- Cryptocurrency firms, led by Coinbase and Ripple, have contributed over $119 million to the 2024 elections.

- The nonpartisan Fairshake PAC has received over half of its $107.9 million funding from the crypto sector.

- Digital currency companies are now the largest corporate donors, making up nearly 50% of corporate political spending this year.

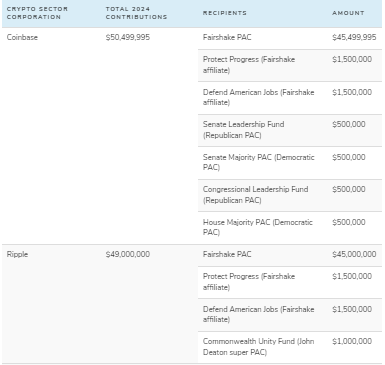

According to a recent report by the consumer protection group Public Citizen, digital currency companies are reshaping the 2024 elections. Led by big players like Coinbase and Ripple, the crypto industry has funneled more than $119 million into federal election campaigns this year, largely through contributions to a nonpartisan super PAC named Fairshake.

This super PAC, which has amassed $202.9 million, has received more than half of its $107.9 million funding from crypto corporations. The rest of Fairshake’s funds come from prominent crypto executives and venture capitalists, including significant donors such as the Winklevoss twins and Coinbase CEO Brian Armstrong.

This unprecedented influx of digital cash represents a dramatic shift in political spending, with digital currency firms now the leading corporate contributors in this election cycle. Nearly half of all corporate political spending in 2024, totaling $248 million, originates from the sector. This trend marks a significant escalation compared to past election cycles, where contributions from these firms were minimal.

The incentives behind this spending spree are obvious: these companies are using their financial clout to drive a pro-crypto agenda and undermine critics. Fairshake’s strategy includes a mix of direct and indirect political interventions.

Controversies and Criticisms Surround Crypto Spending

This aggressive political maneuvering comes with its risks and controversies. The influence of the digital currency sector has been criticized from both sides. Some Republicans say that Fairshake betrayed them by spending money on Democratic candidates in critical races, and major Democratic donors have disavowed the PAC as a result of this bipartisan support strategy.

Putting aside these tensions, the crypto sector has set a new precedent for electoral influence with its approach to leveraging financial resources as a political weapon. In the broader context, the crypto sector’s spending stands in contrast to traditional corporate political contributions, most of which are typically funneled through partisan groups.

Crypto companies have largely kept their funds within non-partisan PACs, allowing them to hold sway on both sides of the aisle. A tactic that has shifted the nature of several key races and illustrates the surging function of corporate money in shaping political outcomes.

Related Reading | Web3 Security Breach: $55 Million in Funds Laundered in 55,473,618 Dai Scam