- Open interest in Ethereum derivatives has soared to a record high of $13 billion, indicating strong market sentiment.

- Ethereum’s leverage ratio has hit a new high, signaling increased risk-taking by investors.

- While the current market conditions appear favorable, investors should exercise caution due to the risks associated with leveraged trading.

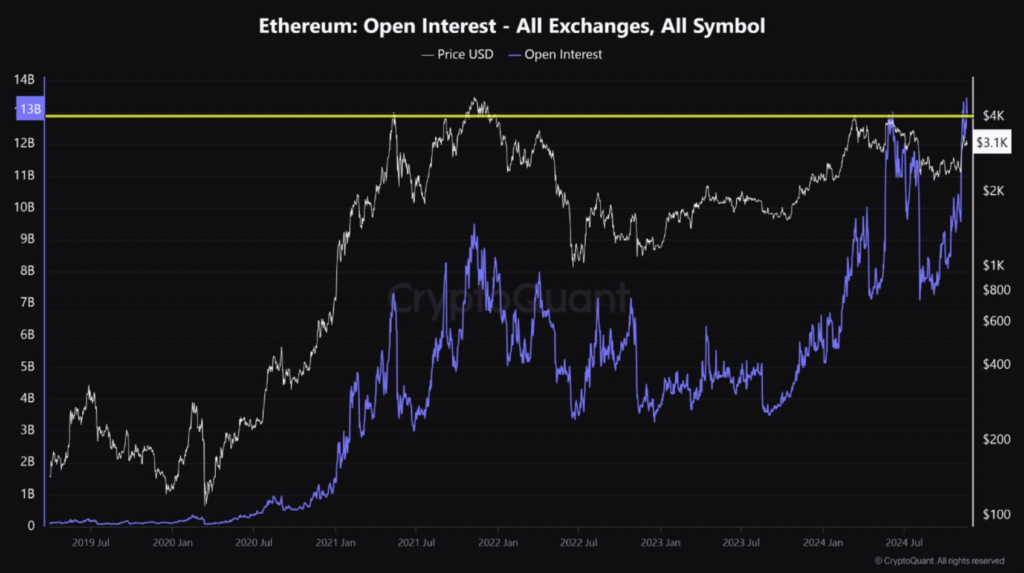

The Ethereum derivatives market has heated up, as key indicators point to a strong bullish momentum. Data from CryptoQuant revealed that Open Interest, a measure of the total value of outstanding derivative contracts, has skyrocketed to over $13 billion, hitting a new record. This is an increase of over 40% in the past four months, underscoring the growing interest and engagement in the derivatives market.

On the other hand, funding rates, which refer to the cost of carrying a long or short position, have been moderately positive, suggesting the dominance of long-position traders. This indicates a positive market outlook with expectations of price movements in the near future.

Apart from that, Ethereum’s estimated leverage ratio, calculated by dividing the open interest by exchange reserves, has also hit new highs of +0.40. This metric signals an increase in leveraged positions, meaning the risk-taking ability of investors has soared in the derivatives market.

Ethereum on the Verge of a Massive Breakout?

The above image depicts Ethereum’s open interest across all exchanges and symbols ranging from July 2019 to June 2024. As seen in the chart, Ethereum’s OI has steadily risen with a clear upward trend, marked by several peaks and troughs throughout the observed period. Notably, the open interest soared significantly in 2021, reaching its all-time high of $13.8 billion. Subsequently, it experienced a decline but has since rebounded, demonstrating sustained interest in ETH derivatives.

While these trends point to a bullish outlook for ETH, it’s essential to acknowledge the inherent risks associated with leveraged trading. A sudden price correction could trigger a long squeeze, potentially leading to significant losses for leveraged traders. Therefore, while the current market conditions appear favorable for Ethereum, it’s crucial for investors to exercise caution and manage risk effectively. As always, thorough research and a diversified investment strategy are recommended.