- Bitcoin ETFs impact 8% of spot volume, while Ethereum ETFs only influence 1%, showing Bitcoin’s market dominance.

- Bitcoin’s network hash rate is nearing an all-time high, increasing mining competition.

- Miners are retaining more Bitcoin as declining transaction fees cut into their incomes.

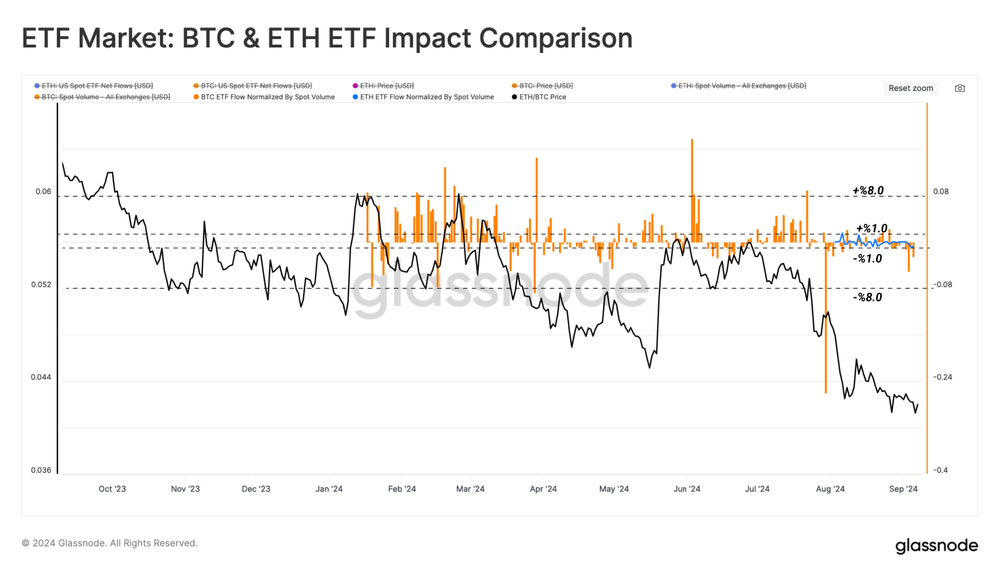

The influence of exchange-traded funds (ETFs) on the cryptocurrency market is experiencing a significant shift with the contrasting behavior of Bitcoin and Ethereum ETFs. A recent Glassnode report highlights that Bitcoin’s ETF impact is far greater than Ethereum’s, which is indicative of a demand disparity that BTC’s strong position in traditional markets has.

Particularly, the impact of Bitcoin ETFs is estimated to affect almost 8% of its spot volume while Ethereum’s ETF influence is only a mere 1%. This difference illustrates the fact that BTC is still the most dominant player in the ETF-dominated market.

