- Bitwise has filed for the Bitwise Bitcoin Standard Corporations ETF, targeting companies holding at least 1,000 Bitcoin.

- The fund will focus on Bitcoin reserves, not market cap, and individual holdings will be capped at 25%.

- The ETF reflects the growing corporate adoption of Bitcoin amid its price surge and institutional interest

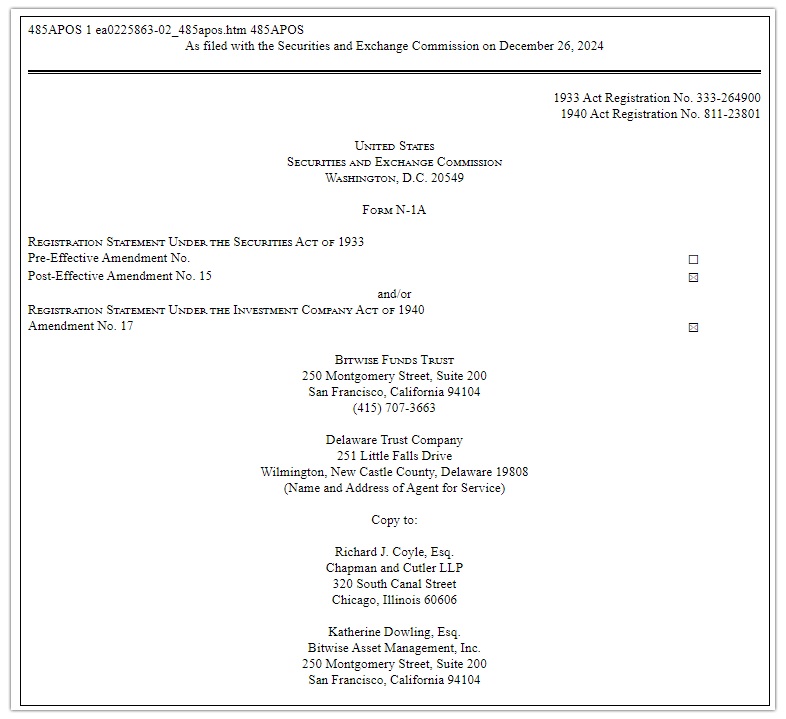

Bitwise, a prominent exchange-traded fund (ETF) issuer, has filed a regulatory application for a new fund to invest in publicly traded companies with significant Bitcoin reserves. The proposed ETF called the Bitwise Bitcoin Standard Corporations ETF, would seek to target firms that have adopted the “Bitcoin standard” by holding at least 1,000 Bitcoin in their corporate treasuries.

According to the Dec. 26 filing with the U.S. Securities and Exchange Commission (SEC), the fund would include companies with a market capitalization of at least $100 million and meet additional criteria, including a minimum average daily liquidity of $1 million and a public free float of under 10%. This focus on corporate Bitcoin holdings marks a departure from traditional ETFs, which typically weigh their holdings based on company market capitalization.

Instead, the proposed fund from Bitwise would weight its holdings based on the market value of each company’s Bitcoin reserves. Notably, it caps the weight of any single holding at 25%. That means that companies with large Bitcoin treasuries could have an outsized impact on how the ETF performs compared to what an investment in their stock might suggest.

For example, Tesla is a $1.42 trillion market capitalization company that would have lesser weight in the Bitwise Bitcoin Standard Corporations ETF than MicroStrategy. However, the latter’s market cap is a small fraction—$83.5 billion—while holding an extremely bigger Bitcoin stash. Tesla owns 9,720 BTC, while MicroStrategy owns 444,262 BTC, making it a far more influential component in the proposed ETF, even with less overall market value.

Bitcoin Hits 100K as Bitwise Proposes Innovative ETF

This comes as corporate interest in Bitcoin, after the cryptocurrency’s performance in 2024, is on the rise. So far in the year, Bitcoin has grown 117%, overtaking the $100,000 mark for the first time in November and reaching a peak of about $108,000 earlier this month before resting around $95,800.

That means if one were to simplify the wording, “Increasingly, the growing trend of Bitcoin on balance sheets is a sign that digital currency is mainstreaming as more public companies place business bets on Bitcoin.” Indeed, KULR Technology Group announced it had invested $21 million in Bitcoin late this month, netting 217.18 BTC. According to Google Finance, that purchase contributed to a whopping 40% jump in its stock price, closing at a record $4.80 per share.

Bitwise’s proposal is part of a larger trend in finance, as other firms are positioned to take advantage of an increasingly large Bitcoin ecosystem. On the same day that Bitwise filed its proposal, Strive, the investment firm from Vivek Ramaswamy, filed its own ETF proposal to provide exposure to “Bitcoin Bonds.” This fund would invest in convertible bonds issued by corporate Bitcoin holders, including MicroStrategy, further highlighting the growing number of traditional financial products centered on cryptocurrency.

As the Bitcoin landscape continues to evolve, the Bitwise Bitcoin Standard Corporations ETF will be a key vehicle for investors looking to gain exposure to companies not only holding Bitcoin but increasingly using it in their business. If approved, investing in the crypto market will be innovative, focusing on the companies leading the charge for Bitcoin adoption.

Related | Bitcoin Whale Transactions Surge 3X with CoinJoin Amid $2.2B Crypto Thefts