- Ethereum has dropped nearly 7% in the past week and around 12% in the last 30 days.

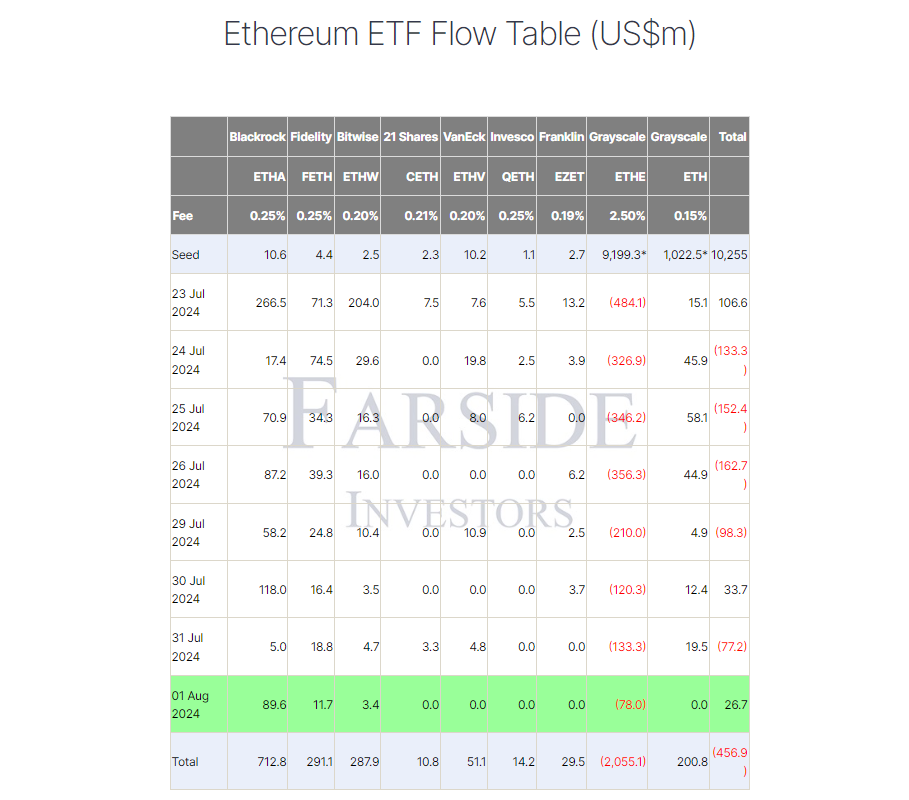

- Spot Ether ETFs saw a net inflow of $26.7 million on August 1, driven by $89.6 million into BlackRock’s iShares Ethereum Trust.

- Grayscale Ethereum Trust experienced cumulative outflows of over $2 billion.

- Crypto analysts warn of a potential drop to $2,800 but note that strong ETF inflows may prevent this decline.

Ethereum, the world’s second-largest cryptocurrency by market capitalization, has been under high volatility, with a visible drop in its value. ETH has lost nearly 7% of its price over the past week while, in the last 30 days, dropping by around 12%.

This downturn follows the launch of Ethereum exchange-traded funds, which have not yet handed ETH the expected boost in value. Today, ETH trades at $3,022.36, with a volume of $33 billion traded in the past 24 hours. Its market capitalization stands at $363.10 billion. Within just the last 24 hours, the price has plunged by 3.01%.

Spot Ether ETFs Record $26.7M Inflow Amid Market Struggles

Despite these challenges, there are glimmers of hope within the ecosystem. On August 1, spot Ether ETFs recorded a net inflow of $26.7 million, indicating some renewed investor interest. According to Faride Investors data, this positive shift was primarily driven by a substantial $89.6 million inflow into BlackRock’s iShares Ethereum Trust (ETHA).

This positive movement in spot Ether ETFs contrasts with the cumulative outflows from the Grayscale Ethereum Trust (ETHE), which have exceeded $2 billion. The divergence between these two investment vehicles highlights the complex dynamics at play in the ETH market.

The recent net inflows into Ether ETFs suggest that some investors still see potential in ETH despite its recent struggles. The influx of capital into BlackRock’s iShares Ethereum Trust is particularly noteworthy, as it signals confidence from one of the largest asset management firms in the world.

Will Ethereum ETFs Save ETH from $2,800 Drop?

Ethereum (ETH) is once again testing a critical trendline. According to crypto analyst CryptoJack, this trendline is currently weaker than before. If it breaks, ETH might see its value drop to $2,800. However, there are reasons to believe a bounce is on the horizon.

CryptoJack believes that inflows from Ethereum-based ETFs may be adequate to prevent any significant fall; on the other hand, these inflows show strong interest from the institutional segment and their confidence in ETH, which might overspill into its price, keeping it strong against downward pressures.

According to data from IntoTheBlock, the level of support that Ethereum has now received has been amplified. At $3,000, approximately 3.69 million addresses hold 1.24 million ETH. As can be seen, this price point is a psychological barrier because it is below the value that many investors are keen to keep. In relation, this support is relatively weak compared to the critical support level of $2,700.

Ethereum finds more substantial support at the $2,700 level. The 11.11 million addresses hold a staggering 59.07 million ETH for an average acquisition cost of $2,647. That essentially means many investors have sunk a lot into holding the price above this level, making it a critical support point.

Related | Bitcoin (BTC) Rebound From $62.3k: Analyst Anticipate Huge Surge In Coming Months