- Over $62.9 billion in capital inflows have entered the market over the last 30 days, primarily driven by Bitcoin.

- 128,000 BTC was sold between October 8 and November 13, with U.S. Spot ETFs absorbing 90% of the selling pressure.

- Bitcoin’s market cap has surged to $1.796 trillion, positioning it as the 7th largest asset globally.

Bitcoin’s recent surge to $93K has been powered by strong capital inflows, with both spot markets and ETFs playing key roles. According to Glassnode’s latest report, over $62.9 billion has flowed into the market over the past 30 days, with BTC capturing the lion’s share of demand.

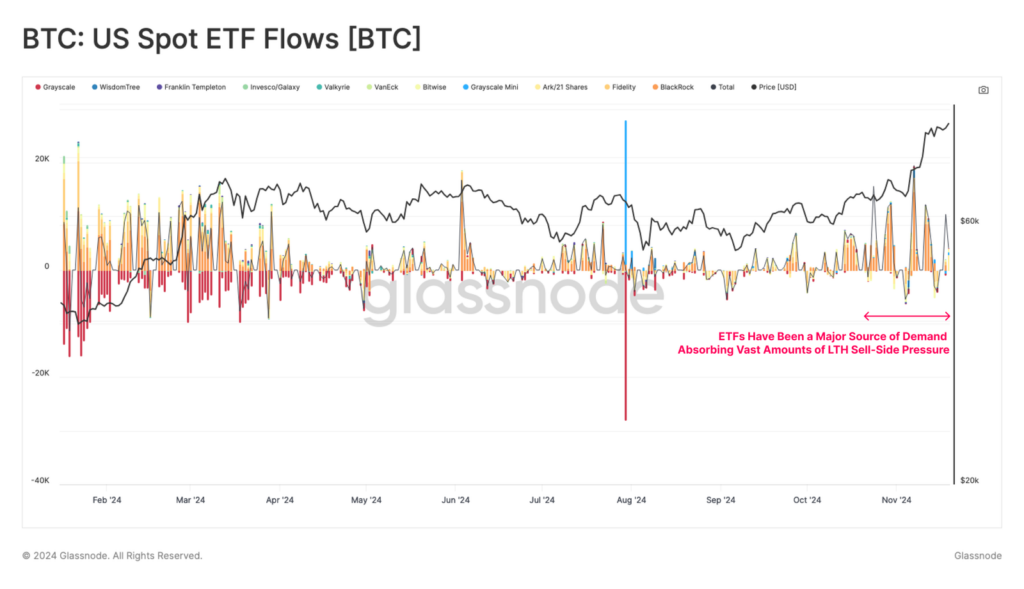

These capital inflows, combined with elevated unrealized profits among long-term holders (LTHs), have sparked significant selling activity. Between October 8 and November 13, 128,000 BTC were sold, as LTHs took profits. U.S. Spot ETFs absorbed roughly 90% of this selling pressure, emphasizing their growing role in stabilizing BTC’s market.

Capital Inflows and Bitcoin’s Consistent Rally

November has seen BTC continue its exceptional price performance, setting new all-time highs (ATHs) repeatedly. Comparing the current cycle to the previous ones, Bitcoin’s rally shows notable similarities in both magnitude and duration, despite different market conditions. This consistency offers insight into BTC’s cyclical price behavior and its macro-market structure.

