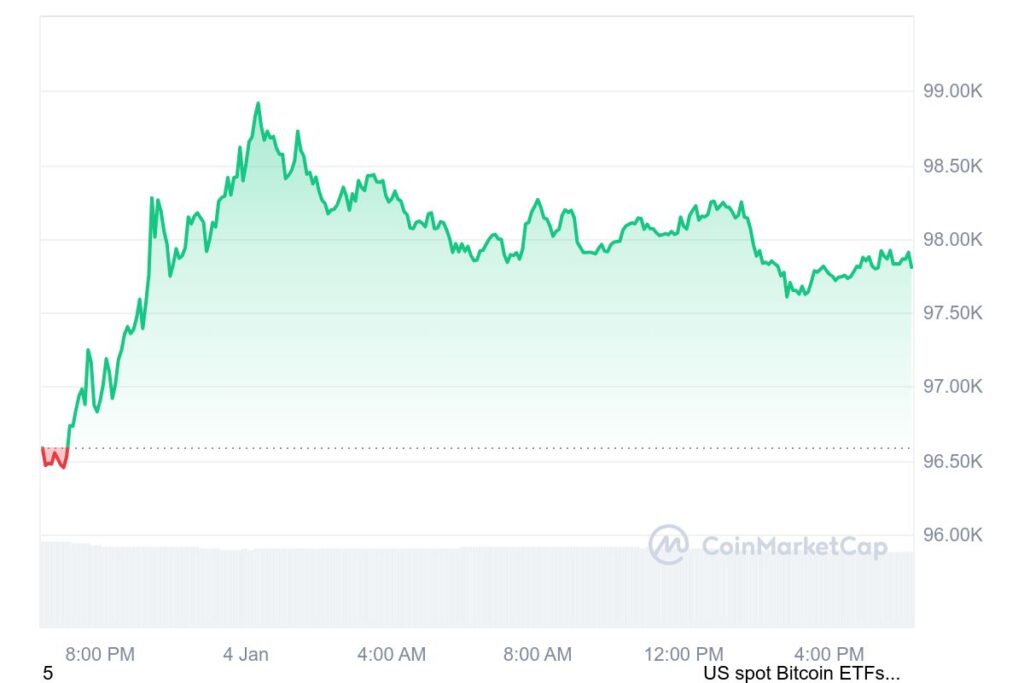

- Bitcoin is priced at $97,868, up 1.19% in the past 24 hours, maintaining strong support levels.

- Shifts in supply between Long-Term and Short-Term Holders suggest stable market conditions.

- The Short-Term Holder Spent Output Profit Ratio (STH SOPR) is neutral at 1, indicating balanced market pressure.

- Bitcoin’s outlook points to potential short-term consolidation or correction, guided by key support levels.

Bitcoin (BTC) remains on a positive price trajectory, maintaining its position above critical support levels and setting its sights on higher price targets. Currently, Bitcoin is priced at $97,868, marking a 1.19% increase over the last 24 hours. It has a 24-hour trading volume of $54.95 billion and a market capitalization of $1.94 trillion. These figures reflect Bitcoin’s solid performance as it continues to demonstrate potential for long-term growth in the cryptocurrency market.

Bitcoin Supply Shift Signals Key Market Trends

A notable trend in Bitcoin’s market is the ongoing transfer of Bitcoin supply between Long-Term Holders (LTHs) and Short-Term Holders (STHs). Insights from CryptoQuant reveal that such shifts have historically been associated with important moments in market cycles, including local price tops and even the peak of broader market trends.

At present, the demand from STHs continues to support Bitcoin’s price, helping absorb any selling pressure from LTHs. This indicates a steady market environment as Bitcoin’s supply dynamics evolve, with a cautious yet persistent upward momentum.

