- Bitcoin (BTC) remains resilient, signaling confidence despite resistance near $100,000.

- Bitcoin spot ETFs recorded a $475 million net inflow on December 26, breaking a 4-day outflow streak, with Fidelity’s FBTC contributing $254 million.

- Analysts identify $87,000 as a potential “maximum pain” level before Bitcoin resumes its upward momentum toward $110,000.

Bitcoin (BTC) is maintaining its strength above critical support levels while setting sights on higher price targets. Despite facing resistance near the $100,000 mark, the flagship cryptocurrency found support at $94,000, signaling strong market confidence and resilience.

At the time of writing, BTC is priced at $96,634, reflecting a 0.99% gain over the past 24 hours. The cryptocurrency boasts a 24-hour trading volume of $57.40 billion, a market capitalization of $1.91 trillion, and a market dominance of 56.47%, underscoring its continued influence in the digital asset space.

Bitcoin ETF Inflows Hit $475M After 4-Day Outflows

A significant development contributing to this positive momentum is the resurgence of Bitcoin spot ETF inflows. According to data from SoSoValue, BTC spot ETFs recorded a net inflow of $475 million on December 26, marking the first positive inflow after four consecutive days of outflows. Notably, Fidelity’s FBTC ETF accounted for $254 million of these inflows, highlighting renewed institutional interest.

Bitcoin Eyes $110K Despite $87K ‘Pain’ Level

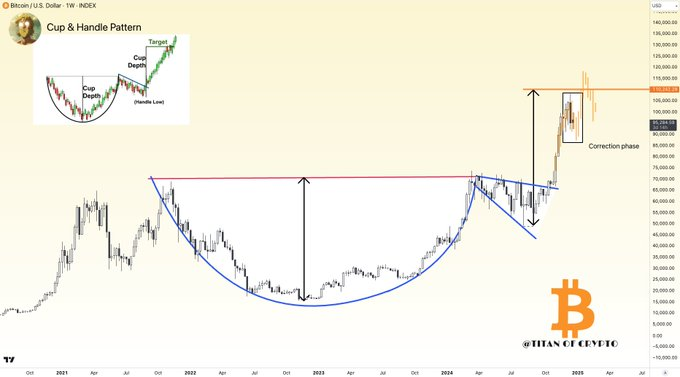

Market sentiment remains cautiously optimistic, with many traders and investors closely monitoring key levels. If BTC faces further downward pressure, analysts have identified the $87,000 mark as a potential “maximum pain” level before the market resumes its upward trajectory. This correction phase aligns with historical market patterns, as Bitcoin rarely moves in a straight line during bull runs.

The overarching narrative suggests that BTC’s path toward the highly anticipated $110,000 level remains intact. With institutional inflows picking up and market structure holding firm above critical support zones, the next leg upward seems increasingly probable.

As the market navigates this phase, investors are reminded of the inherent volatility of cryptocurrency markets. However, the underlying fundamentals supporting BTC’s growth, including institutional adoption and limited supply, continue to drive long-term bullish sentiment.

Related | Ondo Finance (ONDO) Faces 24% Dip but Eyes Bullish Reversal at $1.86 Support