- On October 22, Chainlink launched private transactions for its Cross-Chain Interoperability Protocol (CCIP), trialed by the Australia and New Zealand Banking Group (ANZ).

- The number of addresses holding between 100,000 and 1,000,000 LINK increased from 525 to 541, coinciding with a price rise from $11.26 to $11.95.

- LINK is forming a bullish flag pattern, suggesting a potential breakout towards $15 and possibly targeting $30 in the coming weeks.

Chainlink (LINK) is holding firm despite recent market fluctuations, signaling a potential upward move. Over the past week, LINK has risen by 3.56%, even as the broader crypto market experienced a downturn.

At the time of writing, LINK is trading at $11.57, with a 24-hour trading volume of $610.47 million. Its market cap stands at $7.25 billion, giving it a market dominance of 0.31%. However, LINK has seen a slight drop of 3.81% in the last 24 hours.

Bullish Factors For Chainlink Price Surge

In a significant development on October 22, Chainlink introduced private transactions for its Cross-Chain Interoperability Protocol (CCIP). Australia and New Zealand Banking Group (ANZ) became the first financial institution to trial this feature.

Chainlink’s CCIP private transactions enable cross-chain interactions while keeping sensitive details, such as token amounts, data, and counterparties, confidential. This move could pave the way for wider blockchain adoption by ensuring compliance with regulatory standards and safeguarding institutional privacy.

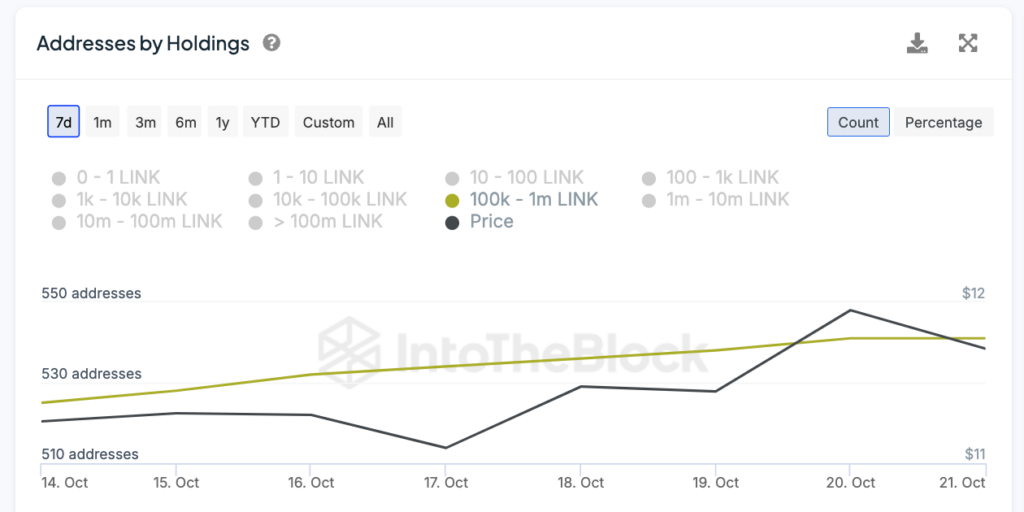

Whale activity has also played a crucial role in LINK’s recent performance. Data from IntoTheBlock shows that the number of addresses holding between 100,000 and 1,000,000 LINK has steadily increased, climbing from 525 addresses on October 14 to 541 by October 20. This accumulation coincided with the token’s price rising from $11.26 to $11.95 during the same period.

However, from October 20 to 21, the number of whale addresses remained stable, indicating a brief pause in accumulation. Chainlink’s ongoing developments and strong whale support hint at the potential for future growth, making it a project to watch closely in the evolving crypto landscape.

LINK Eyes Breakout Towards $30

From a technical standpoint, Chainlink (LINK) is showing signs of strength after a prolonged correction, forming a bullish flag pattern while testing a critical horizontal resistance level. This setup suggests that LINK is poised for a potential breakout.

If the breakout materializes, Chainlink could aim for the trendline resistance around the $15 mark in the coming days. Should LINK clear this trendline, the token could quickly target $30 in the following weeks. This upward trajectory would mark a significant recovery and position Chainlink for further gains.

Related | Bitcoin Nears Key $70K Level: Market Braces For Potential Breakout