- COTI is nearing a potential breakout, signaling a bullish surge towards higher price levels despite market turbulence.

- The price is near the MA50 support zone, with a bounce potentially triggering a rally towards targets of $0.19, $0.27, $0.42, and $0.75.

- The token has shown stability with only a slight 0.56% dip over the past week, maintaining strength in a fluctuating market.

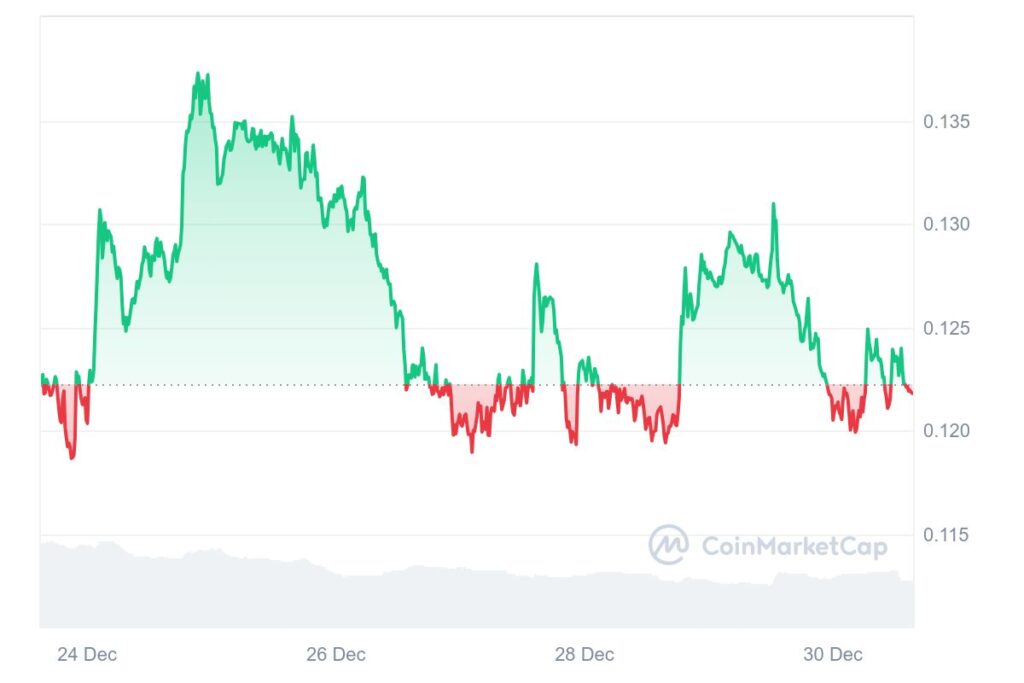

COTI is currently on the brink of a potential breakout, signaling a bullish surge towards higher price targets. Despite market turbulence driven by Bitcoin’s recent decline, COTI has managed to hold its ground, showcasing resilience and preparing for an upward leg. Over the past week, COTI has seen a slight dip of 0.56%, reflecting stability and signs of potential growth.

At the time of writing, the token is trading at $0.1218 with a 24-hour trading volume of $20.32 million and a market capitalization of $191.60 million, holding a market dominance of 0.01%. The token’s price has witnessed a 4.42% decrease in the last 24 hours, mirroring the broader market sentiment.

COTI Targets $0.75 After Symmetrical Triangle Formation

Looking at COTI from a technical perspective, the token consolidates within a large symmetrical triangle pattern on the weekly chart, a formation often seen before significant price movements. As the price nears its 50-day moving average (MA 50), which is currently acting as support, the likelihood of a bounce higher increases.

Should this support hold, analysts anticipate that the token could rise towards key price targets, including $0.19, $0.27, $0.42, and even as high as $0.75. These levels represent potential price milestones in the coming weeks as the token breaks free from its current consolidation phase.

Bitcoin’s Impact on COTI’s Path

While COTI shows promise, the broader cryptocurrency market is facing turbulence, largely driven by Bitcoin’s recent decline. Bitcoin’s performance often influences altcoins like COTI, and if BTC continues to experience downward pressure, it could impact the token’s price in the short term.

However, the token’s ability to maintain its support levels and consolidate within its triangle formation indicates that it might weather the storm and potentially capitalize on a market rebound.

As the token prepares for its next move, investors and traders are closely watching its technical patterns and the broader market conditions to gauge the likelihood of a bullish surge in the coming weeks.

Related | Dogecoin (DOGE) Poised for a Potential 100% Surge, Analyst Predicts Bullish Breakout