- Ethereum ($ETH) is consolidating at $3,351.61, down 3.54% in 24 hours.

- Whale activity is increasing, with a Nexo-linked whale depositing 4,946 ETH ($17.2M) onto Binance.

- Nexo has deposited 114,262 ETH ($423.3M) since December 2, indicating potential market shifts.

- These whale movements suggest a possible breakout or volatility ahead.

Ethereum ($ETH) has recently entered a consolidation phase, as the market awaits its next potential surge. According to crypto trader and analyst Trader Tardigrade, Ethereum’s current price behavior mirrors its previous movements, indicating that a breakout may be on the horizon.

At the time of writing, the price of Ethereum stands at $3,351.61, reflecting a -3.54% decrease over the past 24 hours. With a 24-hour trading volume of $28.18 billion and a market capitalization of $403.73 billion, Ethereum remains a dominant force in the crypto space, holding 12.01% of the market.

Whale Activity Signals Potential Ethereum Price Shifts

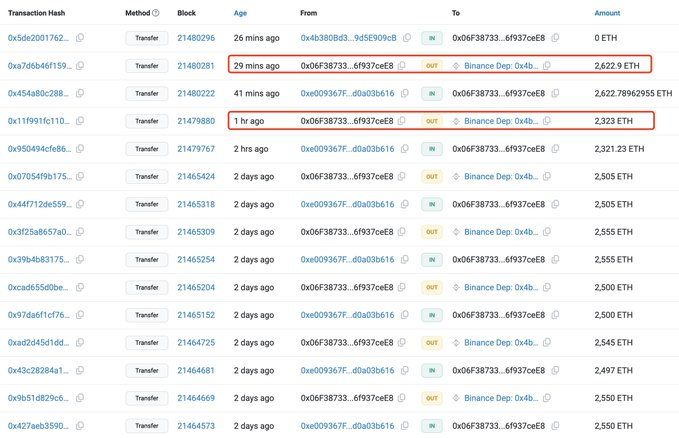

However, the past 24 hours have also seen notable whale activity, which could signal significant movements ahead. Data from Lookonchain reveals that a whale, believed to be linked to the crypto platform Nexo, deposited 4,946 ETH, worth $17.2 million, onto Binance within the past hour.

This follows a series of deposits from Nexo, totaling 114,262 ETH ($423.3 million) since December 2, made at an average price of $3,705. Such large transactions could be an indicator of market sentiment or preparation for a future shift in price action.

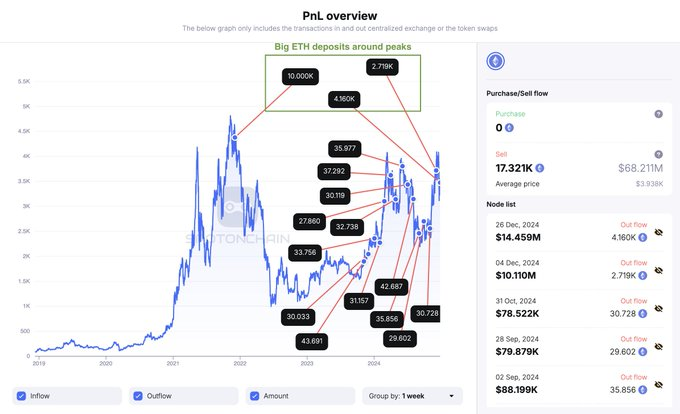

Further data from Spot On Chain highlights additional whale movements, including a deposit of 4,160 ETH (approximately $14.5 million) to Kraken just three hours ago. This particular whale, who received 20,000 ETH (worth $6,200 at the time) during Ethereum’s Genesis block in July 2015, has frequently offloaded Ethereum during market peaks while staking a portion of their holdings. Currently, the whale retains around 7,043 ETH, valued at $24.6 million, staked for future rewards.

As Ethereum continues to consolidate, the presence of significant whale movements and historical patterns suggests that the market is preparing for the next major price movement. Whether this consolidation leads to a bullish breakout or further volatility remains to be seen, but the ongoing activity of large investors points to potential developments in the near future.

Related | Whale Accumulation of Chainlink (LINK) Sparks Attention Amid New DeFi Launch