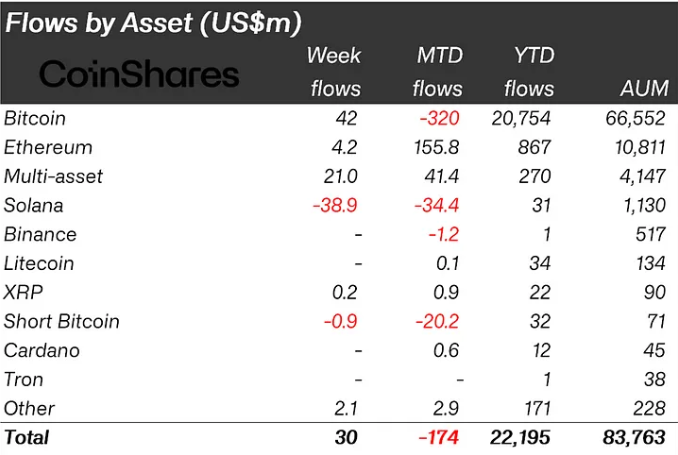

- Bitcoin, the leading crypto asset, Led the market with $42 million in inflows, signaling continued investor confidence.

- Ethereum recorded $4.2 million in inflows, with significant new inflows of $104 million from emerging providers, despite Grayscale’s $118 million outflows.

- Solana’s Struggles faced $39 million in outflows, the largest on record, due to declining memecoin trading volumes.

- The US led with $62 million in inflows, while Switzerland and Hong Kong saw outflows of $30 million and $14 million, respectively.

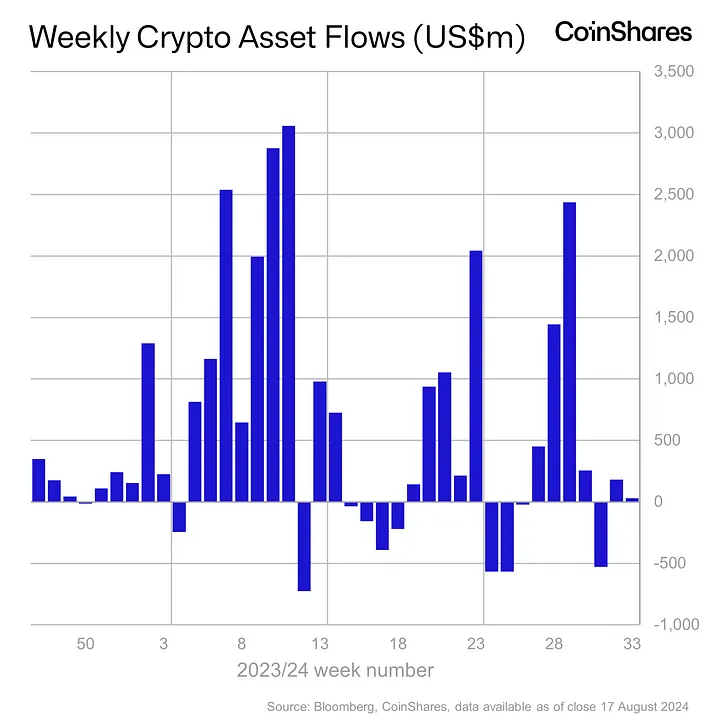

In a week filled with economic uncertainty, digital asset investment products saw modest inflows totaling $30 million, as detailed in Coinshare’s Weekly Report. This influx reflects how markets are treading cautiously due to recent macroeconomic data that says the Federal Reserve may not add a 50 basis point interest rate cut in September. A redistributive factor of uncertainty for probable interest rate changes keeps the atmosphere compelling for investors and results in a mixed trend of different digital assets.

Bitcoin Leads with $42M Inflows

Bitcoin stood out as the leading crypto asset, with inflows reaching $42 million. This demonstrates investors’ ongoing confidence in cryptocurrency, even as global economic conditions remain uncertain. In contrast, short-Bitcoin ETFs experienced outflows for the second week in a row, losing $1 million, indicating a sentiment shift as investors back away from bearish positions.

Ethereum recorded relatively modest inflows of $4.2 million. However, this figure doesn’t tell the whole story. Off the radar, new providers entering the Ethereum market had substantial inflows of $104 million, while the established player Grayscale suffered outflows of $118 million. Such a trend indicates that investors are increasingly looking at new investment products for Ethereum, moving away from traditional channels.

Meanwhile, Solana faced significant challenges, recording its largest outflows on record, totaling $39 million. The platform, which has relied heavily on the trading volumes of memecoins, suffered a sharp decline in this sector. The substantial outflows signal diminishing interest in Solana as the initial hype surrounding memecoins fades, raising concerns about the platform’s long-term growth prospects.

Regional Crypto Trends: US Leads, Switzerland and Hong Kong Lag

The report also highlighted notable regional differences in investment flows. The United States led with inflows of $62 million, followed by Canada and Brazil, which saw $9.2 million and $7.2 million, respectively.

However, not all regions shared this positive trend. Switzerland and Hong Kong suffered significant outflows of $30 million and $14 million, respectively. These regional variations underline diverse investor sentiment across parts of the world that are influenced by local economic conditions and regulatory frameworks.

Related | Bitcoin Weekly Analysis: $69K Breakout Key for Potential Surge to $73K