- The cryptocurrency market is experiencing stagnation with minimal demand and reduced capital inflows and outflows.

- Bitcoin’s Realized Cap is holding steady at $622 billion, reflecting a narrow trading range and stagnation.

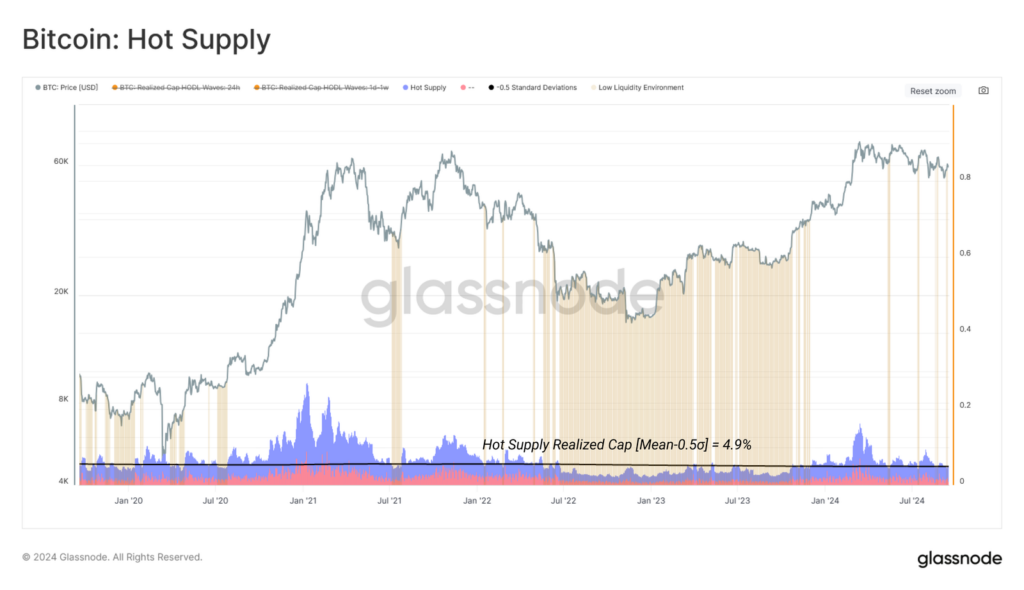

- ‘Hot Supply’ metric shows a drop to 4.7%, indicating reduced liquidity as more coins are held long-term.

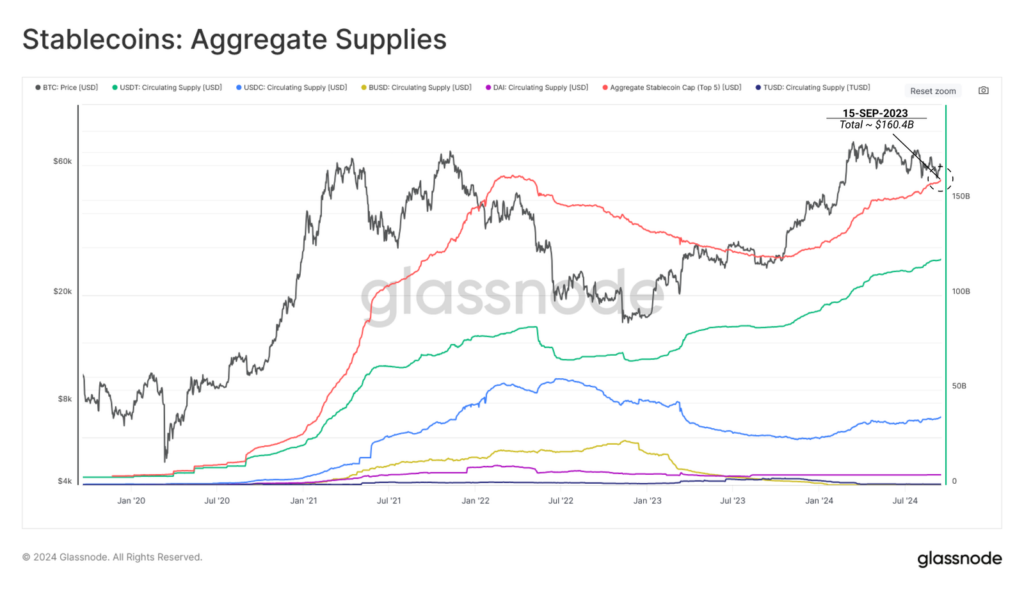

- Stablecoin supply is near an all-time high of $160.4 billion, though it hasn’t yet increased demand for riskier assets like Bitcoin.

