- BTC surged to $99,650, dipped to $90,770, and rebounded to $93,253, signaling potential for further growth.

- Rising daily active addresses and normalized funding rates suggest market stability and investor confidence.

- Bitcoin’s trading volume hit $154.92 billion on Nov 12, marking the highest since May 2021.

- Market expert projections point to a potential 20% rise, with a target of $113,386 as BTC’s momentum builds.

Bitcoin (BTC) recently soared to an all-time high (ATH) of $99,650 and faced turbulence as it dropped to a low of $90,770. Despite the pullback, the leading cryptocurrency displayed resilience, rebounding from its local low and setting the stage for another potential surge toward uncharted territory.

At the time of writing, BTC is trading at $93,253, with a 24-hour trading volume of $122.78 billion. Its market capitalization stands at $1.84 trillion, reflecting a dominance of 56.74% in the cryptocurrency market. While the BTC price has dipped by a modest 0.14% in the last 24 hours, signs suggest the current pause could be short-lived.

On-Chain Insights Signal Market Stability

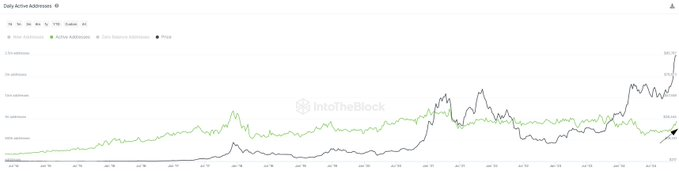

Data from IntoTheBlock sheds light on the factors driving Bitcoin’s recent retracement. Elevated funding rates, indicative of over-leveraged trading positions, contributed to the pullback. However, the normalization of these rates signals a potential stabilization, paving the way for renewed momentum.

Additionally, long-term on-chain activity is experiencing a revival. The number of daily active Bitcoin addresses is nearing the one million mark, a level not consistently seen since 2021. This uptick underscores growing network activity and investor interest, suggesting a robust foundation for sustained price growth.

November Trading Volume Hits Record High

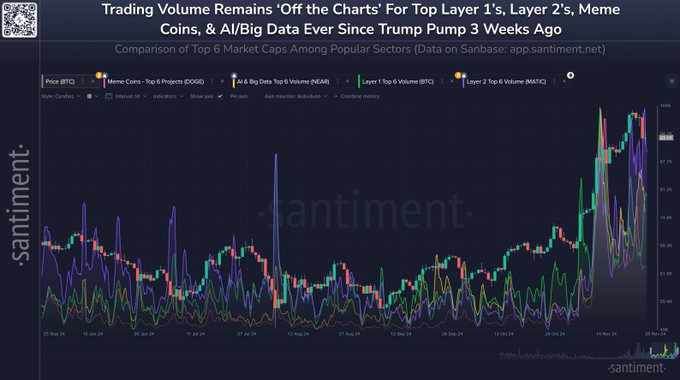

According to Santiment, November has been a standout month for on-chain trading activity. Bitcoin’s trading volume on November 12 surged to 154.92 billion BTC, the highest level since May 2021. Overall trading volumes have climbed by 32% in the past week alone, highlighting increased market participation.

Altcoins are also experiencing heightened activity as profits from Bitcoin’s ATH cycle are redistributed into speculative assets. This dynamic hints at a broader rally across the crypto market, driven by Bitcoin’s leadership.

Bitcoin’s Path to $113K

Market expert projections for Bitcoin remain optimistic. Historical patterns suggest that BTC could have minimal pullbacks as it gears up for the next leg higher. Based on this cycle’s trend, a potential surge of over 20% could push Bitcoin to a target of $113,386.

While short-term corrections may test investor confidence, the broader market environment and strengthening fundamentals appear to favor further upward momentum. BTC’s resurgence from recent lows, combined with increasing on-chain activity and trading volume, positions the asset for a potentially historic rally.

Related | DeFi’s Best-Kept Secrets: Undervalued Projects Poised for Growth