- Bitcoin maintains stability above key support levels, with a current price of $96,030.

- A buy signal from the TD Sequential indicator on the 4-hour chart suggests a potential price rebound.

- Institutional adoption continues to grow, with El Salvador and Metaplanet increasing their Bitcoin holdings.

- Speculation about the UAE holding $40 billion in Bitcoin adds to growing optimism in the market.

Bitcoin (BTC) has managed to maintain its position above a crucial support level, showing resilience after a recent period of volatility. With positive market activity surrounding the leading cryptocurrency, many are optimistic about the potential for a significant price surge in the coming weeks. Bitcoin’s recent performance has been marked by stability, and a variety of factors suggest that BTC could be on the verge of another leg up, potentially reaching new price heights soon.

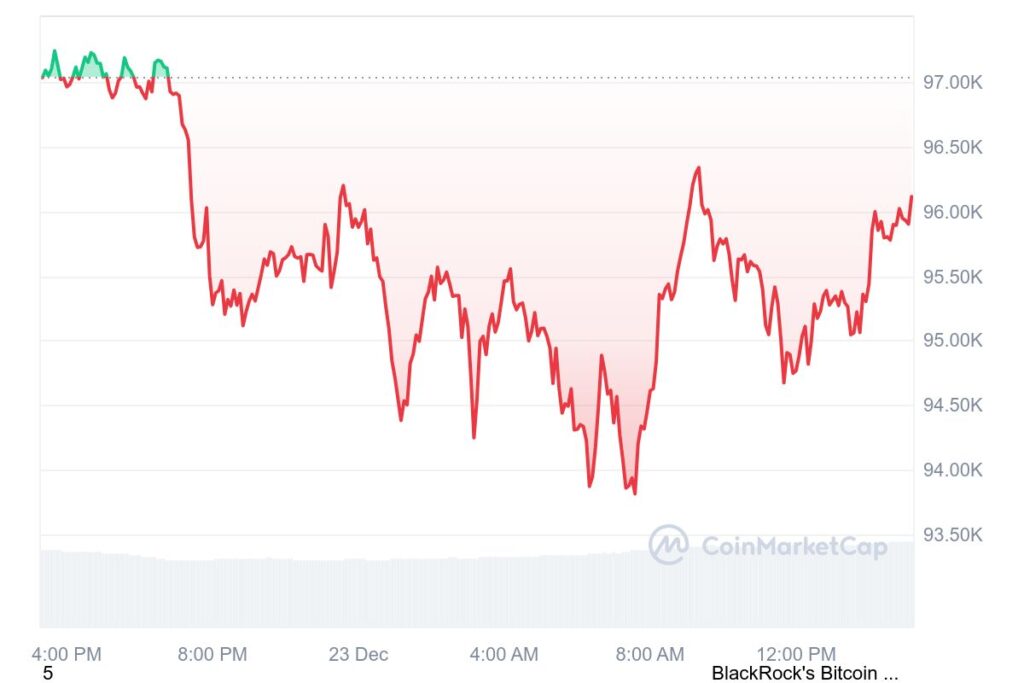

At the time of writing, Bitcoin is priced at $96,030, with a 24-hour trading volume of $62.37 billion. The cryptocurrency holds a market capitalization of $1.90 trillion and a market dominance of 56.96%. Despite a slight decrease of -0.98% in the past 24 hours, the overall market sentiment remains bullish as BTC shows strong support.

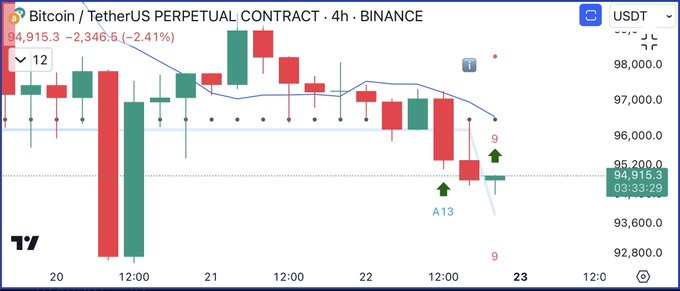

Bitcoin’s 4-Hour Buy Signal Points to Reversal

One key signal pointing toward a potential price rebound comes from the TD Sequential indicator, which has generated a buy signal on the 4-hour chart for Bitcoin. This suggests that a positive price movement could be on the horizon, encouraging traders and investors to anticipate a short-term upward trend. Crypto enthusiast Ali Martinez highlighted this development, suggesting that Bitcoin could soon experience a price reversal and move toward higher levels.

Bitcoin Poised for Price Surge as Institutional Adoption Grows

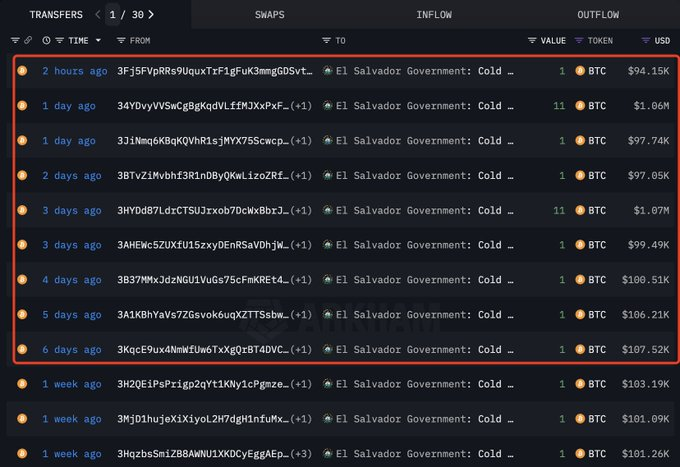

Additionally, Bitcoin’s network has attracted more institutional interest, with significant purchases from various entities. Data from Lookonchain reveals that the government of El Salvador is actively increasing its BTC reserves. El Salvador purchased 29 BTC in the past week alone, valued at approximately $2.84 million.

This move brings the nation’s total BTC holdings to 5,995 BTC, a stake now worth roughly $562 million. The ongoing accumulation strategy signals El Salvador’s commitment to holding Bitcoin as a long-term asset.

Meanwhile, the investment firm Metaplanet has also been adding to its BTC holdings. According to Bitbo data, Metaplanet recently purchased an additional 619.70 BTC, bringing its total BTC holdings to 1,762 BTC, valued at around $168 million. The average acquisition cost for the firm’s BTC portfolio now stands at approximately $75,600 per BTC, further emphasizing the growing institutional interest in the digital asset.

On a global scale, Binance founder Changpeng Zhao has stirred up discussions regarding the United Arab Emirates’ (UAE) BTC holdings. Zhao recently shared an article claiming that the UAE possesses approximately $40 billion worth of BTC, igniting curiosity and speculation within the crypto community.

Bitcoin’s stability above key support levels, coupled with growing institutional adoption, suggests that the cryptocurrency could be poised for significant price movements soon. With major players like El Salvador and Metaplanet increasing their BTC holdings and speculation surrounding the UAE’s BTC reserves, the stage is set for a potential bull run that could drive BTC to new heights.

Related | BPCE to Offer Crypto Services to 35 Million Customers by 2025 Through Hexarq