- Ethereum founder Vitalik Buterin outlines ambitious plans for the network.

- His plan focuses on faster block finality and lower staking threshold.

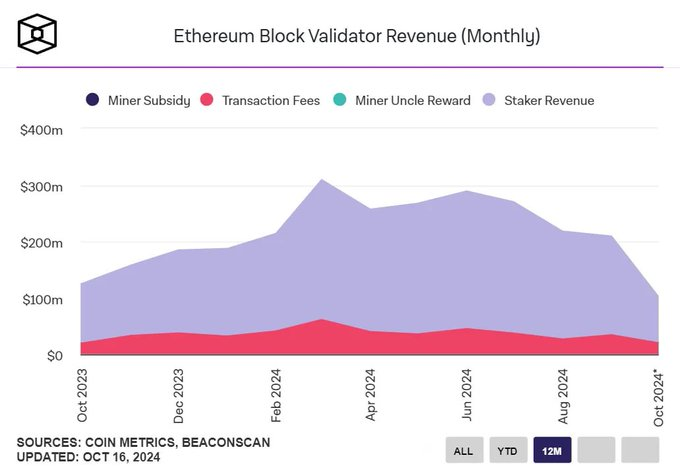

- Reduced on-chain activity and lower market enthusiasm impact staker earnings.

Vitalik Buterin, the co-founder of Ethereum, delivered a keynote speech at the 2024 Shanghai Blockchain Week, outlining the network’s ambitious plans for the future. Buterin acknowledged that Ethereum’s current state is fragmented, with over 34 different chains operating within the ecosystem. To address this challenge, he proposes a more unified and interconnected network.

Buterin highlighted several key goals for the network’s development. These include scaling to over 100,000 transactions per second (TPS) through the use of layer-2 solutions, enabling seamless transfers between any chain within 2 seconds. In this way, user experience would be enhanced across the smart contact platform. The founder underscored the significance of outperforming the capabilities of the Ethereum Virtual Machine (EVM) and achieving secure links between different chains.

In addition to these long-term goals, Buterin earlier discussed plans further to improve Ethereum’s Proof-of-Stake (PoS) mechanism. He focused on two main areas: speeding up block finality and making staking more accessible.

Buterin proposed achieving single-slot finality, which would confirm blocks in a single step instead of the current multi-step process. This would significantly reduce the time it takes for transactions to be finalized. Additionally, he suggested lowering the minimum staking threshold from 32 ETH to 1 ETH. This would make staking more accessible to a wider range of users, promoting decentralization.

If these proposed changes are implemented, Ethereum could become even more efficient, scalable, and user-friendly. Buterin’s vision for the future of Ethereum is ambitious, but it is clear that the network is poised for significant growth and development.

Ethereum Staker’s Revenue Update

Meanwhile, the ETH staker revenue is on a downtrend with September’s total at $174 million, down from its March high of $247 million. Since March, Staker’s revenue has gradually declined, reflecting reduced on-chain activity and lower overall market enthusiasm. September’s staker revenue of $174 million dwarfs the $35.5 million generated from transaction fees, highlighting a significant reliance on the block subsidy.

Despite the revenue drop. the validator landscape continues to expand. As per data, ETH now boasts 1.09 million validators, showcasing growing participation in the network’s security. This increase in validators comes even as individual rewards decrease, demonstrating continued faith in Ethereum’s long-term prospects.