- Coinbase Premium Index hit -0.237 on Dec 31, 2024, marking a 12-month low and reflecting U.S. Bitcoin selling pressure.

- Bitcoin dropped to $91,479 post-election but rebounded above $96,000, driven by political and market dynamics.

- Trump’s pro-crypto stance may drive Bitcoin toward $150K during his term, pending market shifts.

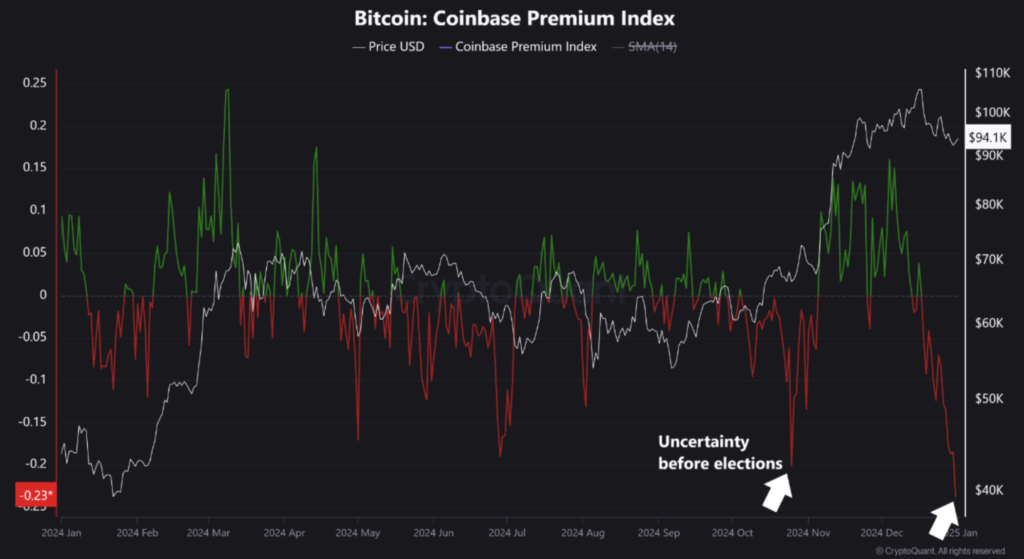

The Coinbase Premium Index recently plunged to its lowest level in 12 months, sparking concerns over Bitcoin (BTC) demand among US investors. According to CryptoQuant analyst Burakkesmeci, the drop underscores reduced institutional interest and heightened selling pressure. This decline signals a cautious sentiment dominating the US market for Bitcoin.

The Coinbase Premium Index measures the price disparity of Bitcoin between Coinbase Pro and Binance. It reflects US investor demand compared to the global market. A negative value, like the recent -0.237 on December 31, 2024, indicates selling pressure. This figure marks a decline from -0.200, recorded before the US elections in October 2024.

Coinbase Premium Index Indicates Bitcoin’s Price Volatility

Political events significantly impacted the Coinbase Premium Index. Before the 2024 US presidential elections, heightened uncertainty drove the index down to -0.200. Following Donald Trump’s victory, the index rebounded, coinciding with Bitcoin’s rise above $100,000. However, renewed market pressures led to a fresh decline, pushing Bitcoin to $91,479 on December 31.

Burakkesmeci attributed this to a low-liquidity market during year-end and intensified selling pressure in the US. He suggested that institutional or retail interest and macroeconomic shifts could alter the current dynamics. Meanwhile, analysts remain divided on whether Bitcoin’s price recovery can be sustained without significant policy or market changes.

The low Coinbase Premium Index presents challenges for Bitcoin’s short-term price recovery. Analysts speculate that political and economic developments, including Donald Trump’s upcoming inauguration, could influence the market. Trump’s pro-crypto stance may encourage policies favoring Bitcoin adoption, potentially driving prices toward $150,000 in his term.

Additionally, long-term Bitcoin holders are currently sitting on substantial profits, with a realized price of $24,298. However, this profit margin could lead to sell-offs as investors seek to cash out. With a realized price of $86,753 for short-term holders, profits remain narrower, adding complexity to market behavior.

Spot ETF Trends Shape Bitcoin Outlook

As 2025 begins, Bitcoin shows resilience, trading at $96,796, up 1.67% in the past 24 hours. Market focus remains on the evolving US political landscape and the potential impact of a second Trump administration. Investors closely monitor his inauguration on January 20, which may usher in policies supporting Bitcoin growth.

Another critical trend is the spot Bitcoin ETF market, offering insights into institutional interest and mainstream adoption. Large inflows or outflows could signal shifts in investor sentiment, influencing Bitcoin’s trajectory. Despite current market challenges, many analysts expect Bitcoin’s rally to resume after an initial correction phase.

With long-term growth prospects intact, Bitcoin’s journey through 2025 will likely be shaped by macroeconomic shifts, policy changes, and investor sentiment. The interplay of these factors could determine whether Bitcoin achieves new highs in the coming months.

Read More: Coinbase Faces $1 Billion Lawsuit Over Wrapped Bitcoin (wBTC) Removal