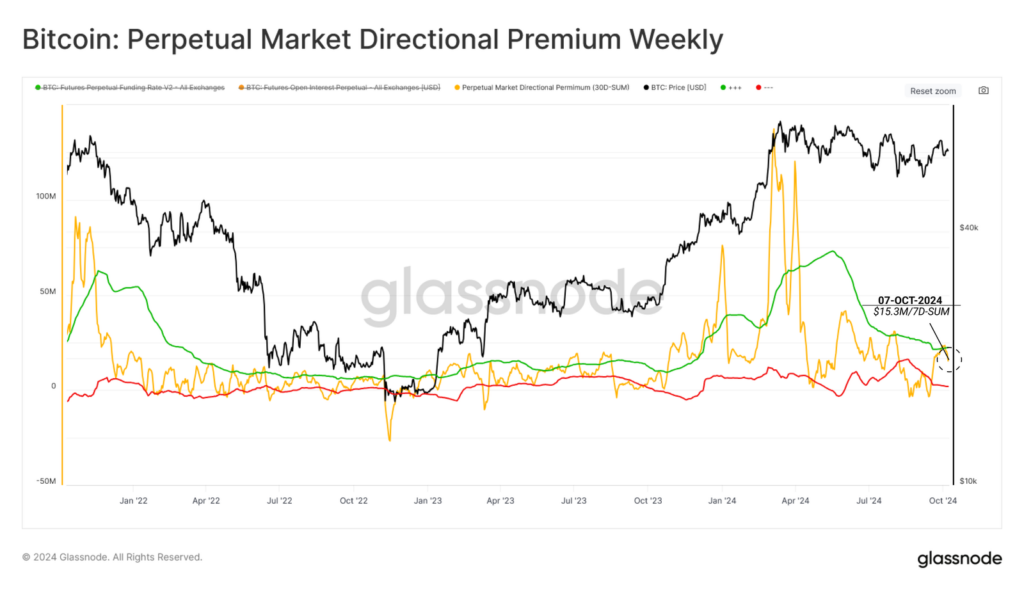

Bitcoin’s derivative market has grown significantly, though long-biased speculation dropped from $120M to $15.3M. However, a recent rise in the directional premium suggests renewed speculative interest. The $2.5B in futures liquidations, mainly affecting short sellers, indicates potential increased volatility. Bitcoin’s next price movement will depend on the balance between speculation and fundamental levels.

Related Reading | WadzChain Launches Hybrid Blockchain To Revolutionize Global Payments: Report