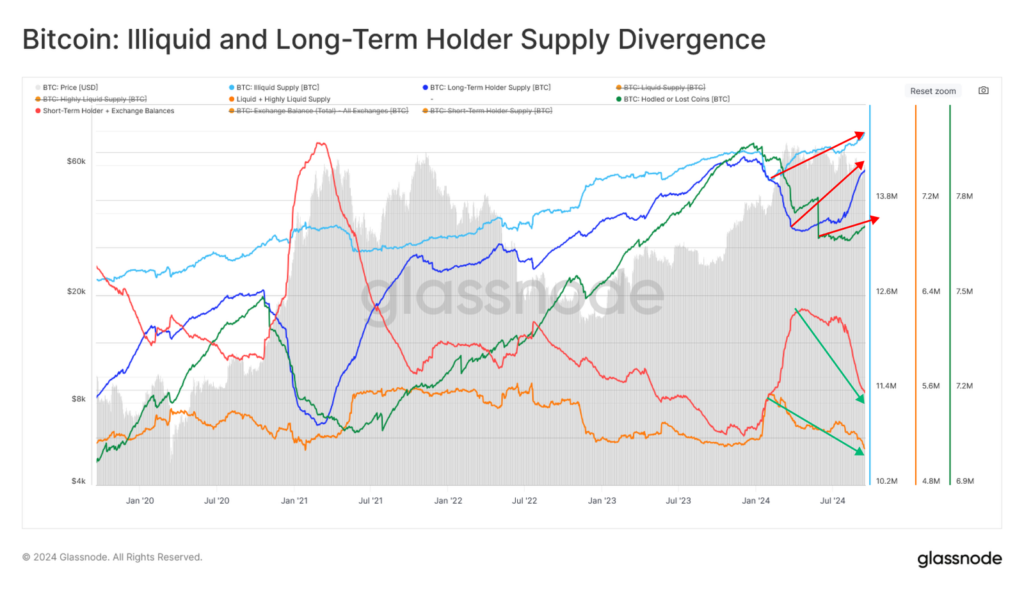

According to the latest Glassnode report, the cryptocurrency market has entered a phase of stagnation, with digital assets showing a lack of enthusiasm on the demand side. Capital inflows and outflows have dried up, investors are holding on or “HODLing” as actively tradable supplies decrease, while coins mature into Long-Term Holder status. The effect? Activity in the market has been scant in recent times, for over six months, pushing volatility indicators to their low levels, and raising expectations for a spike in movement soon.

Crypto Market Activity Suggests Equilibrium

Realized Cap, which accounts for net capital flow into the Bitcoin network, has been reflecting leverage in how the market trades within such a tight range. Currently, Realized Cap floats at around $622 billion, reflecting a flat capital flow over the last two months. This would insinuate that all transactions are happening near acquisition prices, implying market participants aren’t booking large profits and/or cutting significant losses.

On-chain data supports this view: the Net Realized Profit/Loss metric seems to be in balance between profit-taking and loss-making. This balance signals a market literally treading water, similar to the mid-2023 period of consolidation. All in all, buy-side pressure has fallen substantially since March-a sure telltale of weak demand for Bitcoin at prevailing prices of the asset.

Supply Squeeze Tightens

With demand stagnating, the supply side of the market has also shown some signs of constriction. The metric ‘Hot Supply’, measuring coins aged one week or less, has fallen to a mere 4.7% of the wealth of the network. That means fewer coins are available for trading, as most assets are now held for a longer duration, contributing to reduced liquidity.

