- Chainlink (LINK) hit $27.80, marking a market cap of over $16 billion amid whale accumulation.

- Whale transactions moved over $9.6 million in LINK, signaling strong bullish momentum for the asset.

- Technical indicators suggest a target of $31.25, with the potential for LINK to retest its all-time high of $52.

Chainlink (LINK) has continued its strong uptrend, marking three consecutive weeks of gains and reaching its highest price since January 2022. The price surged to $27.80, boosting its market capitalization to over $16 billion. The rally comes amid significant whale accumulation, further fueling the bullish momentum.

Recent data from Lookonchain highlighted a notable whale transaction in which over $9.6 million worth of LINK was transferred from Binance to AAVE. The whale then borrowed $4 million and deposited the funds back into Binance, likely intending to purchase more LINK.

Chainlink Whale Activity Signals Bullish Momentum

Chainlink has seen significant whale activity, with millions of dollars in LINK being moved to self-custody wallets and exchanges. Etherscan data reveals a transfer of LINK worth $7.16 million from Coinbase to a self-custody wallet and another whale moving over $2 million to OKX. A large-scale whale movement is often seen as a bullish signal in cryptocurrency.

According to Nansen data, over 253.4 million LINK are currently held on exchanges, slightly down from last week. Whales are holding onto their assets more, a typically bullish sign. The increase in whale activity corresponds with LINK’s recent price rally, pushing its value to $25 due to growing buying pressure.

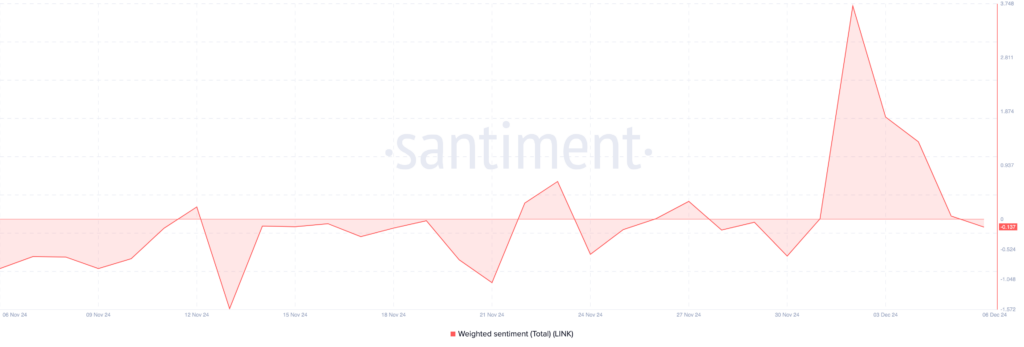

Santiment’s data provides additional insights, showing that LINK’s recent price surge has occurred with minimal retail Fear Of Missing Out (FOMO). The crypto analytics firm notes that this lack of widespread retail enthusiasm could signal further room for price growth as the broader market remains cautious.

“It is encouraging that there is very little retail FOMO toward LINK. Markets move in the opposite direction of the crowd’s expectations, so the crowd’s disbelief will only help fuel this rally further,” the on-chain analytic platform highlighted.

Technical Indicators Point to Higher Targets

The weekly chart for Chainlink shows a strong recovery over the past several weeks. The price successfully flipped the key resistance level at $22.85 into support, a significant milestone, as it was the highest swing on March 11. The rally has pushed LINK to the 50% Fibonacci Retracement level, breaking through resistance from the Murrey Math Lines tool. LINK is trading above the 50-week and 100-week moving averages, indicating ongoing bullish momentum.

In the short term, LINK’s immediate target is $31.25, a level marked by the extreme overshoot of the Murrey Math Lines. Looking ahead, the coin has the potential to double in value, possibly retesting its all-time high of $52. However, this bullish outlook could be invalidated if the price falls below the critical support level at $22.85, which could trigger a decline under $20.

On-chain analysis using Chainlink’s In/Out of Money Around Price (IOMAP) data shows that 79% of LINK holders are currently profitable. The IOMAP also highlights key resistance and support levels, with a strong support zone between $22 and $25, which could propel LINK toward the $30 mark in the short term.