- Experts attribute Bitcoin’s $100K to the surge in realized capitalization and fresh capital inflows

- Despite the significant price increase, experts believe Bitcoin is still far from a bubble, requiring a 43% surge to reach that threshold.

- Two BTC addresses, inactive for over a decade, have been reactivated during the recent price surge, adding to the market’s intrigue.

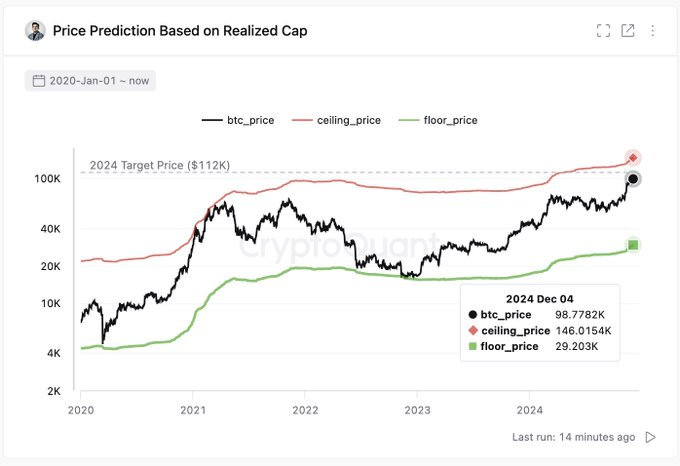

As Bitcoin broke the crucial $100K Barrier, market experts shed light on the influx of fresh capital that fueled the rally. CryptoQuant CEO and lead researcher Ku Young Ju has revealed that fresh capital is driving BTC’s recent surge. A rise in BTC’s realized capitalization has led to a significant increase in its price ceiling, which has increased from $129,000 to $146,000 in a month.

This significant price movement has pushed the dominant token to a historic milestone, surpassing the $100,000 mark for the first time. Despite this achievement, experts believe that Bitcoin is still far from a bubble territory. According to calculations, BTC would require an additional 43% surge to reach the threshold often considered a bubble.

This surge in BTC’s price can be attributed to several factors, including increasing institutional adoption, positive regulatory developments, and growing global interest in cryptocurrency. As more and more investors and financial institutions recognize the potential of Bitcoin as a valuable asset, its demand continues to rise. This landmark achievement pushed its market capitalization to $2.017 trillion, placing it alongside tech giants like Apple, NVIDIA, and Microsoft. BTC’s market cap is now above Saudi Aramco, Meta Platforms, Tesla, and Berkshire Hathaway.

Dormant Bitcoin Wallets Uncovered

Following the unprecedented surge, two dormant BTC addresses have been revived after 12 to 13 years of inactivity, sparking curiosity in the crypto community. The resurfacing of these early adopters comes during Bitcoin’s record-breaking rally.

According to on-chain data from Whale Alert, one address, holding 10 BTC (now worth $1.02 million), remained untouched since 2012 when BTC was valued at just $5. Another address, holding 50 BTC ($5.16 million), was last active in 2011 when the price was only $4.38 per coin. After prolonged dormancy, these two addresses transferred a total of 60 BTC. Originally worth $269, these combined assets are now valued at over $6 million.

Overall, Bitcoin’s recent surge to $100,000 is a testament to its growing adoption and increasing institutional interest. While the market remains volatile, this landmark achievement solidifies Bitcoin’s position as a significant digital asset.