- Chainlink (LINK) experienced a significant price breakout due to whale accumulation.

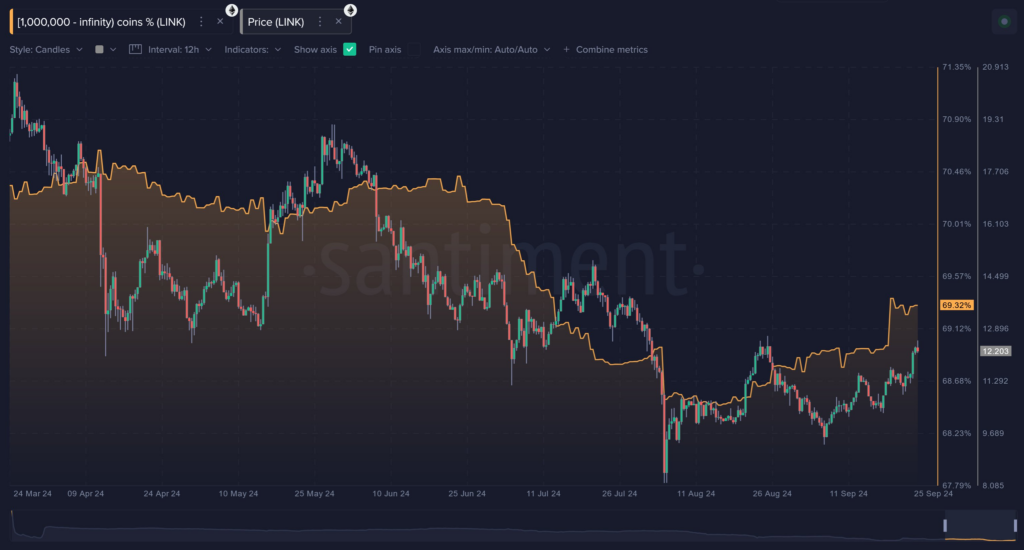

- Over 8.5 million LINK tokens were acquired by large investors in the past six weeks.

- Strong on-chain activity and a passionate community contribute to LINK’s market momentum.

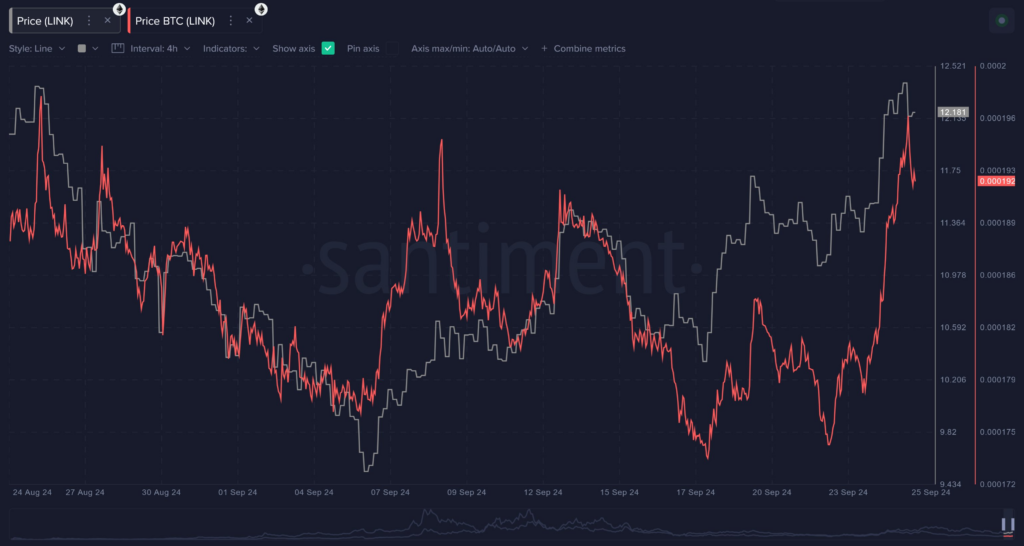

- LINK outperformed Bitcoin, with a 10.2% market cap increase and an 8.8% price rise against Bitcoin.

Chainlink (LINK) has seen a notable price breakout, driven largely by significant whale accumulation. Over the past six weeks, large investors have amassed more than 8.5 million LINK tokens, according to recent data. This surge in interest from high-net-worth individuals comes alongside increasing on-chain activity and a passionate community that continues to bolster the cryptocurrency’s market presence.

According to Santiment’s latest report, Chainlink is widely regarded as a key player in the altcoin space, due to its decentralized oracle technology. This allows smart contracts to interact with real-world data, making it a vital component in decentralized applications across sectors like finance and insurance. As a result, Chainlink has positioned itself as a critical infrastructure provider, driving innovation in blockchain technology.

Chainlink’s community remains highly active and vocal on social media platforms like X (formerly Twitter) and Reddit. Their enthusiasm for the project is a driving force behind its price movement.

Positive news, such as new partnerships or technical developments, often generates buzz that translates into buying pressure. However, this social media-driven momentum also means that Chainlink’s price can be susceptible to fluctuations based on crowd sentiment.

Chainlink Outperforms Bitcoin in Recent Surge

In terms of performance, Chainlink’s market cap saw a 10.2% increase over the past three days, with its price rising by 8.8% against Bitcoin. This recent surge in price can be attributed to several factors, including strong on-chain activity, whale accumulation, and favorable social sentiment.

The rise in whale transactions, particularly those involving over $100,000 or $1 million, signals a growing interest from institutional investors and high-net-worth individuals.

On-chain metrics further underscore the bullish momentum. The “Mean Dollar Invested Age” curve, which measures how long tokens have been held in wallets, significantly dropped in mid-September.

This indicates that long-dormant tokens are re-entering circulation, a historically bullish sign. Additionally, Chainlink experienced its third-largest spike in daily circulation this year, pointing to renewed interest from both retail and institutional investors.

Despite some caution around short-term price peaks, Chainlink’s long-term outlook remains promising. Its continued role in decentralized applications and the increasing involvement of whales suggest that LINK could see further growth in the coming months.

Related | Hamster Kombat’s Controversial Launch Draws Criticism