- Bitcoin reaches an all-time high of $93,500, with an 8% weekly increase.

- MicroStrategy adds 51,780 BTC to its holdings, now valued at $29.75 billion.

- Large whale withdraws $200 million worth of BTC, signaling confidence in long-term value.

- Experts predict Bitcoin could reach $150,000, but warn of a possible 30% correction.

Bitcoin (BTC) has set a new all-time high, reaching an impressive $93,500. The cryptocurrency showed an 8% increase over the past week, reflecting strong bullish momentum. Despite the excitement, some market watchers urge caution, suggesting a potential pullback before Bitcoin’s next major move.

At the time of writing, BTC is trading at $91,596, with a 24-hour trading volume of $116.59 billion. Its market cap has soared to $1.81 trillion, maintaining a dominance of 58.22%. Over the last 24 hours, the BTC price has risen by 2%, underscoring its current upward trajectory.

Institutional Interest Fuels Bitcoin Rally

One of the significant catalysts for Bitcoin’s rally is renewed institutional interest. According to data from Lookonchain, MicroStrategy, led by Michael Saylor, recently acquired 51,780 BTC for $4.6 billion at an average price of $88,627. This move has increased the company’s BTC holdings to 331,200 BTC, valued at approximately $29.75 billion. With an average purchase price of $49,874, MicroStrategy’s unrealized profit now stands at a staggering $13.2 billion.

In addition to institutional players, whales have been making bold moves. A notable whale withdrew 2,189 BTC (worth $200 million) from Binance today, raising their holdings to 23,910 BTC ($2.19 billion). Such large-scale transactions often signal confidence in BTC’s long-term value and contribute to market dynamics.

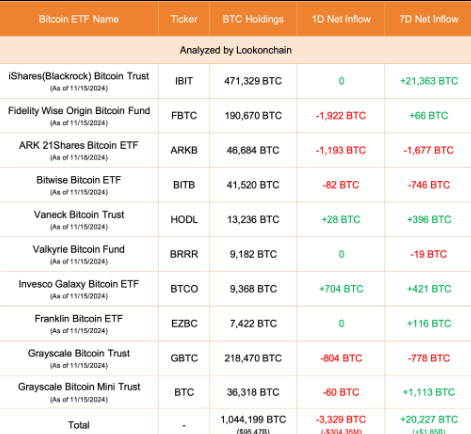

ETF Outflows and Market Behavior

The week also saw notable activity in Bitcoin ETFs. Net outflows of 3,329 BTC (valued at $304.35 million) were reported across 10 Bitcoin ETFs. Among these, Fidelity witnessed a withdrawal of 1,922 BTC ($175.77 million), leaving the fund with 190,670 BTC ($17.43 billion). These outflows could reflect profit-taking or portfolio adjustments amid BTC’s recent price surge.

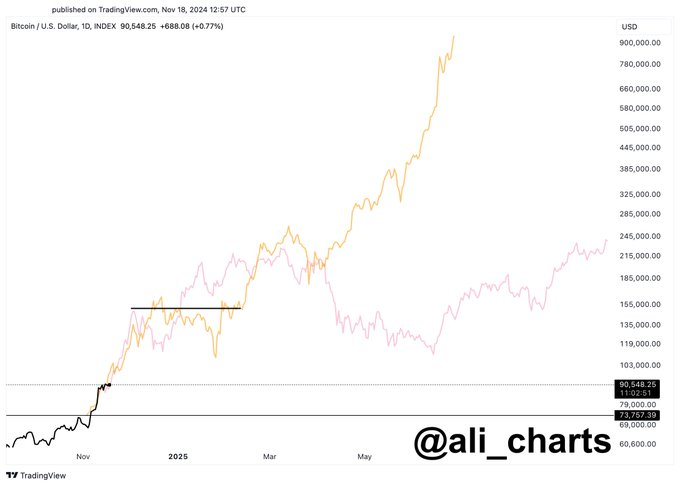

Bitcoin Rally Mirrors Past Bull Cycles

Market experts are drawing parallels between BTC’s current rally and its previous bull cycles. Recent data suggests that Bitcoin’s behavior mirrors patterns observed during its earlier all-time highs. Following its latest price peak, BTC has entered a consolidation phase, a common precursor to another breakout.

Ali Martinez, a prominent market observer, notes that BTC could surge to $150,000 in the near term. However, he warns of a potential 30% correction following this upward trajectory, which aligns with historical trends in the cryptocurrency market.

Bitcoin’s new all-time high and strong market fundamentals highlight the ongoing bullish sentiment in the cryptocurrency space. However, the market’s volatile nature suggests that both opportunities and risks lie ahead. As whales and institutional investors continue to make significant moves, BTC’s price trajectory remains a focal point for the crypto community. Whether it pushes toward $150,000 or faces a temporary correction, BTC’s journey promises to remain eventful.

Related | XRP’s Breakout Could Lead to $23 by January 2025: Legal and Political Factors at Play