- Without strong buying support near $65,500, BTC could drop to $57,500, testing market resilience amid geopolitical uncertainties.

- Historical trends show that major conflicts lead to initial price drops in BTC, often followed by significant rebounds.

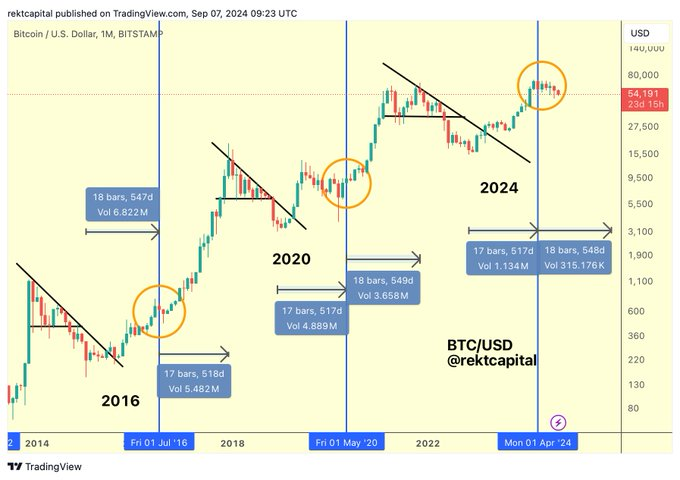

- Bitcoin usually bottoms out 517 to 547 days before halving events, suggesting potential growth ahead.

Bitcoin is currently experiencing technical weaknesses, having failed to break above the significant resistance level of $65,500. As of now, the leading cryptocurrency is trading at $61,000, with a market cap of $1.21 trillion and a trading volume of approximately $129.04 billion over the past 24 hours. This represents a slight decline of 0.51% during this timeframe.

However, if strong buying support does not materialize around the $65,500 mark soon, BTC could potentially decline to the $57,500 level. This drop would signify a further test of market resilience amidst prevailing uncertainty.

Historical Bitcoin Price Drops During Conflicts

Recent geopolitical tensions, particularly the ongoing conflict between Iran and Israel, have contributed to the current uncertainty in the market. Data from Santiment suggests that this turbulence is impacting investor sentiment, leading to a decline in overall crypto market capitalizations.

Historically, major global conflicts have initially triggered price drops in cryptocurrencies, followed by significant rebounds. For example, during the Israel-Palestine conflict in October 2023, BTC saw a 5% decrease in the first four days but recovered with a subsequent 12% increase over the following nine days.

Similarly, in February 2022, following the onset of the Ukraine-Russia conflict, Bitcoin experienced a 10% dip on the first day before climbing 27% in the next six days.

Bitcoin Halving Event Trends

Looking ahead, historical patterns surrounding Bitcoin’s halving events present intriguing insights. In the past, BTC has consistently bottomed out approximately 517 to 547 days before halving events, only to reach new bull market highs roughly 549 days after these halving. With the halving in 2024, projections indicate that BTC could potentially see its next peak around October 2025.

These historical precedents suggest that the current bull market may not be over yet, despite recent fluctuations. As such, the halving phenomenon acts like a mirror, reflecting a timeline where bear market bottoms and bull market tops align closely with these significant events in Bitcoin’s lifecycle.

With Bitcoin’s price fluctuations and the current geopolitical landscape, investors remain cautious but hopeful for a rebound as historical trends may signal an impending recovery. As the market reacts to global events, all eyes will be on BTC’s performance in the coming weeks.

Related | Crypto Crackdown: AFP Seizes $9.3 Million in Digital Assets in Major Operation