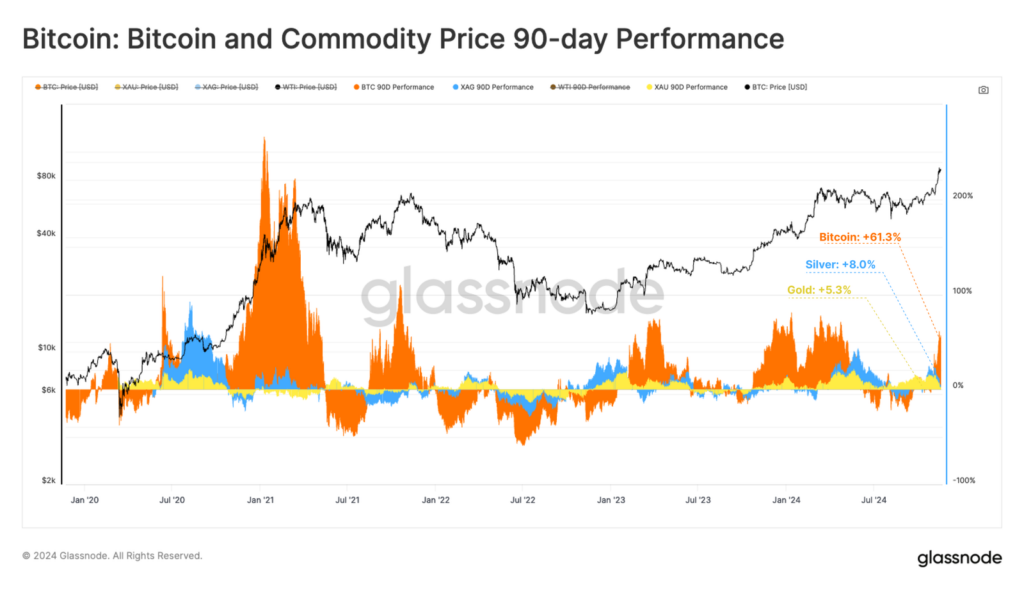

Historically, Bitcoin bull markets have lasted between four to 11 months from similar points, providing a reference for evaluating the current cycle’s potential. As of this week, Bitcoin reached a new ATH of $93.2K, marking a 61.3% increase in the last quarter. This far outpaces the growth of traditional assets like gold (+5.3%) and silver (+8.0%), suggesting a shift in capital from conventional store-of-value assets toward Bitcoin.

Bitcoin’s market capitalization has also surged to $1.796 trillion, ranking as the 7th largest asset globally, surpassing silver ($1.763 trillion) and Saudi Aramco ($1.791 trillion). It is now only 20% behind Amazon, positioning BTC for further growth.

Surge in Digital Asset Inflows

Over the past 30 days, the broader digital asset market has seen massive capital inflows, totaling $62.9 billion. Of this, $53.3 billion flowed into Bitcoin and Ethereum networks, while $9.6 billion went into stablecoins.

This is the highest influx since March 2024, reflecting renewed market confidence following the U.S. presidential election. A significant portion of the stablecoin supply, about $9.7 billion, was deployed directly to centralized exchanges, highlighting the strong speculative demand as investors position for future trends.

Profitability and Potential for Profit-Taking

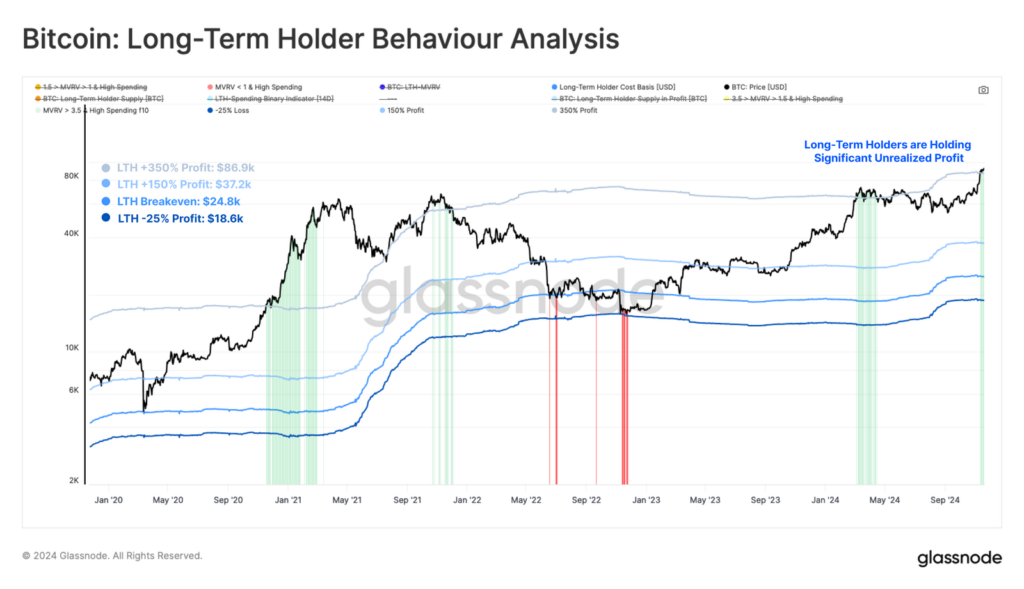

Bitcoin’s price surge has brought significant unrealized profits, particularly among investors holding for the long term. The MVRV Ratio, which compares BTC’s market value to its realized value, has been steadily rising. The ratio has broken into an overheated state, indicating that many investors are sitting on substantial profits. Historically, this has been a precursor to profit-taking activity, though large capital inflows can sustain the bullish momentum even in an overheated market.

