- Long-term holders (LTHs) accumulated 87,000 BTC over the past month, signaling bullish sentiment.

- Bitcoin’s LTH balance rose by 0.06% in 24 hours, with $137 million in Bitcoin leaving exchanges.

- Analysts believe Bitcoin can reach $100,000 if demand continues to outpace supply and LTH selloffs slow.

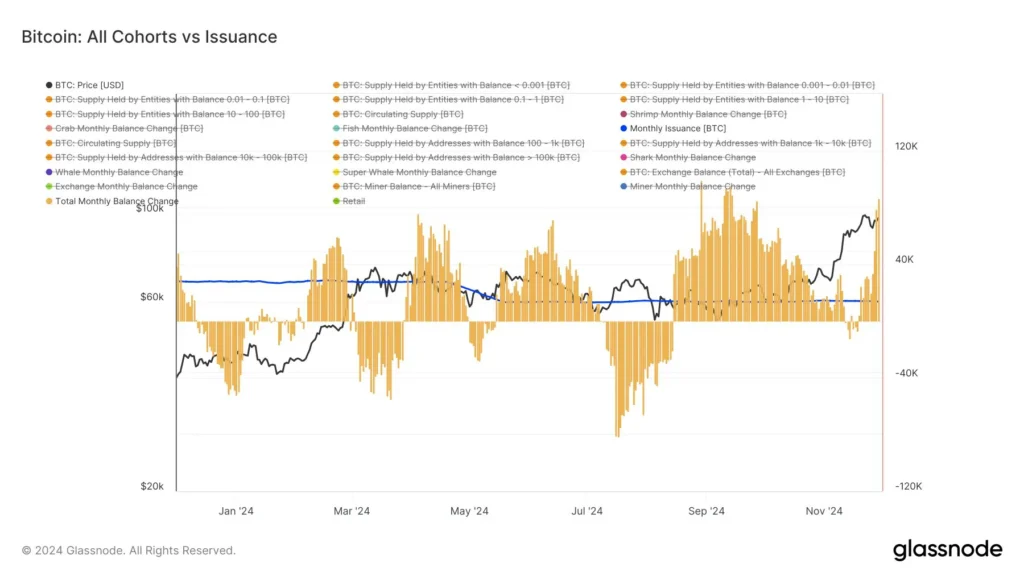

Cryptocurrency analyst James Van Straten highlighted a pivotal trend in Bitcoin’s market Sunday, noting that long-term holders (LTHs) may have reached a supply bottom, signaling the start of an accumulation period. According to Van Straten, the market absorbed 1,098,490 BTCs, suggesting renewed growth in long-term holder balances.

In a post on X, Van Straten projected that Bitcoin’s supply held by LTHs would increase. Historical data backs this up, with long-term holders defined as addresses holding BTC for over 155 days. He noted that Bitcoin’s supply has increased over the past week, signaling a potential upward trajectory. On August 3, BTC dropped from $70K to $49K, just before the Yen Carry Trade Unwind bottomed.

Long-Term Holders Stabilize Bitcoin Market

Van Straten emphasized the critical role of long-term holders, often referred to as “diamond hands,” in stabilizing the market. These investors typically accumulate during weak trends and sell during bull runs. He revealed that Bitcoin’s LTH balance increased by 0.06% within 24 hours, while $137 million worth of BTC left exchanges, reflecting a preference for HODL.

Currently priced at $98,917.76, Bitcoin’s gradual recovery suggests robust investor confidence. Van Straten attributes this to reduced LTH selloffs, which had earlier hindered Bitcoin’s march toward $100,000. He identified a net accumulation of 87,000 BTC over the past month as a significant bullish indicator.

Van Straten believes Bitcoin’s path to $100,000 is achievable if demand outpaces supply. He noted that recent profit-taking by LTHs has slowed, alleviating selling pressure. “Any LTH that wanted to take profit near 100k has pretty much done so,” he stated, adding that short-term holders’ capitulations during a 10% correction have further strengthened this outlook.

Other experts, like technical analyst Ali Martinez, share Van Straten’s optimism but caution against bearish sentiments driven by profit-booking behaviors. November witnessed the highest LTH selloff since April, with 728,000 Bitcoin offloaded, according to CryptoQuant. Despite this, analysts remain bullish on Bitcoin’s upward trajectory.

Read More: Bitcoin (BTC) Outlook: Support Levels and Market Shifts Indicate Consolidation Ahead