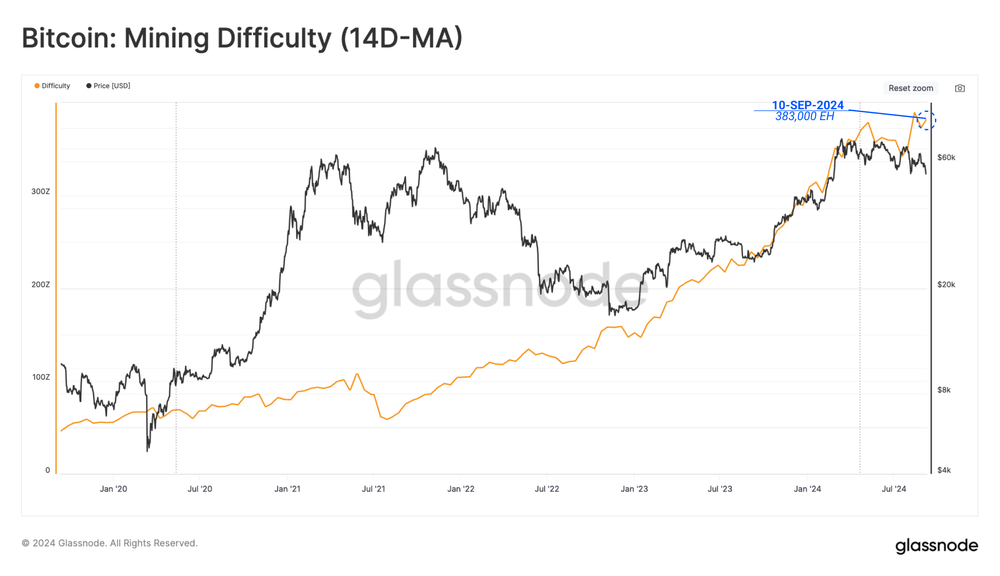

Simultaneously, the BTC mining sector is getting more and more competitive, with the network’s hash rate getting very near to an all-time high (ATH) of 666.4 exahashes per second (EH/s). Even though there is high volatility in the short-term BTC prices, miners are investing more heavily in high-powered ASICs, which in turn, causes the hash rate to increase.

With this surge in hash rate, mining difficulty within the network increases as well, which has recently reached one of the highest levels ever. In this case, the network needs 338,000 exahashes to mine a single block. These figures imply that the mining space is getting more and more competitive as participants are fighting for the shrinking revenue streams.

However, the miners are getting under the pressure of falling incomes despite the technical progresses. A significant decline in transaction fees, caused by the reduced need for monetary transfers and blockchain services such as inscriptions, has been the reason for the decrease in miner income.

Declining Bitcoin Miner Revenues and Strategic Shifts

Presently, miners of the transaction fees receive the payment amounting to only $20 million, while the block subsidy is still a major chunk of $824 million, although it is 22% less than it used to be. Mining is becoming more costly, and revenues are declining, which has led miners to change from net sellers of BTC to retainers, indicating a possible strategic shift in view of concerns about profitability.

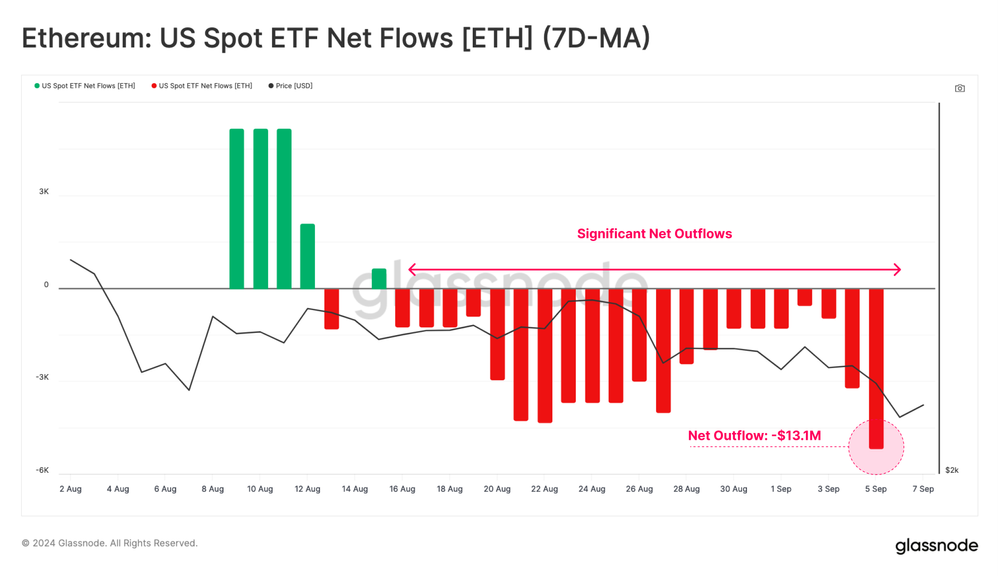

On the other hand, the BTC and Ethereum spot volumes have declined, which means the market sentiment has become bearish. Ethereum experienced more muted demand in its ETF space. The net outflow from Ethereum ETFs, which is $13.1 million, is altogether different from Bitcoin’s $107 million weekly outflow since August 2024, reflecting the softening appetite in both markets.

Yet, despite diminished volumes and ongoing market fluctuations, Bitcoin exchange-traded funds (ETFs) are still dominating over Ethereum funds, thereby making it clear that investors have a strong preference for Bitcoin amidst the challenging market.

Related Reading | Cardano (ADA) Holds Strong at Key Support, Eyes Bullish Reversal