- Bitcoin hits a record $106,500, fueled by a bull rally since October 10.

- Whale wallets holding 100+ BTC rise by 9.9%, signaling strategic accumulation.

- Historical trends hint at potential profit-taking as Bitcoin nears its peak.

- Pi Cycle Top indicator points to a $129,000 target, boosting investor optimism.

Bitcoin, the flagship cryptocurrency, has reached a monumental milestone, climbing to $106,500 for the first time in its 16-year history, according to data from Santiment. This surge marks a significant achievement fueled by an ongoing bull rally that began on October 10th. The rally has not only propelled BTC’s price but also ignited a notable increase in whale activity.

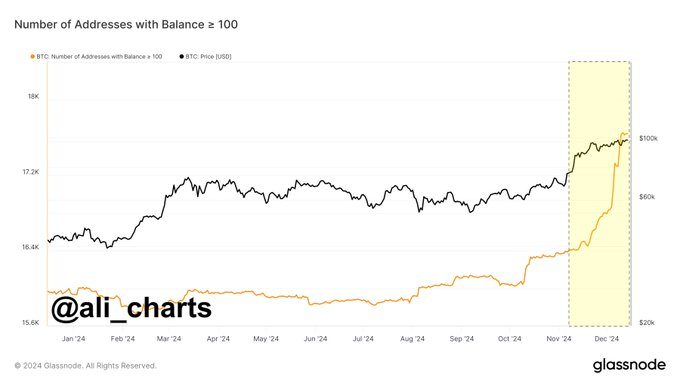

In just over two months, the number of wallets holding at least 100 BTC has grown by 1,582, reflecting a 9.9% jump in large-scale BTC accumulation. This sharp uptick indicates heightened confidence among whales, who appear to be positioning themselves strategically during this bullish momentum.

Bitcoin Whales Fuel Peak Speculation

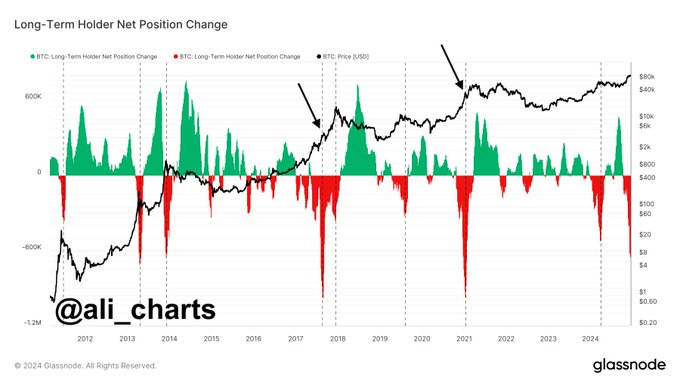

Market veterans suggest that historical patterns could be hinting at a potential market top. In previous cycles, particularly in 2017 and 2021, long-term BTC holders capitalized on peaks by offloading substantial amounts of BTC right before the final explosive surge.

This behavior raises questions about whether a similar trend might unfold now. With BTC whales actively increasing their holdings, some wonder if this signals a strategic buildup before a final leg upward or if it’s a prelude to profit-taking at a perceived market peak.

Interestingly, Bitcoin’s whale activity has intensified since Donald Trump’s political resurgence. Ali highlights a “parabolic” rise in the number of large BTC holders coinciding with Trump’s influence on financial market sentiment. This correlation suggests macro events could be playing a role in driving Bitcoin’s appeal as a hedge against uncertainty.

Bitcoin Momentum Builds Toward $129K Goal

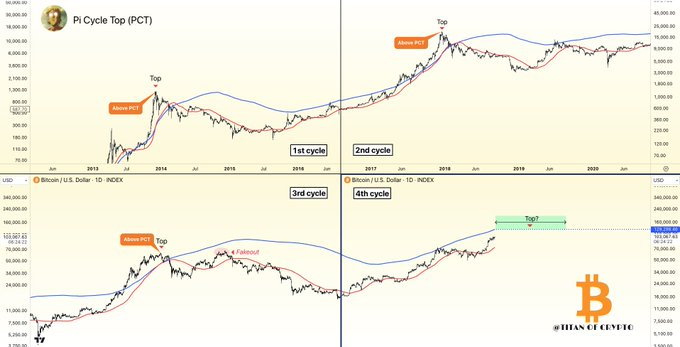

Adding to the optimism, market observers point to the Pi Cycle Top indicator as a potential guide. Historically, BTC’s price has never peaked below this metric, which currently suggests a cycle top well above $129,000. While speculation remains, this threshold has become a psychological target for many investors.

As Bitcoin’s momentum continues, the question remains: Will history repeat itself, or will this cycle defy expectations? With whales accumulating and market patterns aligning, all eyes are on Bitcoin’s next move in its record-breaking journey.

Related | Is Gate.io Safe? Exchange Dispels Hack Rumors and Strengthens Trust