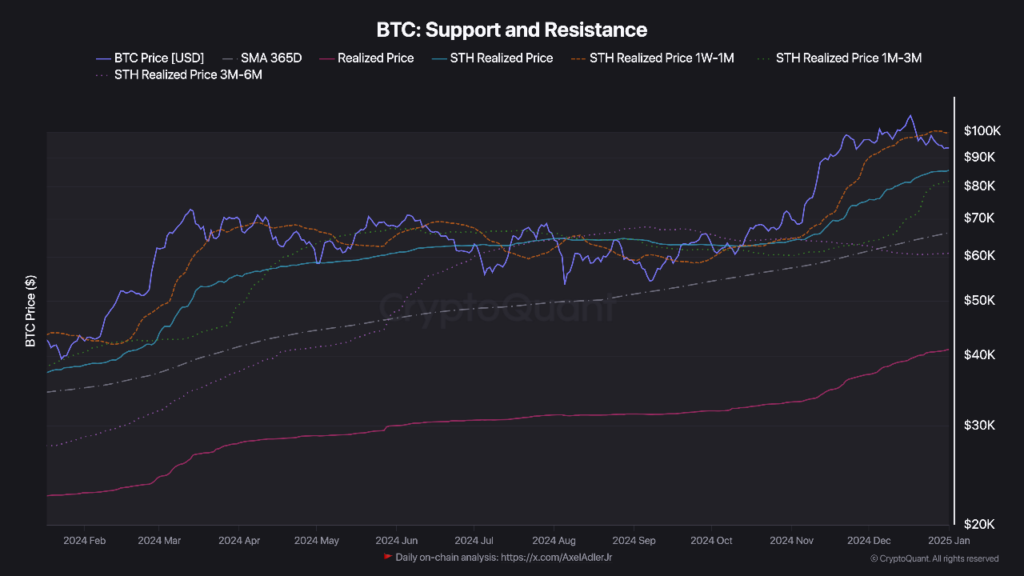

CryptoQuant’s analysis delves deeper into Bitcoin’s key support and resistance levels, based on the “realized prices” of Short-Term Holders (STHs) across various acquisition periods. These realized prices help identify critical points where market participants are likely to buy or sell, giving valuable insight into Bitcoin’s price behavior.

For example, the overall realized price for Bitcoin stands at $41,000, representing the average acquisition price for all Bitcoin in circulation. For STHs, the realized price is significantly higher at $85,000. Further breakdowns show key levels such as:

- 1-week to 1-month acquisition: $99,000

- 1-month to 3-month acquisition: $81,000

- 3-month to 6-month acquisition: $60,000

These support and resistance levels offer a roadmap for traders, showing where Bitcoin may face significant buying or selling activity, influencing its price movement in the near term.

STH SOPR Ratio: Indicator of Market Sentiment

The Short-Term Holder Spent Output Profit Ratio (STH SOPR) is another crucial metric currently shaping Bitcoin’s market sentiment. At present, the STH SOPR ratio sits at a neutral value of 1, having declined from the previous rally that saw Bitcoin reach its all-time high (ATH) of $108,000. A ratio of 1 suggests that STHs are not incurring substantial profits or losses on their positions, reflecting a balance between buying and selling pressures in the market.

The decline in the STH SOPR ratio also signals that selling Bitcoin is no longer highly profitable for many Short-Term Holders, suggesting reduced selling pressure in the short term. However, this neutral stance also hints at market indecision, which could affect Bitcoin’s price in the near future as traders weigh their options.

Bitcoin’s Short-Term Outlook

While Bitcoin’s market appears strong, with solid support levels and continued demand from STHs, the declining STH SOPR ratio suggests the bullish momentum could be slowing. As a result, Bitcoin may face a period of consolidation or even a deeper correction before its next major move. The balance between buying pressure from STHs and selling pressure from LTHs remains stable, but market participants should be prepared for potential short-term volatility.

While Bitcoin is holding steady above support levels and remains poised for growth, the market faces a delicate balance. The ongoing shifts in Bitcoin’s supply dynamics, coupled with the neutral STH SOPR ratio, suggest that the market may experience periods of consolidation or correction. As Bitcoin navigates these evolving market conditions, investors should stay alert to the potential for short-term price fluctuations. By closely monitoring support levels and market sentiment, traders can better understand Bitcoin’s next moves and make informed decisions.

Related | Ripple Expands Stablecoin Strategy with 600K New RLUSD Tokens