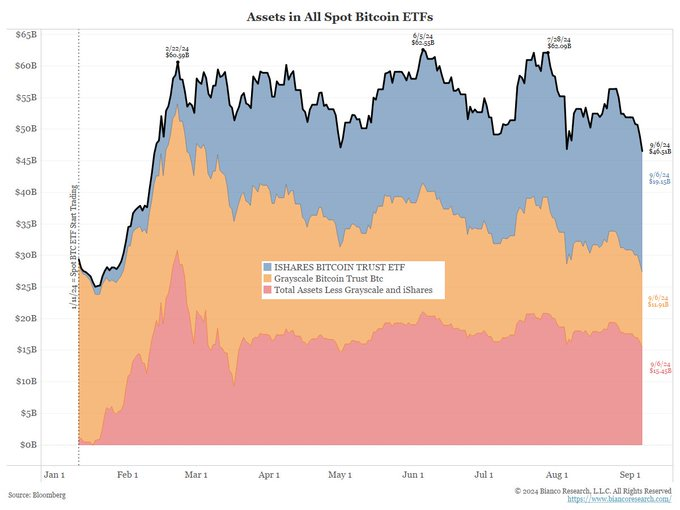

- Bitcoin ETF assets dropped from $62 billion in June to $46 billion, marking the lowest total since February.

- Inflows have significantly slowed, with $1 billion added over the last three months and a $1 billion outflow in the last eight days.

- The average Bitcoin purchase price in ETFs is $61,000, leading to $2.2 billion in unrealized losses at the current price of $52,900.

In the latest evaluation of Bitcoin ETFs, Jim Bianco, the CEO of Bianco Research, gave a rather gloomy analysis of their place in the global cryptocurrency adoption spectrum. Nevertheless, the fact that Bianco has pointed out that the initial enthusiasm is the turning point of success shows the potential of these tools to become the main vehicle for mainstream investment.

Decline in Bitcoin ETF Inflows and Recent Outflows

Now, all of the Spot Bitcoin ETFs have a total of $46 billion in assets, which has dropped from $62 billion in June. Such a figure is the lowest asset total since February 12. Recent data shows a troubling trend: on the one hand, there was $12 billion added to these funds in the initial two months, but now the pace has gone sharply down, and only $1 billion of inflow is there over the last three months, as well as a $1 billion outflow in the last eight days.

The current average purchase price of Bitcoin held in these ETFs is $61,000, juxtaposed against a Friday closing price of $52,900. Thus, ETF owners are at the crossroads of a staggering $2.2 billion in unrealized losses, which is 16% underwater. The average trade size has dwindled to under $12,000, the smallest since March, as it shows a shift toward smaller investors who are not very committed and are referred to as “tourists” by Bianco.

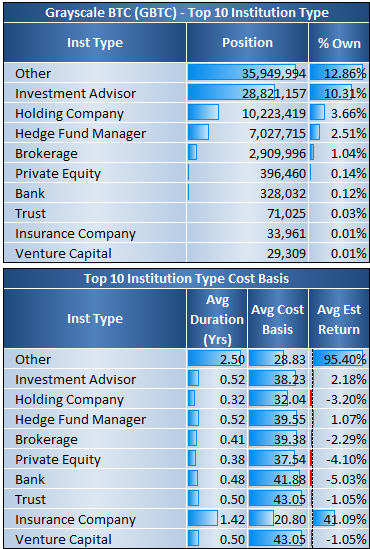

The ETF ownership distribution shows that there is no significant participation from the traditional finance sector, as the wealth advisors only account for less than 10%, while the hedge funds come in with 12%, mainly doing basis trades. This means that about 85% of the holdings are outside of traditional finance, with many of them being holders in losses.

Bianco concludes that Bitcoin ETFs have not yet made their full potential to gain acceptance. The hoped-for influx of traditional investors has not materialized. To convert the doubtful to believers, ETFs need to improve Bitcoin’s DeFi, NFTs, and payment systems. It might take until after the 2028 halving and more crypto developments arrive for Bitcoin ETFs to fulfill their adoption journey.

Related Reading | Ethereum Network Sees Surge in Growth Amid Major Wallet Movements