- Bitcoin fluctuated between $67.8K and $64.8K in 2.5 hours, yet bullish sentiment remains strong, with positive commentary outpacing negative by 2:1.

- Over 70,000 BTC (valued at $4.2 billion) were redistributed by whales during the recent surge, suggesting significant market movement.

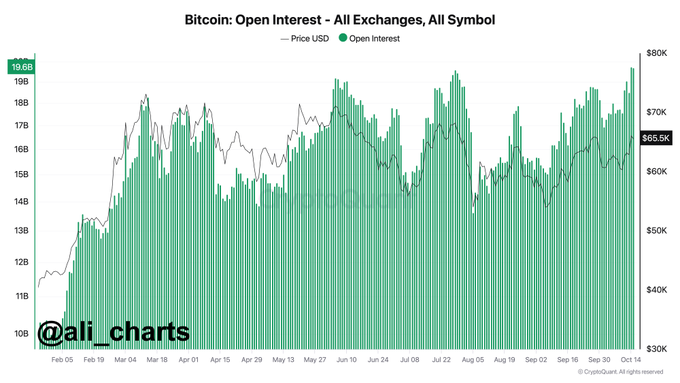

- Bitcoin’s open interest has hit a new high of $19.75 billion, indicating heightened trader anticipation for significant price changes.

Bitcoin (BTC) has been making notable gains, climbing steadily over the past week. The leading cryptocurrency has surged by nearly 9%, a clear sign of strong performance and potential for further upward movement soon. The recent price surge reflects growing confidence in Bitcoin’s resilience and its capacity to maintain an upward trajectory amid market volatility.

Bitcoin Sees Wild Swings Amid Bullish Sentiment

According to data from Santiment, the crypto market has seen heightened volatility, with BTC fluctuating between $67.8K and $64.8K within 2.5 hours. Despite the rollercoaster-like movements, crowd sentiment remains firmly bullish, with positive commentary outpacing bearish views by a 2:1 margin. This optimistic outlook reflects broader market confidence, especially as traders focus on Bitcoin’s ability to weather volatility.

Bitcoin’s price currently stands at $67,726, with a 24-hour trading volume of $61.91 billion. The asset boasts a market cap of $1.34 trillion, securing its dominance at 57.07% of the entire crypto market. Over the last 24 hours, BTC has climbed 3.08%, showing consistent short-term momentum.

Bitcoin Whales Shift Holdings Amid Price Surge

In a notable observation by crypto expert Ali Martinez, the intricate relationship between large whale holdings and Bitcoin’s price has come under scrutiny. As BTC recently surged from $54,000 to $66,000 within just a week, an intriguing development unfolded in the market.

During this price surge, whales—entities or individuals holding substantial amounts of BTC—offloaded or redistributed over 70,000 BTC, valued at approximately $4.2 billion. This significant movement suggests that these major players are actively managing their positions, potentially signaling a shift in market sentiment.

Moreover, Bitcoin’s open interest across all exchanges has reached a new all-time high of $19.75 billion. Open interest refers to the total number of outstanding derivative contracts, such as futures and options, that have not yet been settled. A spike in open interest often indicates that traders are anticipating significant price movements, with more capital at stake in the market.

The combination of whale activity and increasing open interest could foreshadow further volatility ahead. As traders and investors closely monitor these developments, the implications for BTC’s future price trajectory remain a point of keen interest. The behavior of these whales and the heightened open interest could set the stage for major price shifts in the days to come.