- Bitcoin surged 3% to a monthly high of $97,822 despite long-term holders selling and OTC activity signaling potential downward pressure.

- Despite a modest 0.53% daily price increase, Bitcoin’s market cap is $1.91 trillion, and its dominance is at 55.52%.

- Analysts predict Bitcoin’s short-term cooling-off could lead to a rebound, with the potential for a rise past $100,000 in the longer term.

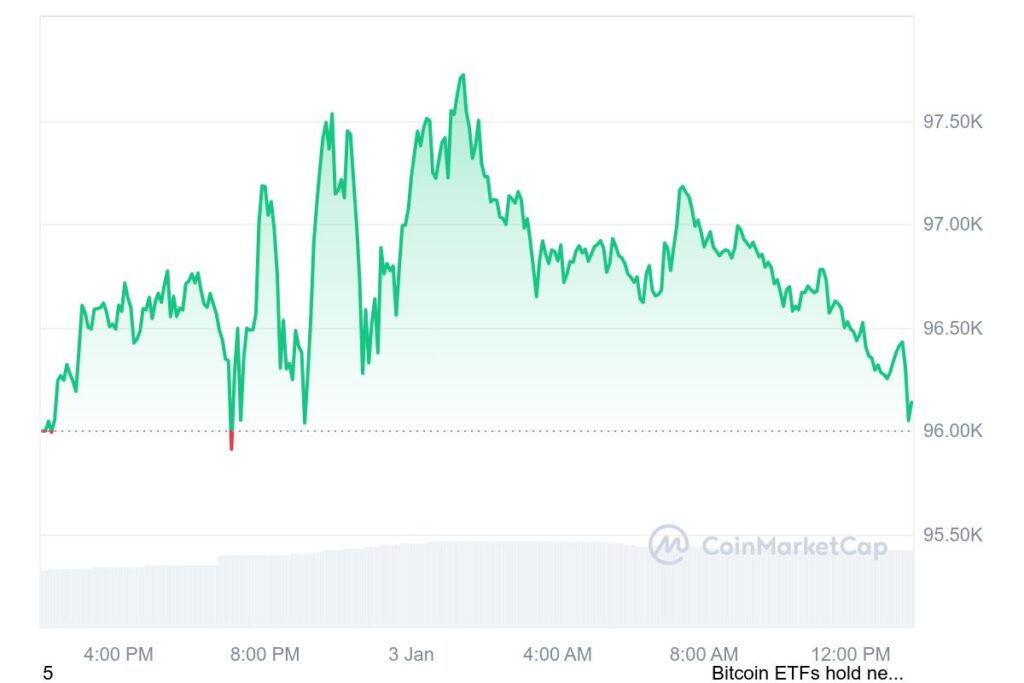

Bitcoin (BTC) surged 3% in the last 24 hours to a month-high of $97,822 after trading below the $95,000 level for over a week. At the time of writing, Bitcoin changes hands at $96,388, with a 24-hour trading volume of $68.32 billion, a market cap of $1.91 trillion, and a dominance rate of 55.52%. Despite these gains, the cryptocurrency’s price only increased modestly by 0.53% in the last 24 hours.

Bitcoin’s recovery comes despite significant sell pressure from long-term holders taking profits. CryptoQuant CEO Ki Young Ju noted an increase in over-the-counter (OTC) trading desk activity and inflows into exchanges-man indicators that presage short-term price drops. Ki remains optimistic: “Buying pressure is mainly from U.S. institutions on Coinbase, but the daily premium is at a two-year low. This needs to recover for Bitcoin to see its next upward leg.”

Bitcoin’s journey back to the $100,000 mark follows a retracement from its all-time high of $108,000 on December 17 to $91,816.86 on December 30. Since then, the cryptocurrency has been steadily recovering.

Crypto analyst Rekt Capital suggested such a movement echoed historical Bitcoin patterns. He noticed that after entry into a price discovery zone, it consolidated for seven-to-nine weeks. “BTC is offering more reasons for downside in the short term, but once the corrective Weeks 7-8-9 are done, the bullish narrative will likely resume,” he explained.

Avocado_onchain, an analyst in the CryptoQuant community, described the current stage as a “cool-off period” of an ongoing bull market. He further reassured investors that by looking at on-chain data, the chances of correction for an extended six-month period are slim.

Bitcoin Market Metrics Indicate Potential Resilience

The 7-day Simple Moving Average (7-SMA) of the Adjusted Spent Output Profit Ratio (SOPR) has remained above 1 but is trending downwards, indicating a profit decline for market participants. Historically, when SOPR dips below 1, Bitcoin often rebounds as selling at a loss triggers reversals—typical in bull markets

Other additional metrics also flash signs of market resilience. First, with a 7-day SMA, the Miner Position Index (MPI) has shown that the miners aren’t sending big chunks to the exchanges, which presupposes that they are holding rather than selling. The funding rates of derivatives have fallen, too, while historically, such events have conventionally preceded rebounds. Lastly, the 7-SMA of the total network fee indicates lower activity and, therefore, the end of the overheated phase after Bitcoin’s recent rally.

While the macro indicators remain bullish, the short-term volatility is still there to be factored in. For now, the cooling phase would serve as the foundation for Bitcoin to consolidate higher and make yet another attempt upwards to reach 100,000 dollars and upwards.

As Bitcoin moves through its price discovery and market cycles, analysts advise investors to stay cautious while maintaining optimism. They recommend focusing on long-term upward trends for potential growth

Related | Garanti BBVA to Launch Crypto Trading Services in the Future