- US Bitcoin Spot ETFs have surpassed Satoshi Nakamoto’s holdings, exceeding $1.1 million in BTC.

- December Bitcoin ETF inflows have surged, with BlackRock’s IBIT ETF leading at $257 million.

- Satoshi Nakamoto’s BTC holdings, mined in early blocks, remain the largest, but untouched since creation.

U.S. spot Bitcoin exchange-traded funds (ETFs) have reached a significant milestone, surpassing the Bitcoin holdings of the cryptocurrency’s creator, Satoshi Nakamoto. Since launching spot Bitcoin ETF trading in January, these ETFs have accumulated over 1.1 million BTC, marking the first time they’ve outpaced Nakamoto’s holdings, according to Bloomberg ETF analyst Eric Balchunas on Dec. 6.

“The US spot ETFs have just passed Satoshi in total bitcoin held, now hold more than 1.1m, more than anyone in the world, and they’re not even a year old yet, literally babies still. Mind blowing,” Eric Balchunas said on X (Twitter).

Bitcoin ETF Inflows Surge as BTC Breaks $100K

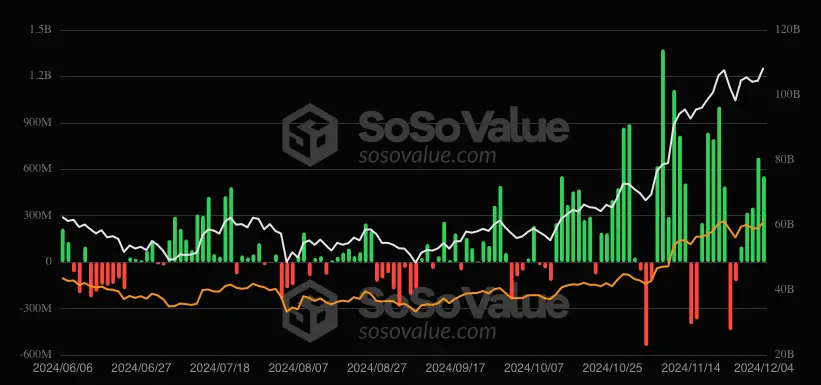

Bitcoin exchange-traded fund (ETF) inflows in December are poised to challenge the record-breaking billions seen in November as BTC rises above $100,000. According to SoSoValue data from Chain Catcher, the total net inflow of BTC spot ETFs on December 6 reached $377 million.

Grayscale’s GBTC ETF experienced a net outflow of $32.26 million, bringing its historical outflow total to $20.824 billion. Conversely, Grayscale Bitcoin Trust ETF (BTC) saw a modest net inflow of $6.75 million, accumulating $887 million in inflows.

BlackRock’s IBIT ETF led the pack in inflows, with $257 million, bringing its historical net inflows to $34.369 billion. Fidelity’s FBTC ETF followed closely, with $120 million in net inflows, reaching $11.717 billion in historical inflows. Currently, BTC spot ETFs have a combined net asset value of $112.744 billion and an ETF net asset ratio of 5.62%, reflecting a historical cumulative net inflow of $33.434 billion.

Satoshi Nakamoto’s Holdings

Satoshi Nakamoto is believed to have mined around 22,000 of Bitcoin’s early blocks, earning approximately 1.1 million BTC. These coins have remained untouched since their creation, making Nakamoto the largest individual BTC holder. Despite speculation, Nakamoto’s identity remains one of the greatest mysteries in the crypto world.

MicroStrategy leads with 402,100 BTC, worth over $40 billion, purchased as part of its strategy to adopt BTC as its primary treasury asset. Other firms like Marathon Digital Holdings (MARA) and Worksport have followed suit, accumulating significant BTC stakes. The US government also holds a sizable portion, with over 208,000 BTC seized from criminal activities, making it the largest national BTC holder, surpassing China and the UK.

Speculation about Nakamoto’s identity continues, with various individuals such as Australian scientist Craig Wright and Canadian cryptographer Peter Todd being subjects of controversy and intrigue. However, these claims have been met with scepticism, leaving Nakamoto’s true identity an enduring enigma in the crypto world.

Read Also: Bitcoin ETFs On Track To Surpass Gold ETFs: A Shift In Investment Trends