- Bitcoin leads the charge as it nears ATH, outperforming most altcoins which remain significantly below their peaks.

- TON’s resilience shines, especially in its one-year moving average, and offers a compelling investment opportunity.

- While Bitcoin dominates, altcoins face challenges in regaining momentum, suggesting a cautious market outlook.

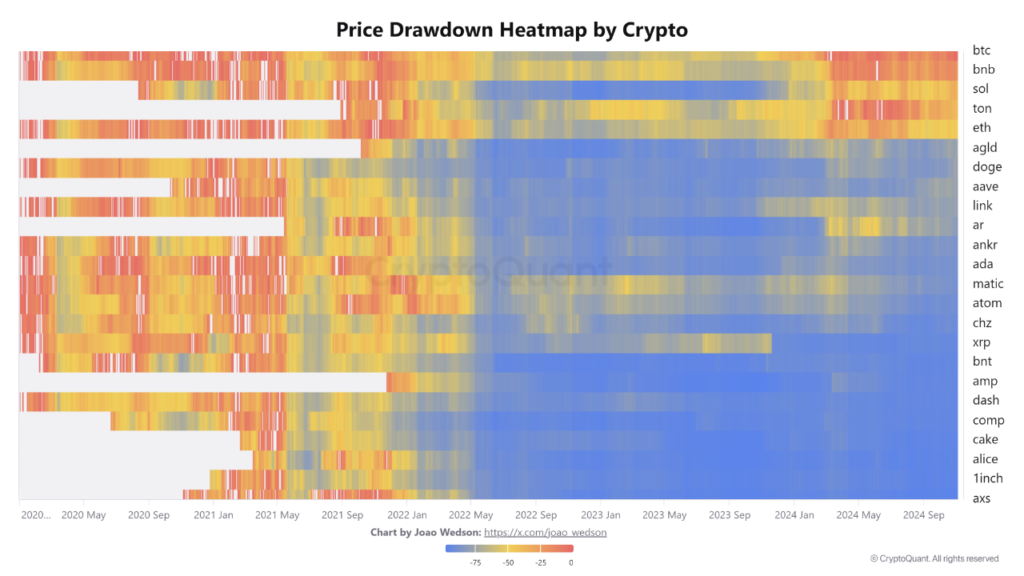

Bitcoin reigned supreme as its price trajectory approached its all-time high (ATH). Along with BTC, The Open Network’s TON and BNB are the cryptocurrencies closest to reaching their previous peaks. CryptoQuant’s latest report provides a visual analysis of market dominance.

Illustrating the trend through the Price Drawdown Heatmap, BTC’s proximity to ATH is also closely mirrored by Binance’s native token BNB, TON, Solana’s SOL, and ETH. On the other hand, most altcoins are significantly distant from their peaks, with declines ranging from a staggering -74% to a jaw-dropping -97%. The report offers a clear explanation for Bitcoin’s rising dominance. While altcoins occasionally experience brief rallies, these upswings are often short-lived, followed by a return to historical lows.

CryptoQuant also observed an interesting trend. Unlike in 2021, BTC’s 2024 ATH contrasts the current price trend of the altcoins have yet to match the vigor even after the passing of ten months. This suggests a slower, more risk-averse cycle, with a sense of uncertainty engulfing the cryptocurrency market.

Bitcoin and Ton: A Tale of Two Coins

In terms of TON, historical data reveals a compelling pattern: Its price has only dipped below the one-year moving average (orange trend) during bear markets. Given the current bullish market conditions, this support level offers a unique opportunity for long-term investors.

CryptoQuant earlier provided a Heat Map that offers a comprehensive view of TON’s price behavior, highlighting periods of high volatility and low volatility. Currently, the price is residing in a relatively “cool” zone, marked by decreased volatility. This presents a favorable environment for investors who prefer a more cautious approach. While the current price level offers a favorable entry point, it’s essential to exercise caution and conduct thorough research before making any investment decisions.

Overall, Bitcoin and altcoins surge, especially as the US election results are around the corner. This increase reverberated across various altcoins, particularly among meme coins and AI/Big Data tokens, suggesting that traders are caught up in the election frenzy with both optimism and anxiety.

As we move forward, it will be fascinating to observe whether altcoins can regain momentum or if Bitcoin’s dominance will continue to solidify.