- A strong demand zone has formed just below $100k, potentially preventing Bitcoin from falling below that level.

- Over $1.1 billion worth of BTC has flowed out of Coinbase in a single hour, indicating strong institutional buying or Spot ETF demand.

- U.S. investors are actively accumulating Bitcoin, unfazed by market volatility, as evidenced by the significant Coinbase outflow.

After Bitcoin’s recent rally and subsequent correction, market investors are closely monitoring potential support levels. As per onchain data, a significant demand zone for BTC has formed just below $100k. This indicates that a large number of addresses totaling 1.45 million have accumulated BTC at an average price of $97.5k. Market experts believe this demand zone could act as a strong support level preventing the asset from falling below $100k.

The emergence of this demand zone suggests that there is strong buying interest at the $100k level. This could potentially limit any significant downside movement in Bitcoin’s price. Some of the possible scenarios include Retracement to the Demand Zone leading to a consolidation phase or even a bounce back to higher levels. Another possibility is a breakthrough above the $100k resistance level, signaling a continuation of the uptrend. The demand zone below $100k could further strengthen this upward momentum.

While the demand zone below $100,000 provides a potential support level, it’s crucial to consider other factors that could influence BTC’s price trajectory. This includes the overall market sentiment and news events can significantly impact BTC’s price. Positive news and strong investor sentiment could drive the price higher, while negative news or a bearish market could weaken the support level.

U.S. Investor Sentiment Stands Strong For Bitcoin

In short, while the demand zone below $100k offers a potential support level, it’s important to monitor market dynamics and consider other factors to make informed predictions about Bitcoin’s future price movement.

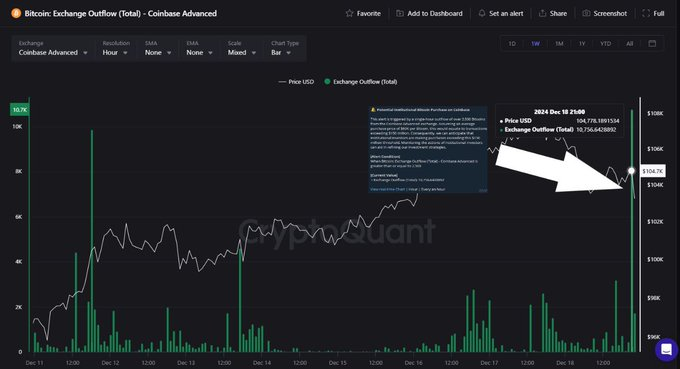

On the other hand, a massive outflow of 10,650 BTC worth over $1.1 billion from Coinbase has just been detected. The on-chain data suggests that U.S. investors are showing strong interest in Bitcoin, despite the market volatility. This sentiment is evidenced by the massive outflow from Coinbase, indicating that investors are accumulating Bitcoin and holding it outside of exchanges.

Coinbase saw 10,650 $BTC ($1.1B) flow out in just one hour—massive. Likely institutional buys or Spot ETF demand, right as the Fed announced rate changes. U.S. investors are stacking hard, unfazed by volatility.