Overall, the market supply is dominated by the HODLing behavior, where “stored supply” from the long-term holders significantly went up. This reflects the tightening supply side, given the number of coins available to actively transact continues to shrink. In simple words, the investors are holding onto their assets instead of selling them, thus piling further pressure on both the buying and selling sides of the market.

Stablecoin Liquidity on the Rise

Amid the market’s tightening, one bright spot is the growing stablecoin supply, which now sits just below its all-time high of $160.4 billion. Stablecoins continue to serve as the go-to trading currency across both centralized and decentralized exchanges. However, despite this increase in stablecoin liquidity, it has not yet translated into increased demand for riskier digital assets like Bitcoin.

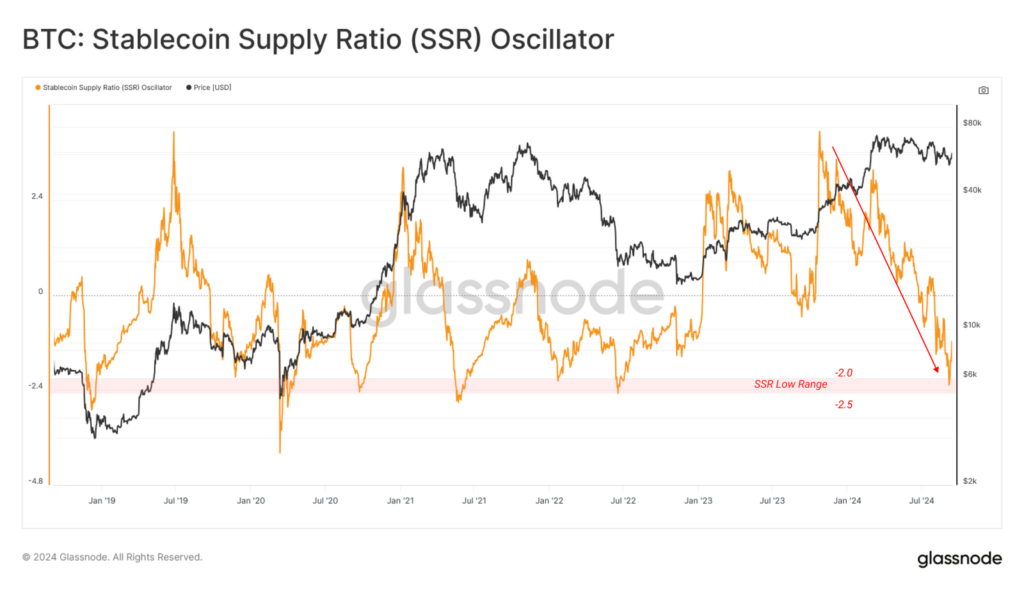

The Stablecoin Supply Ratio (SSR) is now at historic lows, indicating that there is significant buying power on the sidelines. If these stablecoin reserves start moving into digital assets, it could signal a resurgence in demand and lead to an eventual price breakout.

Volatility Set to Surge?

The market’s stagnation has created a scenario akin to a coiled spring, with volatility poised to increase. Bitcoin’s price has oscillated within a narrow range over the past 180 days, with similar conditions only seen in August 2023 and May 2016. This tightening price range suggests that a period of heightened volatility may be on the horizon.

Adding to this expectation is the Sell-Side Risk Ratio, which has dropped further to persuasively low levels and indicates very negligible profit-taking or loss-cutting. This would suggest that the market has reached a point of equilibrium, where investors are waiting for a breakout prior to moving coins. The same pattern can be witnessed both by short-term and long-term holders; onchain activity has significantly cooled off in recent months.

Crypto Market Awaits Its Next Move

With both demand and supply in a holding pattern, the crypto market has reached a fork in the road. The dominance of HODLing, combined with declining liquidity and rising stablecoin reserves, paints a picture of a market ready to break out of its six-month range. About the next move-the question is whether it will be upward or downward. Investors still need to prepare themselves for a return to volatility as the market searches for its next direction.

Related | Bitcoin Surge Ahead? $1B USDT Minted as Fed Meeting Nears