- BTC’s daily chart shows a promising uptrend, with a key support level at $60,500 that could lead to further gains.

- Bitcoin ETFs experienced a net outflow of 646 BTC (about $39.02 million), indicating some shifting market dynamics.

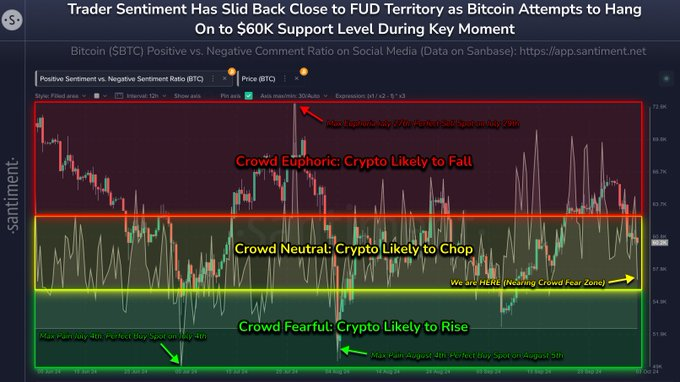

- A recent -9.2% retracement may have cooled investor enthusiasm, which could signal an upcoming positive momentum for Bitcoin.

Bitcoin is grabbing the headlines as it has recovered from the recent market fluctuations. Currently, BTC changes hands at $61,000, with a huge 24-hour trading volume of $129.04 billion. The market capitalization has reached as much as $1.21 trillion. In the last 24 hours, its price changed by 1.43%, which can signal a potential change in market sentiment.

Bitcoin’s Daily Chart Shows Promising Uptrend

Bitcoin is creating a noteworthy uptrend on the daily chart, reflecting a potential trend reversal that may be able to push its value toward fresh regional highs. The main support zone lies at $60,500; thus, if this zone sustains, BTC may bounce higher from this level. It is strong support, and this may provide a launching pad to BTC for further gains.

Adding to this optimism, on-chain data from Santiment reveals that Bitcoin’s recent -9.2% retracement from its $66.4K local high on September 27th has noticeably cooled down the excitement among investors.

Interestingly, this dip in market enthusiasm may be a positive sign, as markets tend to move in the opposite direction of prevailing crowd expectations. This sentiment shift could spark new momentum for BTC in the near future.

Bitcoin ETFs Experience Significant Outflows Amidst Stability

Meanwhile, data provided on October 3 by the on-chain data explorer Lookonchain indicated a net inflow of Bitcoin and Ethereum in ETFs. Bitcoin ETFs saw a net outflow of 646 BTC valued at approximately $39.02 million, while ARK21Shares counted an outflow of 998 BTC that “leaves the number of BTC in this fund to 48,173.

Ethereum ETFs also suffered, where there was a net outflow of 1,289 ETH, which was valued at $3 million. Grayscale’s Ethereum Trust, ETHE, had an outflow of 10,828 ETH ($25.23 mln), while the current holding is at 1,653,384 ETH worth $3.85 billion.

Despite the recent pullbacks, these figures show that BTC and Ethereum are still long-term game interests, since ETF investors hold massive positions in both assets. With BTC holding above the $60,500 mark, the market is possibly building up for its next phase of rally, and the next few days will be crucial for BTC’s trajectory.

Related | Shiba Inu Offers Limited Early-Bird Deal: 75% Off On Shibacon Tickets