Long-term holders (LTHs) have been spending at extreme levels, with 100% of their holdings becoming profitable after Bitcoin crossed the $75.6K threshold. Since then, more than 200,000 BTC have been sold. This aligns with past patterns, where LTHs tend to take profits during strong market moves, provided demand is sufficient to absorb their sell-off.

Long-Term Holder Behavior and Market Stability

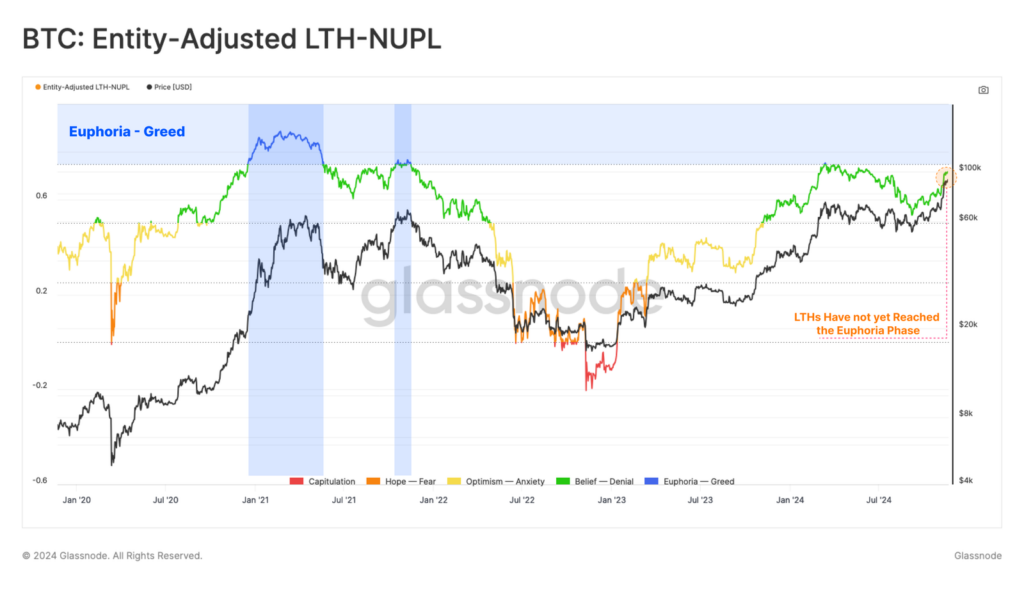

The behavior of LTHs is crucial in shaping Bitcoin’s market cycles. As of now, sentiment remains measured among LTHs despite the surge in price. While the NUPL (Net Unrealized Profit and Loss) metric sits at 0.72—just below the threshold for “euphoria”—it suggests room for further growth before reaching the peak of the cycle.

Bitcoin’s price surpassing $87K has pushed LTH profits into the +350% range, prompting more profit-taking. This distribution pressure is likely to increase as the market rallies, and LTHs continue to hold substantial amounts of Bitcoin. Despite their increasing spending activity, the amount of Bitcoin in LTH hands means that significant sell-side pressure is still under their control, keeping the market relatively stable for now.

Institutional Demand and ETF Influence

Institutional demand, particularly through U.S. Spot ETFs, has played a pivotal role in absorbing the selling pressure from LTHs. Since mid-October, ETF inflows have surged to between $1 billion and $2 billion per week, highlighting the growing influence of institutional investors on Bitcoin’s price movement.

Between October 8 and November 13, ETFs absorbed about 128,000 BTC, accounting for approximately 93% of the sell-off by LTHs. This influx has been crucial in maintaining market liquidity and stability, but as LTH selling pressure now outpaces ETF inflows, volatility could increase. A pattern seen in late February 2024, where an imbalance between supply and demand led to market consolidation, may repeat as long-term holders continue their distribution.

Bitcoin’s $93K rally is a powerful reminder of the growing institutional influence in the market and the critical role long-term holders play in shaping the bull market’s trajectory. As institutional capital and LTH activity continue to influence price action, Bitcoin’s market structure is evolving, setting the stage for further milestones and potential volatility ahead.

Related | XRP Price Surge: Ripple Hits 3-Year High, Faces Pullback But Bulls Remain Confident